Latest Version

3.37.1

November 05, 2024

Bangkok Bank PCL

Finance

Android

0

Free

com.bbl.mobilebanking

Report a Problem

More About Bangkok Bank Mobile Banking

Unlocking the Full Potential of Bangkok Bank Mobile Banking

In today's fast-paced world, managing your finances efficiently is crucial. Bangkok Bank's mobile banking application offers a comprehensive suite of features designed to enhance your banking experience. From account management to investment opportunities, this guide will explore the various functionalities available to both new and existing customers.

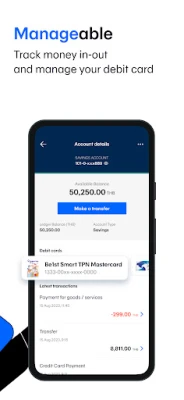

Account Management Made Easy

One of the standout features of the Bangkok Bank mobile app is the ability to lock and unlock accounts. This functionality is essential for preventing unauthorized transfers, top-ups, and payments. Users can easily manage their accounts, ensuring that their funds remain secure.

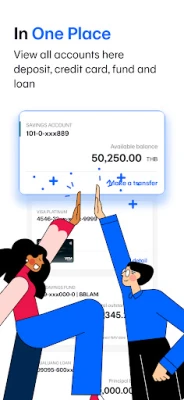

Comprehensive Account Overview

The app allows users to view all types of deposits, including credit cards, mutual funds, government bonds, and Bualuang loan accounts. This holistic view of your financial portfolio enables better decision-making and financial planning.

Requesting Account Statements

Need to keep track of your finances? The mobile banking app lets you request Thai baht and Foreign Currency Deposit (FCD) account statements with just a few taps. This feature simplifies the process of monitoring your financial activities.

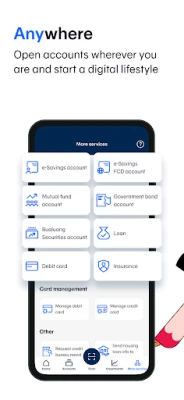

Open an e-Savings Account

For those looking to save, the app provides an option to open an e-Savings account. This account type offers competitive interest rates and easy access to your funds, making it an ideal choice for savvy savers.

Cardless Withdrawals

With Bangkok Bank's mobile app, you can make cardless withdrawals at ATMs, including those of other banks. This feature is particularly convenient for users who may not have their debit cards on hand.

Convenient Withdrawals at Multiple Locations

Withdrawals are not limited to ATMs. The app allows you to make withdrawals at 7-Elevens and Thailand Post offices, providing flexibility and convenience for your banking needs.

Investing in Mutual Funds

Investing has never been easier. The app enables users to conveniently invest in mutual funds. You can open a mutual fund account, place your first buy order, sell, switch funds, and even set up Dollar Cost Averaging (DCA) subscriptions.

Government Bonds and Corporate Debentures

For those interested in fixed-income investments, the app allows you to open a government bonds account. You can buy, make payments for reservations, and subscribe to corporate debentures, all from the comfort of your mobile device.

Home Loan Management

Managing your home loan is straightforward with the app. You can make Bualuang home loan payments and request the bank to submit housing loan information to the Revenue Department, facilitating a convenient tax deduction claim.

International Funds Transfers

Need to send money abroad? The app supports international funds transfers via SWIFT, allowing transactions in 17 currencies across 124 countries. Additionally, you can transfer funds to Singapore using PromptPay International.

Insurance Management

Stay on top of your insurance needs by using the app to buy insurance and check your policies. This feature ensures that you are always informed about your coverage and can make necessary adjustments.

LINE Pay and BTS Trip History

Manage your LINE Pay balance and view your BTS trip history directly through the app, making it easier to keep track of your daily expenses and travel activities.

Applying for Banking Services

The app simplifies the process of applying for various banking services. You can:

- Request a debit or credit card

- Open a Securities Trading Account

- Subscribe, edit, or cancel the Dollar Cost Average (DCA) service

- Register for direct debit services

- Manage your PromptPay registration

- Request a Credit Bureau Report

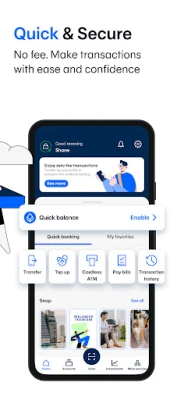

Quick Access Features

With the Quick Balance feature, you can view your account balance without needing a mobile PIN. Additionally, the Scan to Pay functionality allows you to make payments effortlessly using QR codes, whether at local merchants or those with the UnionPay logo overseas.

Easy Activation and Support

Activating the app on new devices is a breeze. You can use your debit card or account number along with facial authentication for added security. If you need assistance, customer support is just a call away at 1333 or (66) 0-2645-5555.

How to Get Started

For customers without a Bangkok Bank account, simply open an e-Savings account and apply for mobile banking and debit card services directly in the app. Existing customers can download the application and use their Bangkok Bank debit or credit card to apply. If you need to visit a branch, you can obtain a User ID and PIN at any Bualuang ATM or Bangkok Bank branch.

Conclusion

Bangkok Bank's mobile banking application is a powerful tool that offers a wide range of features to enhance your banking experience. Whether you are managing your accounts, investing in mutual funds, or making international transfers, the app provides the convenience and security you need. Download the app today and take control of your financial future.

For more information, visit www.bangkokbank.com/mobilebanking.

Disclaimer: This application is intended for prospective customers and existing customers of Bangkok Bank only. It should not be used for any illegal purposes.

Rate the App

User Reviews

Popular Apps

Editor's Choice