Latest Version

8.78.0

November 14, 2024

Betterment

Finance

Android

0

Free

com.betterment

Report a Problem

More About Betterment Invest & Save Money

Maximize Your Financial Future with Betterment: The Ultimate Digital Investment Advisor

In today's fast-paced financial landscape, making informed investment decisions is crucial for achieving your financial goals. Betterment, an independent digital investment advisor and fiduciary, is designed to help you optimize your money management so you can live your best life. With a user-friendly app and a low entry point of just $10, Betterment makes it easy to track your financial journey across both short- and long-term savings objectives.

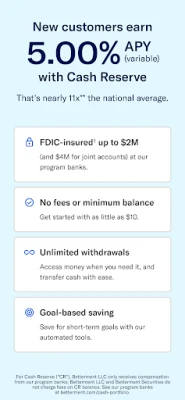

Attractive Cash Management Options

New customers can take advantage of a competitive 5.00% variable APY* on cash deposits as of September 20, 2024. This rate is significantly higher than the national average, allowing you to grow your savings effectively.

- Boost Your Earnings: Qualifying deposits can earn an additional 0.50% APY*, ensuring your money works harder for you.

- FDIC Insurance: Protect your earnings with up to $2 million† in FDIC insurance through our partner banks.

For more details, visit www.betterment.com/cash-portfolio.

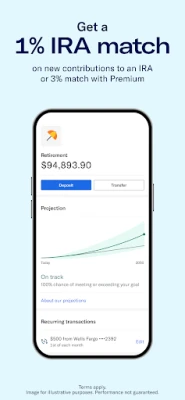

Retirement Savings Made Simple

Betterment offers an enticing opportunity to enhance your retirement savings with a match on new contributions to an IRA. Enjoy a 1% match for digital customers and a generous 3% match for Premium customers. Premium membership also provides access to a team of Certified Financial Planner™ professionals and a 0.25% Cash Reserve preferred rate boost.

Start saving for retirement effortlessly with an IRA, as Betterment will match net Roth and traditional IRA contributions until December 30, 2024. For more information, check out www.betterment.com/ira-and-401k.

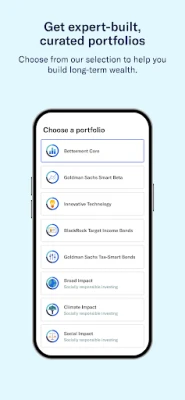

Expertly Curated Investment Portfolios

Betterment's expert-built portfolios are designed to help you navigate market fluctuations with confidence. You can customize your stock-and-bond risk level based on professional recommendations, ensuring your investments align with your financial goals.

- Diverse Portfolio Options: Choose from a variety of optimized, curated portfolios, including Innovative Tech, Goldman Sachs Smart Beta, and socially responsible investing options such as Broad, Social, or Climate Impact portfolios.

- All-Bond Strategies: If you prefer a conservative approach, consider our BlackRock Target Income portfolio or Goldman Sachs Tax-Smart Bond portfolio, which aim for higher yields with reduced risk compared to stocks.

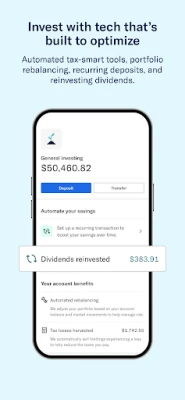

Advanced Technology for Optimal Investing

Investing with Betterment means leveraging technology that optimizes your financial strategy. Key features include:

- Automatic Rebalancing: Your portfolio is automatically rebalanced, and dividends are reinvested to maintain your desired asset allocation.

- Tax Efficiency: Utilize automated tools like tax-loss harvesting and tax coordination between accounts to minimize your tax impact.

- Flexible Deposits: Set up recurring deposits on your preferred schedule to ensure consistent investment growth.

If you have questions, Betterment offers a wealth of resources or you can consult with their financial advisors for personalized guidance.

Cost-Effective Investment Management

Betterment provides an affordable investment solution, charging just $4/month or an annual fee of 0.25% on your investing account balance. You can qualify for this low fee by:

- Maintaining a total Betterment balance of $20,000 or more across your investing and cash accounts.

- Setting up recurring deposits of $250/month or more into any account.

For those seeking more personalized service, upgrading to Premium offers unlimited access to advisors for just 0.65% of your invested assets, significantly lower than traditional advisory fees. All advisors are CERTIFIED FINANCIAL PLANNER™ professionals, ensuring you receive expert advice without the pressure of commissions.

Transform Life Goals into Financial Achievements

Betterment empowers you to manage your finances effectively, whether you're saving for everyday expenses or planning for significant life events. Key features include:

- Cash Management: Use Betterment Checking to manage everyday spending and earn cash back.

- Goal-Oriented Savings: Save for specific goals like a new exercise bike or your next vacation.

- IRA Options: Go beyond your 401(k) with an IRA to enhance your retirement savings.

- Projection Tools: Utilize our projection tools to create a comprehensive financial plan and calculate how to reach your targets with our goal forecaster.

Comprehensive Financial Overview

With Betterment's all-in-one financial dashboard, you can see the bigger picture of your financial health. Connect outside accounts to view your net worth and track your investment performance—all in one convenient location.

In conclusion, Betterment stands out as a leading digital investment advisor, offering innovative solutions to help you achieve your financial goals. With competitive rates, expert guidance, and advanced technology, Betterment is your partner in building a secure financial future.

Rate the App

User Reviews

Popular Apps

Editor's Choice