Latest Version

2.1

October 07, 2024

BBVA

Finance

Android

0

Free

com.bbva.empresas

Report a Problem

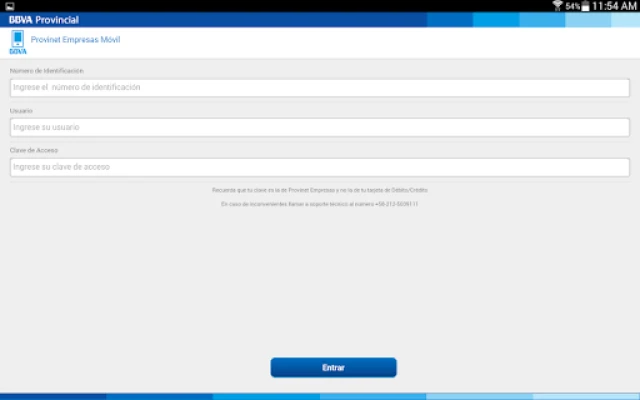

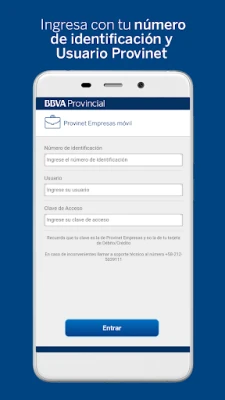

More About BBVA Provinet Empresas Móvil

Comprehensive Global Position Consultation: Your Financial Management Hub

In today's fast-paced financial landscape, having a clear understanding of your financial position is crucial. This article delves into the various features and services that can help you manage your finances effectively, from loan consultations to service payments. Let's explore how you can take control of your financial journey.

Global Position Consultation: A Detailed Overview

Understanding your global financial position is the first step towards effective financial management. A comprehensive consultation allows you to assess your assets, liabilities, and overall financial health. By utilizing advanced tools and resources, you can gain insights into your financial standing, enabling you to make informed decisions.

Check Your Loans and Investments

Keeping track of your loans and investments is essential for maintaining financial stability. Regularly reviewing your loan status and investment performance helps you identify opportunities for growth and areas that may require attention. Utilize online platforms to access real-time information about your financial commitments and investment portfolios.

Visualize Your Transaction Details

Having a clear view of your financial transactions is vital for effective budgeting and planning. By visualizing your transaction history, you can identify spending patterns, track expenses, and make necessary adjustments to your financial strategy. Many financial management tools offer detailed reports and analytics to help you stay on top of your finances.

Authorize Your Payroll Payments

Managing payroll efficiently is crucial for both employees and employers. By authorizing payroll payments through a secure platform, you ensure timely and accurate disbursement of salaries. This not only enhances employee satisfaction but also streamlines your financial operations.

Adjust Your Transaction Limits

Flexibility in managing your transaction limits is essential for adapting to changing financial needs. Whether you need to increase your spending limit for a significant purchase or decrease it for better control, having the ability to adjust these limits empowers you to manage your finances effectively.

Make Payments for Services, Credit Cards, and Transfers

Convenience is key when it comes to managing payments. With the right financial tools, you can easily make payments for various services, credit card bills, and transfers. This not only saves time but also helps you avoid late fees and maintain a good credit score. Look for platforms that offer seamless payment options to enhance your financial management experience.

Join Quick Money Services: Manage Your Checkbooks and More

Affiliating with quick money services can significantly simplify your financial management. These services often provide tools for managing checkbooks, tracking expenses, and accessing loans quickly. By leveraging these resources, you can enhance your financial literacy and make smarter financial decisions.

Conclusion: Take Charge of Your Financial Future

In conclusion, understanding and managing your financial position is essential for achieving your financial goals. By utilizing comprehensive consultation services, monitoring your loans and investments, and leveraging modern financial tools, you can take control of your financial future. Start today by exploring the various options available to you and make informed decisions that will lead to financial success.

Rate the App

User Reviews

Popular Apps

Editor's Choice