Latest Version

2.88.0

October 16, 2024

B9 - Get Your Paycheck Early

Finance

Android

0

Free

com.b9.app

Report a Problem

More About B9: Fast Cash Advance

Maximize Your Savings: Earn Up to 5% Cash Back with B9 Visa® Debit Card

Unlock the potential of your spending with the B9 Visa® Debit Card, where you can earn up to 5% cash back on eligible purchases made both online and in physical stores. This innovative financial solution is designed to reward you for your everyday spending while providing you with flexible cash advance options. Below, we’ll explore how the B9 system works, the subscription plans available, and the benefits of using the B9 Visa® Debit Card.

How the B9 Visa® Debit Card Works

Getting started with the B9 Visa® Debit Card is simple and straightforward. Follow these steps to maximize your cash back and access cash advances:

- Download the App: Begin by downloading the B9 app and opening your B9 account. You can easily deposit your income or paycheck into your B9 account. This includes recurring direct deposits from various sources such as multiple employers, side hustles, government benefits, and rental income.

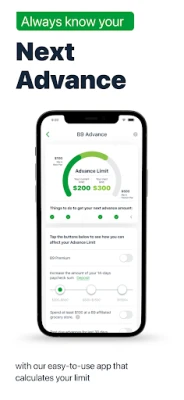

- Check Your Cash Advance Eligibility: Once your account is set up, check the amount of cash advance you qualify for. Confirm your cash advance for immediate use.

- Withdraw or Spend Your Cash Advance: Use your cash advance whenever you need it, providing you with financial flexibility.

- Repayment: When your next paycheck is deposited, the amount of your cash advance will be deducted from your B9 account.

- Build Your Credit: Consistent on-time payments can increase your cash advance eligibility over time, allowing you to access more funds as needed.

Choose Your Subscription Plan

B9 offers two subscription plans tailored to meet different financial needs: the Basic Plan and the Premium Plan. Each plan comes with unique features and benefits.

Basic Plan ($11.99 or $0* Monthly Fee)

- B9 Visa® Debit Card with up to 5% cash back on eligible purchases.

- Access to B9 cash advance of up to $100 per pay period.

- Instant cash advance available with your B9 Visa® Debit Card.

- No-fee ACH withdrawals to bank accounts.

- Instant transfers to other B9 members at no extra cost.

- Additional fees may apply for instant withdrawals and deposits.

Premium Plan ($19.99 or $0* Monthly Fee)

- B9 Visa® Debit Card with up to 5% cash back on eligible purchases.

- B9 Advance℠ offering up to $500 cash advance per pay period.

- Instant cash advance available with your B9 Visa® Debit Card.

- No-fee ACH withdrawals to bank accounts.

- Instant transfers to other B9 members at no extra cost.

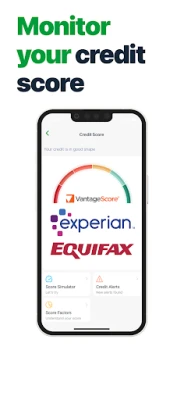

- No-impact credit report and access to a credit score simulator.

- Additional fees may apply for instant withdrawals and deposits.

*Enjoy a waived subscription fee for the first 30 days of the B9 Basic plan. After this period, the fee will be $11.99 per month for Basic or $19.99 for Premium. If you direct deposit more than $5,000 per month, you will continue to receive your B9 subscription fee for free. Note that other fees may still apply. For more details, visit bnine.com/tos.

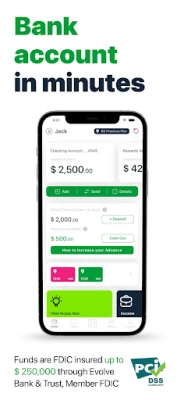

Important Information

It’s essential to understand that B9 is not a bank. Banking services are provided by Evolve Bank & Trust, a member of the FDIC. The B9 account and B9 Visa® Card are issued by Evolve Bank & Trust, ensuring your funds are secure.

The B9 cash advance is an optional service that requires members to set up a direct deposit to their B9 account at least once a month. The amount of cash advance available is based on your account history, income frequency, and other factors determined by B9. Cash advance amounts range from $30 to $500 per pay period, with average approved amounts of $79 for the Basic plan and $257 for the Premium plan as of April 2024. For more information on terms and conditions, or to check eligibility, contact B9 at support@bnine.com. Availability may vary by state.

B9 does not hold any legal or contractual claims against you for failing to repay a cash advance. However, further advances will not be provided while any previous cash advance remains unpaid.

Privacy and Security

Your privacy is paramount. For details on how your information is handled, please review the B9 Privacy Policy.

Conclusion

The B9 Visa® Debit Card is an excellent choice for those looking to earn cash back on their purchases while enjoying the flexibility of cash advances. With two subscription plans to choose from, you can select the option that best fits your financial lifestyle. Start maximizing your savings today with B9!

Rate the App

User Reviews

Popular Apps

Editor's Choice