Latest Version

November 28, 2024

Finansiell ID-Teknik BID AB

Finance

Android

0

Free

com.bankid.bus

Report a Problem

More About BankID security app

Understanding Mobile BankID: A Comprehensive Guide

Mobile BankID has become an essential tool for secure digital identification and authentication in Sweden. Issued by several prominent financial institutions, including Danske Bank, Handelsbanken, ICA Banken, Länsförsäkringar, Nordea, SEB, Skandia, Sparbanken Syd, Swedbank, and Ålandsbanken, it facilitates seamless online transactions and access to various services.

What is Mobile BankID?

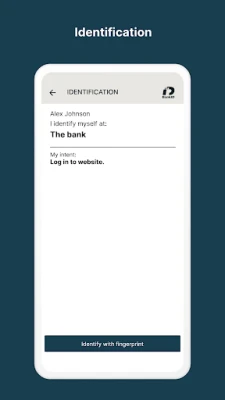

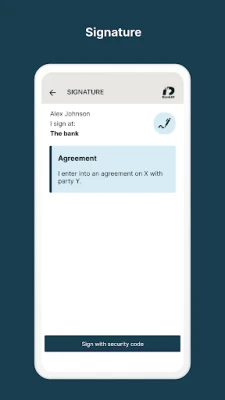

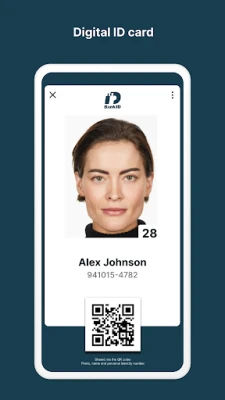

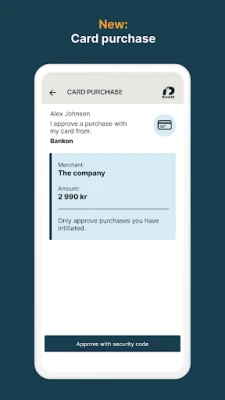

Mobile BankID is a mobile application that allows users to verify their identity and sign documents electronically. This digital identification method is widely accepted across various sectors, including banking, healthcare, and government services. By using Mobile BankID, individuals can securely log into their online accounts, approve transactions, and access sensitive information without the need for physical identification.

How Does Mobile BankID Work?

The functionality of Mobile BankID is straightforward yet highly secure. Users download the app on their smartphones and link it to their bank accounts. When a user needs to authenticate their identity, they receive a prompt on their device. By entering a personal identification number (PIN), they can confirm their identity and complete the transaction or access the service.

Key Features of Mobile BankID

- Secure Authentication: Mobile BankID employs advanced encryption techniques to ensure that user data remains confidential and secure.

- Wide Acceptance: Many businesses and government agencies in Sweden accept Mobile BankID for various services, making it a versatile tool for users.

- User-Friendly Interface: The app is designed for ease of use, allowing users to navigate effortlessly through the authentication process.

- Instant Access: Users can quickly access their accounts and services without the need for lengthy verification processes.

Benefits of Using Mobile BankID

Mobile BankID offers numerous advantages for both users and service providers. Here are some of the key benefits:

Enhanced Security

With the increasing prevalence of online fraud, security is a top priority for users. Mobile BankID provides a robust security framework that protects personal information and financial transactions. The use of two-factor authentication adds an extra layer of protection, ensuring that only authorized users can access sensitive data.

Convenience and Efficiency

Gone are the days of carrying physical identification documents. Mobile BankID allows users to authenticate their identity anytime and anywhere, making it a convenient option for busy individuals. This efficiency not only saves time but also streamlines processes for businesses and service providers.

Cost-Effective Solution

For businesses, integrating Mobile BankID into their services can reduce costs associated with traditional identification methods. By minimizing the need for physical paperwork and in-person verification, companies can enhance their operational efficiency and reduce overhead expenses.

How to Get Started with Mobile BankID

Getting started with Mobile BankID is a simple process. Follow these steps to begin using this powerful tool:

- Download the App: Visit your device's app store and download the Mobile BankID application.

- Register with Your Bank: Open the app and follow the instructions to link it to your bank account. You may need to provide personal information and verify your identity.

- Set Up Your PIN: Create a secure PIN that you will use to authenticate your identity during transactions.

- Start Using Mobile BankID: Once set up, you can use Mobile BankID to log into various services, approve transactions, and sign documents electronically.

Resources for Developers

For developers looking to integrate Mobile BankID into their electronic services, comprehensive information is available. Visit www.bankid.com/rp/info for detailed guidelines and resources tailored for developers.

Conclusion

Mobile BankID is revolutionizing the way individuals authenticate their identities and conduct transactions online. With its robust security features, convenience, and wide acceptance, it has become an indispensable tool for both users and businesses in Sweden. As digital services continue to evolve, Mobile BankID stands at the forefront, providing a reliable and efficient solution for secure online interactions.

Rate the App

User Reviews

Popular Apps

Editor's Choice