Latest Version

1.49.1

November 15, 2024

Bright Money

Finance

Android

0

Free

com.brightcapital.app

Report a Problem

More About Bright - Crush Your Card Debt

Transform Your Financial Future with the Bright App: Simplify Debt Management and Build Credit

Managing multiple debts can be overwhelming, but with the right tools, you can take control of your finances. The Bright App offers a seamless solution to consolidate your debts into one manageable credit line, allowing you to pay down your balances monthly and simplify your financial management. Let’s explore how the Bright App can help you achieve your financial goals.

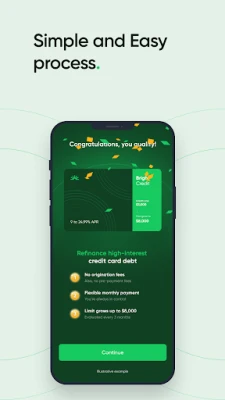

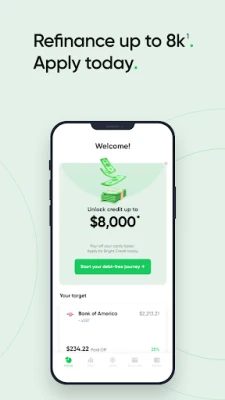

Consolidate Your Debt with Ease

The Bright App enables you to consolidate high-interest credit card balances into a single credit line of up to $8,000. This feature allows you to streamline your payments, making it easier to manage your debt. With affordable monthly payments, you can focus on paying down your debt without the stress of juggling multiple bills.

Transparent and Affordable Credit Fees

Understanding the costs associated with credit is crucial for effective financial planning. Here’s a breakdown of the fees associated with the Bright Credit:

- Credit Limit: $500 - $8,000

- APR (Annual Percentage Rate): 9% – 24.99%

- Application Fee: $0

- Origination Fees: $0

- Late Fees: $0

- Prepayment Fees: $0

- Monthly Minimum Payment: 3% of the outstanding principal balance plus accrued interest

For example, if you have a credit limit of $5,000 with a 12% APR, your monthly minimum payment would be approximately $200. This transparency allows you to plan your finances effectively.

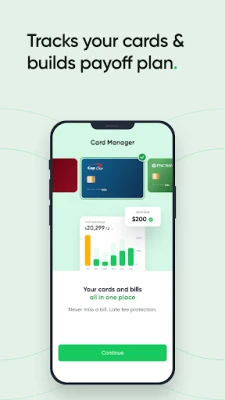

Streamlined Credit Card Management

With the Bright App, you can manage all your credit cards in one convenient location. The app organizes multiple cards and bills, providing payment reminders to help you avoid missed payments. This AI-driven approach ensures you stay on top of your financial obligations, reducing the risk of falling into debt.

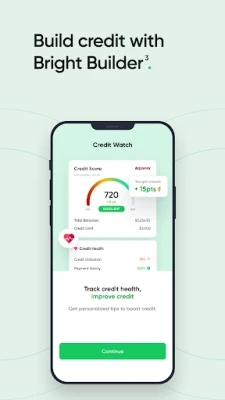

Build Your Credit with a Secured Line of Credit

The Bright App also offers a secured line of credit starting at just $50. By making on-time monthly payments, you can build a positive payment history that is reported to credit agencies. This consistent payment behavior can help improve your credit score over time, paving the way for better financial opportunities.

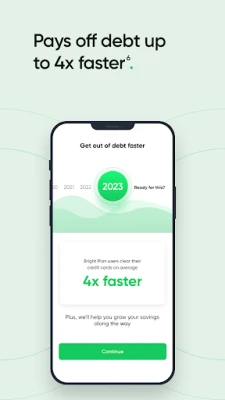

Grow Your Savings with Smart Financial Planning

In addition to debt management, the Bright App helps you build savings that grow consistently. Its AI-driven plan assists you in paying down debt while creating a pathway to financial stability. By planning your financial future wisely, you can achieve your long-term goals.

Personalized Budget Plans Tailored to Your Needs

The Bright App generates personalized payoff plans that make repaying debt straightforward. Whether you’re saving for a dream vacation, a new car, a home, or retirement, the app guides you toward smart budgeting within your current income. This tailored approach ensures you stay on track with your financial objectives.

Expert Financial Guidance at Your Fingertips

Access a wealth of financial knowledge through the Bright App. It offers expert tips, short articles, and practical guides to help you manage your money effectively. With a comprehensive answer bank for all your financial questions, you can stay informed and make educated decisions about your finances.

Quick Sign-Up and 24/7 Customer Support

Getting started with the Bright App is quick and easy. The sign-up process takes just 2 minutes, allowing you to begin your personalized debt management journey immediately. Plus, with 24/7 live customer chat support, you can get assistance whenever you need it. For any inquiries, you can reach out via email at support@brightmoney.co or call +1 877-274-6494 during operational hours (Mon-Fri, 9:30 AM to 6:30 PM CST).

Join a Community of Satisfied Users

Become part of a growing community of over 1 million satisfied customers who have experienced the benefits of the Bright App. Take control of your financial future today and discover how easy it can be to manage debt and build credit.

In conclusion, the Bright App is a powerful tool for anyone looking to simplify their debt management and improve their financial health. With its user-friendly features, transparent fees, and expert guidance, you can confidently navigate your financial journey.

Rate the App

User Reviews

Popular Apps

Editor's Choice