Latest Version

4.0

November 13, 2025

AVSgroup

Finance

Android

0

Free

my.cash.olly

Report a Problem

More About Borrow Money App: Payday Loans

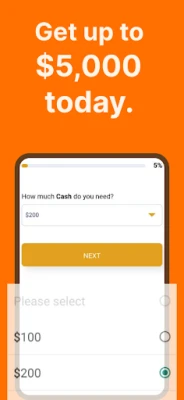

Fast Cash Solutions: Your Guide to Payday Loans and Instant Cash Advances Online

In today's fast-paced world, financial emergencies can arise unexpectedly, leaving you in need of quick cash. If you're searching for a way to borrow money online without the hassle of traditional banks, look no further. Our platform offers a simple, secure, and instant solution for payday loans, cash advances, and short-term loans, all accessible from your smartphone.

Why Choose Our Money Borrowing App?

Are you in need of a straightforward money borrowing app? Our application is designed to help you secure funds quickly, whenever you need them. With no credit checks and minimal paperwork, you can apply and receive cash in just minutes. This service is ideal for small loans, covering bills, rent, or urgent expenses. Many users successfully obtain funds instantly, even without a job or bank account. Experience an easy loan process that is 100% online. Download our app today and start borrowing money effortlessly.

Understanding Payday Loans

Payday loans are small, short-term loans intended to bridge the gap between paychecks. Unlike borrowing from an employer, these loans are provided by licensed lenders and are typically repaid in full within a few weeks. They are particularly useful for:

- Emergency expenses

- Utility bills

- Car repairs

- Unplanned purchases

- Covering costs between paydays

One of the significant advantages of payday loans is that you don’t need perfect credit. Lenders focus more on your ability to repay the loan than on your credit score.

How the Borrow Money App Works

Getting started with our app is a breeze:

- Select your desired loan amount (ranging from $100 to $5,000).

- Enter your basic personal details.

- Provide your bank information.

Once you complete these steps, you will be instantly connected to a licensed lender. If approved, funds are typically deposited into your account by the next business day. There are no hidden fees or commitments; you have the freedom to accept or decline the loan offer.

Key Features of Our Service

- Easy-to-use loan request form

- Fast matching with direct lenders

- No upfront fees, ever

- Accessible for individuals with bad credit

- Safe and secure with industry-standard encryption

- Transparent loan terms presented before acceptance

- No obligation to accept the offer

Our app serves as a loan connection platform, matching users with licensed payday lenders in their state. You can review the loan terms and choose to decline the offer at any time.

Security and Privacy Assurance

Your privacy and data security are our top priorities. We utilize industry-standard encryption to safeguard your information. Personal data is shared only with trusted lenders and is never sold or distributed to third parties.

Understanding APR and Loan Disclosure

The Annual Percentage Rate (APR) reflects the yearly cost of your loan, including fees and interest. APR varies based on the lender, loan amount, repayment period, and state regulations. Typical APRs range from 6.63% to 35.99%, with repayment terms spanning from 65 days to 3 years. Failure to repay may lead to late fees, additional interest, collection activities, and negative credit reporting.

For example, if you borrow $1,000 for one year at a 20% APR, your total repayment would be $1,200, which includes $200 in interest, resulting in monthly payments of $100.

Important Disclosures

- Our app is a loan connection service, not a lender.

- We do not charge users to submit loan requests.

- There is no obligation to accept any loan offer.

- Loan terms vary by lender and state laws.

- Having bad credit may not prevent you from approval.

Download the Borrow Money app now to access the funds you need quickly, easily, and entirely online. Don't let financial emergencies catch you off guard—take control of your finances today!

Rate the App

User Reviews

Popular Apps

Editor's Choice