Latest Version

10.2

October 03, 2024

Axis Bank Ltd.

Finance

Android

0

Free

com.axis.mobile

Report a Problem

More About Axis Mobile: Pay, Invest & UPI

Unlock the Benefits of an Online Digital Savings Account with Axis Bank

In today's fast-paced world, convenience is key, especially when it comes to managing your finances. With Axis Bank's innovative online digital savings account, you can open an account from the comfort of your home or anywhere you choose. This article explores the features, benefits, and services that make Axis Bank's digital savings account a top choice for savvy savers.

Seamless Account Opening Process

Opening a digital savings account has never been easier. Axis Bank's latest offering allows you to complete the entire process online, including a video-based KYC (Know Your Customer) verification. This means you can set up your account at your convenience without the need to visit a physical branch. Once your account is active, you will receive a virtual debit card linked directly to your digital savings account, enabling you to make transactions instantly.

Enhanced Banking Experience

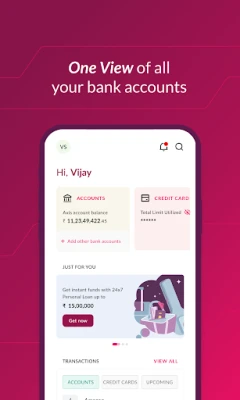

Banking needs vary from person to person. Some individuals prefer detailed insights into their financial activities, while others may only want to check their account balance. With Axis Bank's customizable dashboard, you can tailor your banking experience to suit your preferences. The Explore tab provides one-stop access to your account balances and frequently used features, such as mutual fund investments and bill payments.

Robust Security Features

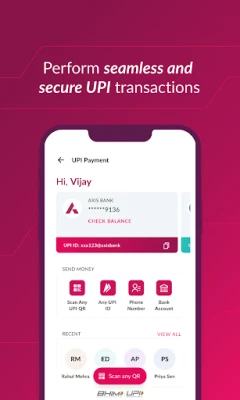

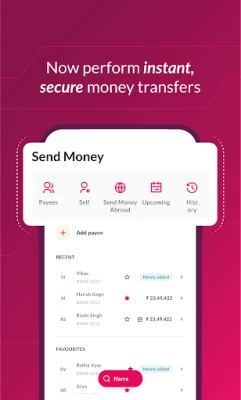

Security is paramount in online banking. When using Axis Bank's digital platform, you can set up a 6-digit MPIN for secure transactions. This cross-platform security code ensures that your fund transfers and transactions are validated, providing peace of mind. Additionally, the Bhim Unified Payment Interface (UPI) is integrated into the app, allowing you to make UPI payments, add payees, and even create your own UPI QR code. Remember, your UPI PIN is confidential and should never be shared.

Comprehensive Transaction Records

Keeping track of your financial activities is essential. Axis Bank provides a detailed record of your transactions for easy reference. You can access:

- UPI transaction history

- Savings account summary

- Card statements

- Utility bill payments made to over 200 registered billers

One-Touch Access to Financial Services

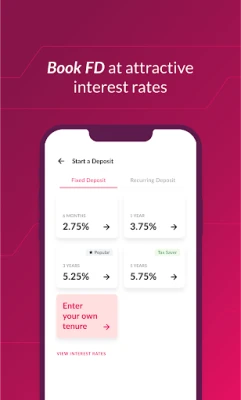

Whether you're looking to invest in mutual funds, open fixed deposits (FDs), or recurring deposits (RDs), Axis Bank's digital platform offers a streamlined experience. The revamped mutual fund journey allows you to start investing with just a few clicks. Additionally, you can access insurance services and apply for credit cards directly through the app.

If you need funds instead of making investments, Axis Bank provides pre-approved loans available 24/7. You can easily apply for a 100% digital personal loan in just a few simple steps. Existing customers can also manage their savings accounts, loan statements, forex, demat accounts, and credit card dues with ease.

Exclusive Offers and Cashback Deals

Beyond everyday banking, Axis Bank offers exciting deals on various brands in lifestyle, travel, and more through the Grab Deals feature on the Axis Mobile App. Customers with specific products, such as the Full Power Digital Savings Account, can enjoy exclusive cashback offers. This adds an extra layer of value to your banking experience.

Stay Informed with Open Access Blog

For those looking to enhance their financial knowledge, the Open Access blog provides timely and thematic articles on personal finance. Stay informed about the latest trends and tips to manage your finances effectively.

Find Your Nearest Branch

If you have questions that require in-person assistance, the app's branch locator feature helps you find the nearest Axis Bank branch quickly. This ensures that you have access to support whenever you need it.

Join Axis Bank's Digital Revolution

With a plethora of features designed to enhance your banking experience, Axis Bank's online digital savings account is a smart choice for anyone looking to manage their finances efficiently. Explore the benefits and services tailored to your needs and take control of your financial future today.

For any feedback, queries, or issues related to the Axis Mobile application, please contact customer service at customer.service@axisbank.com or call 1860-419-5555.

For more details, visit Axis Bank's official website.

Rate the App

User Reviews

Popular Apps

Editor's Choice