Latest Version

24.90.13

October 26, 2024

BBVA

Finance

Android

0

Free

co.com.bbva.mb

Report a Problem

More About BBVA Colombia

Maximize Your Banking Experience with BBVA: A Comprehensive Guide

In today's fast-paced world, managing your finances efficiently is crucial. BBVA offers a range of features designed to enhance your banking experience, ensuring security, convenience, and accessibility. This article explores the various functionalities available through the BBVA app, empowering you to take control of your financial activities seamlessly.

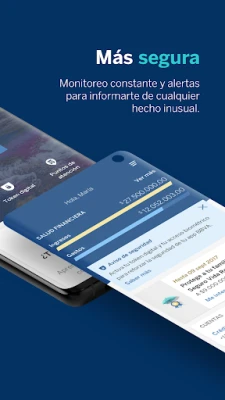

Enhanced Security Features

BBVA prioritizes your security with advanced features that protect your personal information and transactions. You can log in using a unique password or utilize biometric identification, such as fingerprint or Face ID, to maximize security. This dual-layer protection ensures that only you can access your account.

Effortless Transaction Management

Managing your finances has never been easier. With just a tap, you can view detailed information about your accounts, including transaction history and balances. The app allows you to perform transactions directly from your product details, making it simple to stay on top of your finances.

Access to Account Statements and Certificates

Stay informed about your financial status by accessing statements for all your accounts. You can generate certificates for your savings and checking accounts directly through the app, providing you with essential documentation whenever you need it.

Control Your Debit and Credit Cards

Take charge of your spending by managing your debit and credit cards directly from the app. You can easily turn your cards on or off, ensuring that you have complete control over your finances at all times.

Convenient Bill Payments

Paying your bills is a breeze with BBVA. Simply scan the barcode on your bill using your phone's camera or enter the payment reference number. The app also supports payments for bills with dual reference numbers, making it versatile for all your payment needs.

Tax Payments and Mobile Recharges

In addition to utility bills, you can conveniently pay your taxes and recharge your mobile phone directly through the app. This feature saves you time and effort, allowing you to manage multiple financial tasks in one place.

Favorite Transactions for Quick Access

To streamline your banking experience, you can mark your favorite transactions, such as utility payments, mobile recharges, and interbank transfers. This feature allows you to access these transactions quickly without needing to search for the details each time.

Paying Family and Friends

BBVA makes it easy to pay credit card bills for your family and friends, as well as your own. You can also manage payments for credit cards from other banks, ensuring that you can handle all your financial obligations in one app.

Loan Management Made Simple

Managing your BBVA loans is straightforward. You can make payments directly through the app, ensuring that you stay on top of your financial commitments without any hassle.

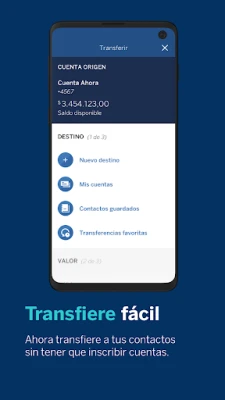

Seamless Transfers Between Accounts

Transfer funds effortlessly between BBVA accounts and accounts from other banks. The app allows you to save account information for future transfers, making the process quick and efficient.

Instant Credit Card Advances

If you need immediate funds, you can request advances from your credit card, with the amount credited instantly to your savings or checking account. This feature provides you with quick access to cash when you need it most.

Withdraw Cash Without a Card

BBVA offers a unique feature that allows you to withdraw cash from ATMs without your card. Simply generate a token from your account details, which is valid for three hours, and use it to access your funds securely.

Online Shopping Made Easy

When shopping online, you can easily view the CVV of your debit and credit cards through the app, ensuring that you can make purchases securely and conveniently.

Check Your Pre-approved Credit Options

Stay informed about your financial opportunities by checking for pre-approved credit card offers, revolving credit limits, and loans directly through the app. This feature helps you make informed financial decisions.

International Money Transfers

BBVA facilitates sending and receiving money internationally, making it easy to manage your finances across borders. This feature is particularly useful for those with family or business interests abroad.

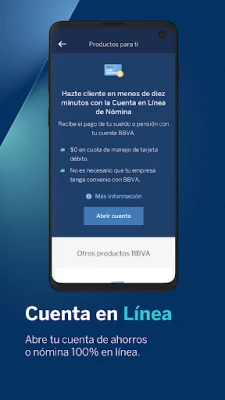

Digital Credit Management

You can request additional resources for your current consumer credit through a credit top-up, contract a CDT, or access payroll advances and investment funds digitally, eliminating the need to visit a physical branch.

Investment Fund Management

With BBVA, you can create or cancel your investment fund at any time, giving you the flexibility to manage your investments according to your financial goals.

Stay Updated with Promotions and Points

Keep track of the latest promotions available to you and utilize your BBVA points effectively. The app provides updates on how you can benefit from various offers.

Easy Communication and Support

Ensure that your contact information is up to date, particularly your email address, so you can receive important notifications and updates from BBVA. If you need assistance, you can reach out to customer support through various channels.

Accessing Your Transaction Profile

The Transaction Profile is now represented by the Digital Token, enhancing security and convenience. You can activate the Digital Token directly from the app, eliminating the need to visit an ATM.

Comprehensive Product Information

BBVA provides detailed information about all your products, including fees, commissions, and charges. The app also features helpful messages to clarify any confusing concepts, ensuring you understand your financial products fully.

Get Help When You Need It

In addition to product information, the app guides you on how to get assistance, whether you need to call customer service or visit a branch. If you choose to visit a branch, the app will direct you to the nearest location.

Accessing Statements Made Easy

Requesting account statements through the app is hassle-free, as you no longer need a password to open them. This feature enhances accessibility and convenience.

Quick Access Without Login

Even without logging into the app, you can access certain options from the Side Menu, providing you with quick access to essential features.

Contact Us for Support

Rate the App

User Reviews

Popular Apps

Editor's Choice