Latest Version

7.95.0

January 03, 2026

Savings Bank of Mendocino County

Finance

Android

0

Free

com.apiture.xpressmobile.sbmcuca.sub

Report a Problem

More About SBMC Mobile

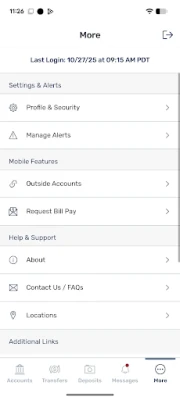

Maximize Your Banking Experience: A Comprehensive Guide to Online Account Management

In today's fast-paced digital world, managing your finances has never been easier. With advanced online banking features, you can effortlessly keep track of your accounts, make transfers, pay bills, and more—all from the convenience of your device. This article explores the essential functionalities of online banking, ensuring you make the most of your financial management tools.

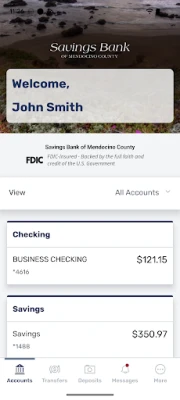

Check Your Account Balance and Transactions

Staying informed about your finances is crucial. With online banking, you can quickly check your latest account balance and monitor your spending habits. The platform allows you to search for recent transactions by date, amount, or check number, giving you a clear overview of your financial activity. This feature not only helps you track your expenses but also assists in identifying any discrepancies or unauthorized transactions.

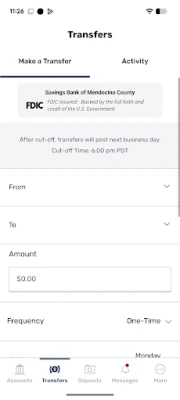

Effortless Cash Transfers Between Accounts

Transferring funds between your accounts has never been simpler. Online banking enables you to easily transfer cash with just a few clicks. Whether you need to move money from your checking to savings account or vice versa, the process is quick and efficient. This feature is particularly useful for managing your budget and ensuring you have the necessary funds available when needed.

Streamlined Bill Payments

Paying bills can be a tedious task, but online banking simplifies this process. With the Bill Pay feature, you can make payments and view both recent and scheduled transactions. This functionality allows you to set up automatic payments for recurring bills, ensuring you never miss a due date. Additionally, you can easily track your payment history, making it easier to manage your monthly expenses.

Convenient Check Deposits

Gone are the days of visiting a bank branch to deposit checks. With online banking, you can submit check deposits using your device’s camera. Simply take a picture of the front and back of the check, and the funds will be deposited directly into your account. This feature not only saves you time but also provides a secure way to manage your deposits from anywhere.

Find Nearby Branches and ATMs

Need to locate a bank branch or ATM? Online banking makes it easy to find nearby locations using your device’s built-in GPS. This feature is particularly helpful when you’re traveling or in a new area, ensuring you can access your funds whenever necessary. Simply enter your location, and the system will provide you with a list of nearby banking facilities.

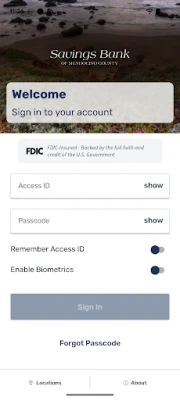

Enhanced Security with Biometrics

Security is a top priority in online banking. The biometrics feature allows you to enjoy a secure and efficient sign-on experience using your fingerprint or facial recognition. This advanced technology not only enhances your account's security but also streamlines the login process, making it quicker and more convenient to access your financial information.

Conclusion

Online banking offers a wealth of features designed to simplify your financial management. From checking your account balance and making transfers to paying bills and depositing checks, these tools empower you to take control of your finances with ease. By leveraging the convenience of online banking, you can save time, enhance security, and stay informed about your financial health. Embrace the digital banking revolution and maximize your banking experience today!

Rate the App

User Reviews

Popular Apps

Editor's Choice