Latest Version

9.49

October 01, 2025

St.George Bank

Finance

Android

0

Free

org.banksa.bank

Report a Problem

More About BankSA Mobile Banking

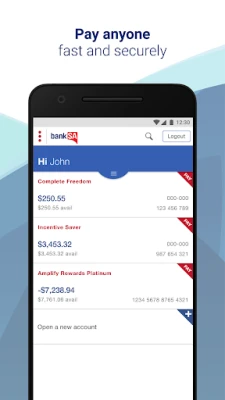

Maximize Your Banking Experience with Our Comprehensive Mobile App Features

In today's fast-paced world, managing your finances efficiently is crucial. Our mobile banking app offers a suite of features designed to enhance your banking experience, making it easier than ever to stay on top of your finances. From quick access to your account balance to advanced payment options, discover how our app can simplify your banking needs.

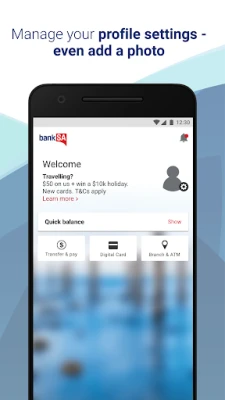

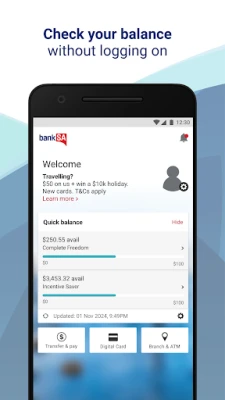

Instant Account Overview

With our Quick Balance feature, you can effortlessly view your account balance at a glance. Need to transfer money between accounts? Our app allows you to do this seamlessly, ensuring you have full control over your finances at all times.

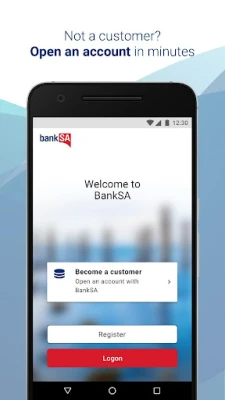

Secure and Convenient Logon

Experience Quick Logon with the convenience of using your fingerprint or a security number. This feature ensures that your banking information remains secure while providing you with quick access to your accounts.

Effortless Expense Management

Have you shared expenses with friends or family? Our Expense Splitter tool helps you keep track of who owes you money, making it easier to manage shared costs and settle up quickly.

Stay Informed with Notifications and Alerts

Customize your banking experience with Notifications and Alerts. Choose from seven different types of alerts and receive them as mobile push notifications, SMS, or email. Stay updated on your account activity and never miss an important transaction.

Card Security at Your Fingertips

If you misplace your card, don’t panic! You can temporarily lock your card for up to 15 days, preventing unauthorized transactions. Additionally, you can report your card as lost or stolen directly through the app, ensuring your account remains secure.

Contact Us with Ease

Need assistance? Our app allows you to contact us directly without the hassle of answering security questions. Get the help you need quickly and efficiently.

Fast Payments and Transfers

Send and receive payments in near real-time with our app. Whether you’re making transfers, payments (including BPAY®), or sending money overseas to existing payees, our platform makes it simple. Plus, with Google Pay™, you can make payments using your eligible card, enhancing your convenience.

Enhanced Security with Digital Card

Boost your card security by utilizing our Digital Card feature, which provides a dynamic CVV for your credit or debit card. This added layer of security helps protect your financial information during online transactions.

Verify Payee Details

When adding a new payee, our Verify feature checks the account details you’ve entered against commonly used information. This helps ensure that your payments reach the right destination, minimizing errors and enhancing your peace of mind.

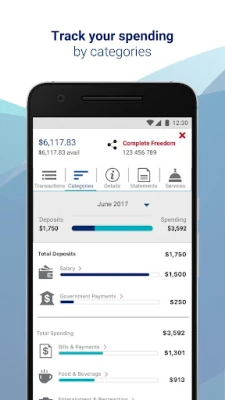

Track Your Spending Effectively

Gain insights into your financial habits with our spending tracker. The 'Categories' feature allows you to see where your money goes, helping you make informed decisions about your spending.

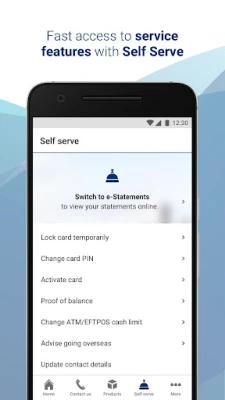

Access a Range of Services

Tap into our Services Menu to:

- Search past transactions

- Schedule future and recurring payments

- Download reports such as Proof of Balance, Interest Earned, or Transaction Listings

- Activate your new credit or debit card

- Change your daily ATM/EFTPOS cash withdrawal limit (daily limits apply)

- Notify us when you’re traveling overseas

- Set up a Plan&Pay instalment plan - learn more at stgeorge.com.au/planandpay

- Block gambling transactions on eligible cards

Find Your Nearest ATM or Branch

Need to withdraw cash or visit a branch? Use our ATM & Branch Locator to find the nearest BankSA, St.George, Westpac, or Bank of Melbourne ATM or branch quickly and easily.

Need Help? We’re Here for You

If you encounter any issues with our app, simply delete and reinstall it. Should problems persist, please call us at 13 13 76 (available from 7:30 am to 7:30 pm, Monday to Saturday) for further assistance.

Important Information

Note that some features may not be available on rooted devices. For a complete list of compatible phones, visit banksa.com.au/devices.

Locking your card will temporarily halt new transactions for up to 15 days or until reactivated. If you do not unlock the card or report it lost or stolen, it will automatically reactivate after 15 days.

For more details on terms and conditions, please visit banksa.com.au before making any decisions. Fees and charges may apply.

BankSA is a division of Westpac Banking Corporation, and we are committed to providing you with the best banking experience possible.

Rate the App

User Reviews

Popular Apps

Editor's Choice