Latest Version

4.41.118

August 19, 2025

Beacon Credit Union, Inc.

Finance

Android

0

Free

com.softek.ofxclmobile.Beaconcu

Report a Problem

More About Beacon Mobile Banking

Unlocking Financial Freedom: Explore the Features and Benefits of Beacon Credit Union's Loan Services

In today's fast-paced financial landscape, having access to reliable banking services is essential. Beacon Credit Union offers a suite of features designed to empower members in managing their finances effectively. From checking balances to secure messaging for support, this article delves into the key functionalities and lending options available to members.

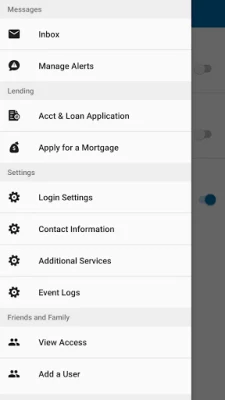

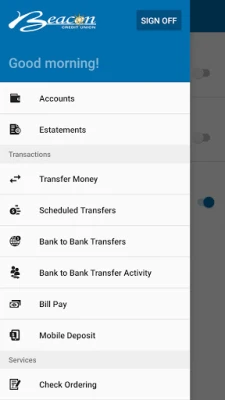

Essential Features of Beacon Credit Union

Beacon Credit Union provides a user-friendly platform that allows members to take control of their finances. Here are some of the standout features:

- Check Balances: Easily monitor your account balances in real-time, ensuring you stay informed about your financial status.

- View Transaction History: Access a detailed history of your transactions, helping you track spending and manage your budget effectively.

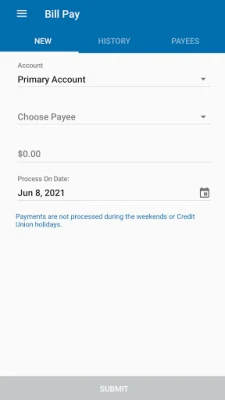

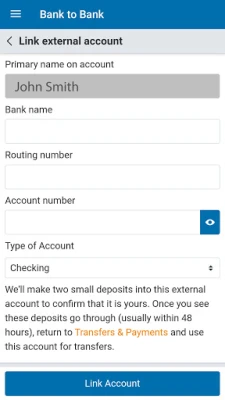

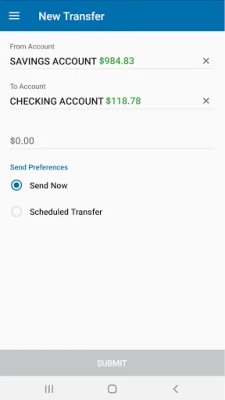

- Transfer Funds: Seamlessly transfer funds between accounts or to other members, making it convenient to manage your money.

- Pay Loans: Stay on top of your loan payments with easy online payment options, ensuring you never miss a due date.

- Secure Messaging for Support: Reach out for assistance through secure messaging, providing peace of mind when you need help.

Loan Options Tailored for You

Beacon Credit Union understands that financial needs vary among members. Therefore, they offer a range of personal loan options designed to meet diverse requirements. If you have questions about the application process or loan eligibility, contact Beacon Credit Union at 434-237-1566.

Understanding Loan Eligibility and Terms

Current members may qualify for various loan options. It’s crucial to review the lending information to understand the terms and conditions. For the latest rate information, visit Beacon Credit Union's loan rates page.

Here are some key details regarding personal loans:

- Repayment Period: Personal loans have a minimum repayment period of 6 months and a maximum of 96 months.

- Annual Percentage Rate (APR): The maximum APR for personal loans is 36%.

- Loan Amounts: Members can borrow a minimum of $1,000 and up to $100,000.

Loan Approval Criteria

Not all applicants will qualify for the most favorable rates or the highest loan amounts. Approval depends on several factors, including:

- Credit union membership history

- Credit risk evaluations

- Responsible credit history

- Debt-to-income ratio

- Availability of collateral

Highly qualified applicants may receive higher loan amounts and lower APRs. However, it’s important to note that personal loans cannot be used for specific purposes, such as:

- College or post-college education expenses

- Business or commercial purposes

- Buying cryptocurrency or other speculative investments

- Gambling or illegal activities

Additionally, active-duty military personnel and their families are subject to the Military Lending Act, which restricts the use of vehicles as collateral.

Example Loan Scenario

To illustrate how personal loans work, consider a scenario where a borrower receives $10,000 at an APR of 24.99% over 48 months. The monthly repayment would be approximately $331.52, leading to a total repayment amount of $15,912.74. Keep in mind that actual loan terms may vary based on the borrower’s credit profile, existing debts, income, and membership history.

Debt Consolidation Options

Some loan options at Beacon Credit Union are specifically designed for consolidating existing debts into a single loan. While this can simplify your financial obligations, it’s essential to understand that total finance charges and the amount owed over the new loan term may exceed the existing debt. This can occur due to longer repayment terms or higher interest rates.

Conclusion

Beacon Credit Union offers a comprehensive suite of features and loan options that cater to the diverse needs of its members. With tools to check balances, view transaction history, and transfer funds, managing your finances has never been easier. If you’re considering a personal loan, take the time to review the eligibility criteria and understand the terms to make informed financial decisions. For any inquiries, don’t hesitate to reach out to Beacon Credit Union for assistance.

Rate the App

User Reviews

Popular Apps

Editor's Choice