Latest Version

569.0

August 26, 2024

Brigit

Finance

Android

0

Free

com.hellobrigit.Brigit

Report a Problem

More About Brigit: Borrow & Build Credit

Unlock Your Financial Freedom with Brigit: A Comprehensive Guide

In today's fast-paced world, managing finances can be challenging. Whether you're facing unexpected expenses or looking to build your credit, Brigit offers a seamless solution. This article will guide you through the process of getting started with Brigit, the benefits of using the app, and how it can help you achieve your financial goals.

Getting Started with Brigit

Starting your journey with Brigit is simple and straightforward. Follow these easy steps to access financial support:

- Download the Brigit App: Begin by downloading the Brigit app from your device's app store.

- Connect Your Bank Account: Securely link your bank account to the app for a personalized experience.

- Request an Instant Cash Advance: Need quick cash? Request an advance of up to $250.

- Receive Funds Instantly: Get the money deposited directly into your bank account.

It’s that easy! For more details, see the full disclosures below.

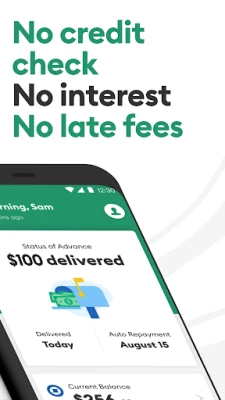

Access Cash Quickly: $50 to $250*

When financial emergencies arise, Brigit is here to help. With cash advances ranging from $50 to $250, you can bridge the gap when you need it most. Here are some key features:

- No credit checks required

- No interest or hidden fees

- No late payment penalties

- Flexible repayment options based on your payday

Explore Fast Personal Loan Offers

If you need to borrow $500 or more, Brigit connects you with personal loan offers from trusted partners. This feature allows you to:

- Compare various personal loan options

- Select a loan that best fits your financial needs

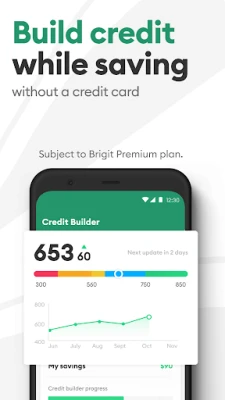

Build Credit and Save Money**

Brigit not only helps you access funds but also assists in building your credit without the need for a credit card. Here’s how:

- No hard credit inquiries, no interest, and no security deposits required

- Start building your credit history with payments as low as $1 per month

- Brigit reports your payments to all three major credit bureaus: Experian, Equifax, and TransUnion

- Any extra money deposited into your account is returned to you upon repayment

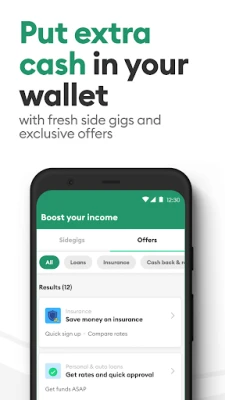

Earn and Save with Brigit

Brigit is dedicated to helping you maximize your earnings and savings. Here’s what you can do:

- Participate in surveys to earn extra cash quickly

- Discover part-time, full-time, gig, and remote job opportunities

- Take advantage of cash back offers, discounts, and insurance savings

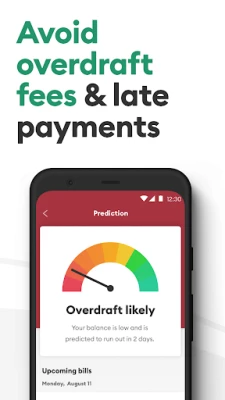

Budget Better with Financial Insights

Connecting your bank account to Brigit provides you with valuable financial insights:

- Monitor your income and expenses effortlessly

- Utilize bill forecasts and spending breakdowns for smarter budgeting

- Identify and eliminate unnecessary subscriptions

Protect Your Finances

Brigit offers comprehensive tools to safeguard your financial health:

- Track your credit score with detailed reports

- Receive real-time alerts for your bank balance

- Access identity theft protection services

- Utilize free financial tools to enhance your savings and spending habits

Simple Sign-Up Process

Getting started with Brigit is hassle-free. Download the app and sign up in just a few minutes:

- Brigit is compatible with major banks like Chime, Bank of America, Wells Fargo, Chase Bank, and over 15,000 others

- Basic Plan: Free account alerts and insights, plus access to exclusive earning and saving opportunities

- Paid Plans: Ranging from $8.99 to $14.99 per month, offering cash advances* and tools for credit building, budgeting, and saving. Cancel anytime.

For assistance, Brigit offers support seven days a week at info@hellobrigit.com.

Download Brigit Today!

Take control of your financial future by downloading the Brigit app today. With its user-friendly interface and powerful features, Brigit empowers you to manage your finances effectively and confidently.

Important Disclosures

Brigit is not affiliated with various loan and money apps. Some features may require a paid plan.

Cash Advances: Not all users will qualify. Subject to eligibility and Brigit’s approval, cash advances range from $50 to $250 and may not be available in all states. Express transfer fees may apply for debit card disbursements. Advances have no mandatory minimum or maximum repayment period, with a maximum interest rate of 0%. For example, a $100 cash advance sent via ACH and repaid on the date you set incurs no fees.

Credit Builder: The impact on your credit score may vary, and some users may not see improvements. Results depend on various factors, including timely loan payments and overall financial history. Credit builder loans are issued by Coastal Community Bank, Member FDIC.

For more information, please review our Privacy Policy.

Brigit, 36 W 20th St, New York, NY 10011

Rate the App

User Reviews

Popular Apps

Editor's Choice