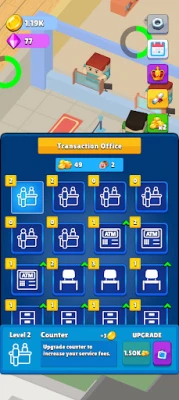

Latest Version

1.5.5.37

January 25, 2025

Ciao Games

Games

Android

0

Free

com.MomoshStudios.BankEmpireIdle

Report a Problem

More About Bank Empire Idle 3D

Transform Your Banking Experience: Elevate Departments and Delight Customers

In today's competitive financial landscape, banks must continuously innovate to meet the evolving needs of their customers. Upgrading your bank's departments is not just a strategy; it's a necessity. By enhancing operational efficiency and customer satisfaction, financial institutions can unlock new opportunities and thrive in a dynamic market. This article explores how to elevate your bank's departments, ensure customer happiness, and embark on a journey of transformation.

Revamping Bank Departments for Enhanced Efficiency

To stay ahead, banks must focus on upgrading their internal departments. This involves streamlining processes, adopting new technologies, and fostering a culture of continuous improvement. Here are some key areas to consider:

1. Embrace Digital Transformation

In an era where technology drives customer expectations, banks must invest in digital solutions. Implementing advanced software for customer relationship management (CRM) can help departments manage client interactions more effectively. Additionally, utilizing data analytics can provide insights into customer behavior, enabling personalized services that cater to individual needs.

2. Enhance Employee Training and Development

Your employees are the backbone of your bank. Investing in their training ensures they are equipped with the latest skills and knowledge. Regular workshops and seminars can keep staff updated on industry trends and customer service best practices. A well-trained team is more likely to provide exceptional service, leading to increased customer satisfaction.

3. Foster Interdepartmental Collaboration

Breaking down silos between departments can lead to improved communication and efficiency. Encourage collaboration through regular meetings and joint projects. When departments work together, they can share insights and resources, ultimately enhancing the overall customer experience.

Creating a Customer-Centric Culture

Happy customers are the cornerstone of any successful bank. To achieve this, it's essential to cultivate a customer-centric culture that prioritizes client needs and preferences. Here are some strategies to consider:

1. Actively Seek Customer Feedback

Understanding your customers' needs is crucial for improvement. Implement surveys, feedback forms, and focus groups to gather insights on their experiences. Use this information to make informed decisions that enhance services and address any pain points.

2. Personalize Customer Interactions

In a world where personalization is key, banks must tailor their services to meet individual customer needs. Utilize data analytics to understand customer preferences and behaviors. This allows you to offer personalized recommendations, promotions, and services that resonate with your clients.

3. Provide Exceptional Customer Support

Responsive and effective customer support can significantly impact customer satisfaction. Ensure that your support team is well-trained and equipped to handle inquiries promptly. Consider offering multiple channels for support, including phone, email, and live chat, to cater to diverse customer preferences.

Completing Quests: Setting Goals for Continuous Improvement

Just like in a game, banks can set quests or goals to drive continuous improvement. These quests can focus on various aspects of the banking experience, from enhancing service delivery to increasing customer engagement. Here’s how to implement this concept:

1. Define Clear Objectives

Establish specific, measurable, achievable, relevant, and time-bound (SMART) objectives for each department. This clarity helps teams understand their roles in achieving the bank's overall goals and fosters a sense of purpose.

2. Monitor Progress and Celebrate Achievements

Regularly track progress towards these objectives and celebrate milestones. Recognizing achievements boosts morale and motivates employees to continue striving for excellence. Consider implementing a rewards program to incentivize outstanding performance.

3. Adapt and Evolve

The banking industry is constantly changing, and so should your strategies. Be prepared to adapt your goals and processes based on market trends and customer feedback. This flexibility ensures that your bank remains relevant and competitive.

Unlocking New Worlds: Expanding Services and Offerings

As banks upgrade their departments and enhance customer satisfaction, they can also explore new service offerings. Unlocking new worlds means diversifying your portfolio and providing innovative solutions that meet the changing needs of your clients.

1. Explore Fintech Partnerships

Collaborating with fintech companies can provide access to cutting-edge technology and innovative solutions. These partnerships can enhance your service offerings, from mobile banking apps to advanced payment solutions, making banking more convenient for customers.

2. Introduce New Financial Products

Consider expanding your range of financial products to cater to different customer segments. This could include offering specialized loans, investment options, or savings accounts tailored to specific demographics. A diverse product lineup can attract new customers and retain existing ones.

3. Focus on Sustainability and Social Responsibility

Today's consumers are increasingly concerned about sustainability and social responsibility. By integrating these values into your banking practices, you can appeal to a broader audience. Consider offering green loans or supporting community initiatives to demonstrate your commitment to positive change.

Conclusion: A Path to Banking Excellence

Upgrading your bank's departments, prioritizing customer happiness, and completing quests for continuous improvement are essential steps toward achieving banking excellence. By embracing digital transformation, fostering a customer-centric culture, and exploring new service offerings, your bank can unlock new worlds of opportunity. The journey may be challenging, but the rewards of satisfied customers and a thriving business are well worth the effort.

Rate the App

User Reviews

Popular Apps

Editor's Choice