Latest Version

6.24.15

October 03, 2025

Blue FCU

Finance

Android

0

Free

com.bluefcu.business

Report a Problem

More About Blue Business Banking

Unlock the Power of Blue Business Banking: Your Comprehensive Guide

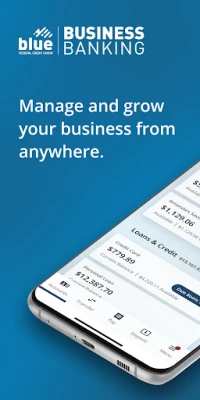

In today's fast-paced financial landscape, managing your business banking needs efficiently is crucial. With Blue Business Banking, you can easily access your accounts and perform a variety of transactions right from your mobile device. This guide will walk you through the features, security measures, and access requirements of the Blue Business Banking app, ensuring you make the most of its capabilities.

Getting Started with Blue Business Banking

To begin your journey with Blue Business Banking, simply log in using your username and password. If you are a first-time user, you can easily enroll for a login directly within the app. This straightforward process allows you to create your credentials and start managing your finances in no time.

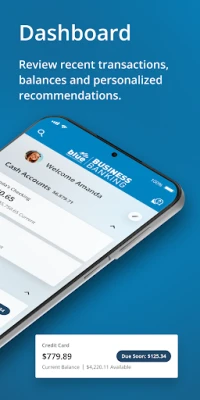

Highlighted Mobile Features

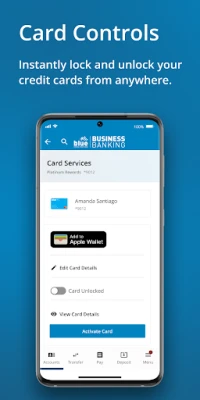

Blue Business Banking offers a range of features designed to enhance your banking experience:

- View Balances and Transaction History: Access your account balances and transaction history securely, giving you a clear overview of your financial status.

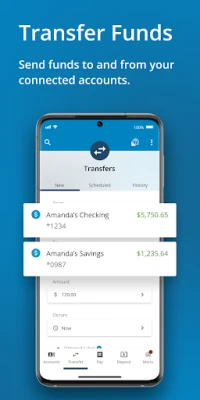

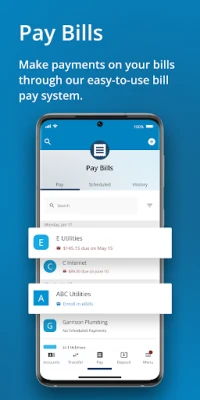

- Effortless Money Transfers: Move money seamlessly between accounts, make loan payments, pay bills, and set up external accounts. The app also supports new ACH and wire payment solutions for added convenience.

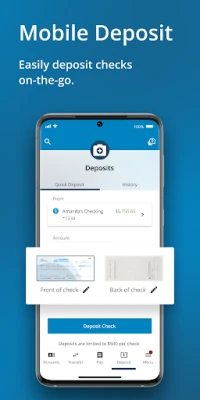

- Remote Check Deposits: Utilize your mobile device's camera to deposit checks quickly and securely, eliminating the need for physical trips to the bank.

- Secure Messaging: Communicate with Blue securely through the app, ensuring your inquiries and concerns are handled with confidentiality.

- Update Your Information: Keep your contact information current, allowing for smooth communication and service updates.

Robust Security Measures

Your security is a top priority with Blue Business Banking. All transactional data is encrypted, ensuring that your sensitive account information remains protected. Importantly, no sensitive data is stored on your mobile device, further safeguarding your financial information.

Understanding Permissions

To fully utilize the features of the Blue Business Banking app, certain permissions are required:

- Location Permissions: These permissions help determine your location, making it easier to find nearby branches and ATMs.

- Camera Permissions: Required for remote check deposits, allowing you to deposit checks directly from your mobile device.

- Notification Permissions: Stay informed with important updates regarding your account through timely notifications.

Access and Limitations

While Blue Business Banking offers a wealth of features, it's essential to be aware of certain access limitations:

- Deposit and Transaction Limits: Be mindful of deposit limits and transaction restrictions that may apply to your account.

- Eligibility Requirements: Access to Blue Business Banking is subject to eligibility criteria. Some features may only be available to eligible members and accounts.

- Fee Schedule: Review the latest fee schedule and disclosures from Blue Federal Credit Union to understand any fees associated with premium features and services.

Additionally, message and data rates may apply, so be sure to check with your mobile provider for any potential charges.

Funds Availability Policy

All transactions conducted through the Blue Business Banking app are subject to the Funds Availability Policy and applicable laws. This policy outlines the timing and conditions under which funds will be available for withdrawal or use.

Need Assistance? Contact Blue FCU

If you have questions, comments, or need help with your Blue Business Banking experience, don't hesitate to reach out:

- Website: www.BlueFCU.com

- Phone: 1-800-368-9328

- Email: support@BlueFCU.com

With Blue Business Banking, you have the tools you need to manage your business finances effectively and securely. Take advantage of its features today and streamline your banking experience.

Rate the App

User Reviews

Popular Apps

Editor's Choice