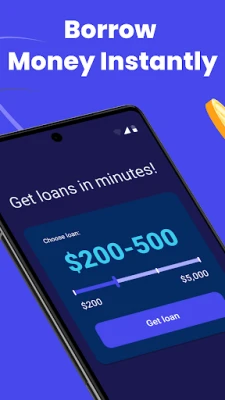

Latest Version

2.0.2

January 05, 2025

Payday Loans Apps

Finance

Android

0

Free

com.borrow.money.app.payday.loans

Report a Problem

More About Borrow Money App: Payday Loans

Unlock Financial Freedom with Instant Payday Loans: Your Guide to Quick Cash Solutions

When faced with unexpected financial challenges, a short-term cash loan can provide the relief you need. The Borrow Money App was developed by industry professionals who recognized the need for a more straightforward and efficient way to access funds. This innovative app simplifies the borrowing process, allowing you to secure payday loans online quickly and easily.

What Are Payday Loans?

Payday loans function as a cash advance on your upcoming wages, but they are not sourced from your employer. Instead, a lender provides you with a small sum of money, typically ranging from $100 to $1,000, which you must repay in full by your next payday. This type of loan often comes with a fee, commonly referred to as interest.

These loans are particularly useful for managing unforeseen expenses or unplanned purchases that might otherwise require you to wait until your next paycheck. With the right tools, you can navigate these financial hurdles with ease.

Why Choose the Borrow Money App?

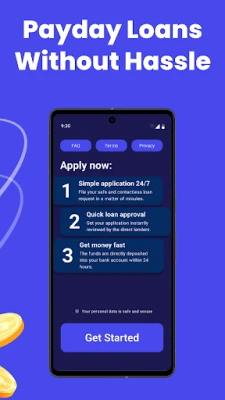

What sets the Borrow Money App apart from traditional lenders or banks? The answer lies in convenience. There’s no need to wait in long lines or deal with cumbersome paperwork. Everything can be completed from the comfort of your home, making the process seamless and efficient.

How to Get Started

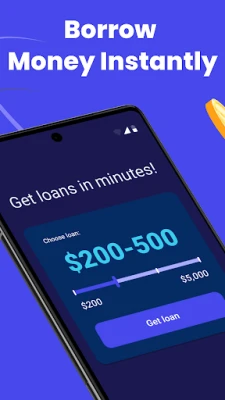

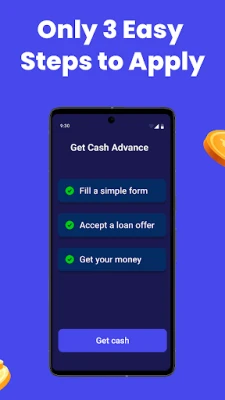

If you’re looking to borrow money instantly, follow these simple steps:

- ✅ Select your desired loan amount.

- ✅ Provide your basic personal information.

- ✅ Enter your bank details for a swift deposit, which can occur in as little as one business day.

Using our money borrowing app is entirely free. After years of witnessing individuals struggle to secure cash, we designed this tool to streamline the process and alleviate the stress associated with borrowing.

Connecting with Lenders Made Easy

By filling out a single loan request form, you can quickly connect with licensed direct lenders. This eliminates the need to apply to multiple lenders individually, saving you time and avoiding unnecessary credit checks.

Once you submit your request, you’ll receive immediate feedback on whether a lender is willing to offer you a loan, along with the complete terms of the offer. You have the freedom to decide whether to accept the offer or not.

Bad Credit? No Problem!

Worried about your credit score? Don’t be. Many lenders within our network prioritize your ability to repay the loan over your credit history. Even if a credit check is performed, lenders will assess your application fairly, provided you meet the basic requirements.

Understanding Rates and Fees

It’s important to note that the Borrow Money App is not a lender. Instead, it serves as a platform to connect eligible borrowers with licensed lenders offering payday loans online. The app does not charge users for its services, and any personal information shared is only accessible to participating lenders. We prioritize your privacy and employ industry-standard encryption to safeguard your data.

Consumers are under no obligation to accept any loan offer and can exit the app at any time before signing an agreement. By law, lenders must provide a comprehensive overview of the loan terms, including principal amounts, fees, interest rates (APR), and repayment schedules before finalizing any loan.

APR Disclosure: What You Need to Know

The Annual Percentage Rate (APR) represents the cost of borrowing expressed as a yearly rate. It varies based on the loan amount, duration, and lender policies. Some states impose legal limits on APRs, which can range from 6.63% to 35.99%. Loan repayment terms also differ, typically spanning from 65 days to 3 years.

Failure to repay a loan can lead to additional fees, increased interest, collection actions, and a negative impact on your credit score. Here’s a representative example of how APR is calculated:

If you take out a loan of $1,000 for one year at a 20% APR, your costs would break down as follows:

- Total charge for the loan: $1,000 * 0.20 (20% APR) = $200

- Total repayment amount: $1,000 + $200 = $1,200

- Monthly payment: $1,200 / 12 = $100

Conclusion: Your Path to Financial Relief

Thank you for considering the Borrow Money App as your solution for quick cash needs. With our user-friendly platform, you can navigate financial emergencies with confidence and ease. Whether you need to cover unexpected bills or make unplanned purchases, we are here to help you find the right lending solution.

Rate the App

User Reviews

Popular Apps

Editor's Choice