Latest Version

2.8

October 20, 2024

Axis Bank Ltd.

Finance

Android

0

Free

com.axisidp.mobile

Report a Problem

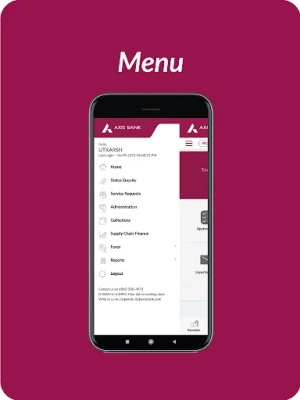

More About Axis Mobile - Corporate

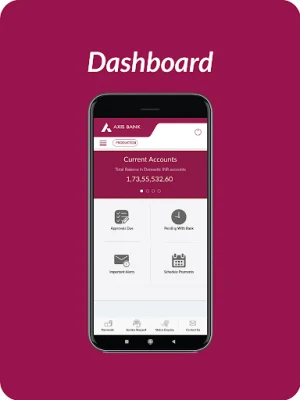

Unlocking the Power of Axis Corporate Internet Banking: Features and Benefits

In today's fast-paced digital world, managing your finances efficiently is crucial for businesses. Axis Corporate Internet Banking offers a comprehensive suite of features designed to streamline your banking experience. This article delves into the key functionalities of the app, ensuring you can make the most of your banking needs.

Enhanced Security Features

Security is paramount when it comes to online banking. Axis Corporate Internet Banking provides robust security measures to protect your financial information:

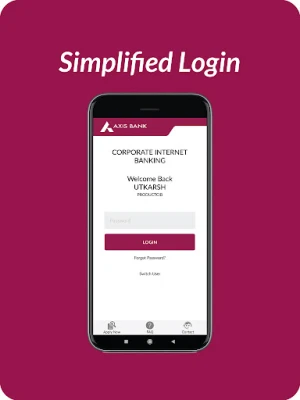

- One-Time Password (OTP) on Mobile App: Receive an OTP directly on your mobile app for secure transactions.

- Login with mPIN: Enjoy added convenience by logging in with your mPIN, ensuring quick access to your accounts.

- Reset mPIN: If you forget your mPIN, easily reset it through the app.

- Change mPIN: Update your mPIN regularly for enhanced security.

Comprehensive Account Management

Managing your accounts has never been easier. The app allows you to:

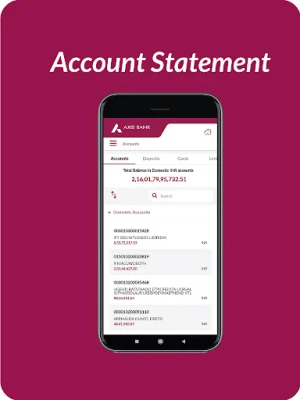

- View Current Account Balance and Statements: Keep track of your finances with real-time updates on your account balance and transaction history.

- Access PCFC and EBRD Accounts: Manage your Foreign Currency accounts seamlessly.

- Monitor Deposits: View all deposits created with the bank for better financial planning.

- Manage Loan Accounts: Check outstanding balances and repayment schedules for your loans.

- Commercial Cards: Keep track of your commercial card transactions effortlessly.

Efficient Transaction Management

Axis Corporate Internet Banking simplifies transactions with a variety of options:

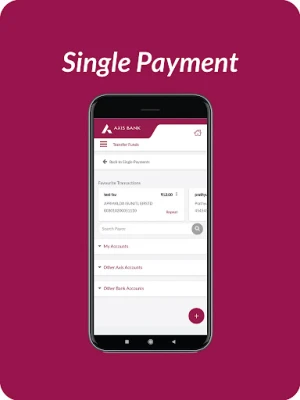

- Add Payees: Easily add your payees and initiate single payments through RTGS, NEFT, Axis to Axis accounts, and IMPS.

- Transact Within Linked Accounts: Move funds between your linked Axis Bank accounts or to other Axis Bank accounts with ease.

- Approve GST Transactions: Authorize GST transactions in both single and bulk formats.

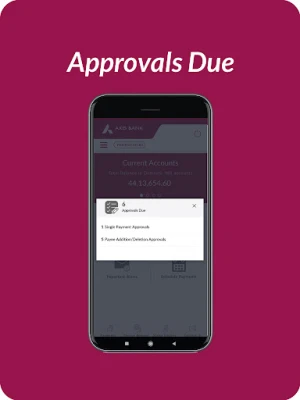

- View and Authorize Transactions: Manage single, bulk, Host to Host (H2H), and trade transactions efficiently.

Streamlined Service Requests

Axis Corporate Internet Banking allows you to initiate various service requests directly through the app:

- Email ID Update: Update your registered email ID for seamless communication.

- Scheme Update: Modify your account schemes as per your business needs.

- Create Fixed Deposits: Easily create fixed deposits to grow your savings.

- Update Positive Pay Details: Ensure your cheque payments are secure by updating your Positive Pay details.

Self-Service Options for Convenience

Take control of your banking experience with self-service features:

- Unlock Account: Instantly unlock your account if it gets locked due to incorrect login attempts.

- Re-Trigger Credentials: Retrieve your login credentials if you have misplaced your earlier SMS or email.

- Super Admin Access: Authorized signatories can create access for their “Maker” and “Viewer” users immediately, enhancing operational efficiency.

Reporting and Insights

Stay informed with comprehensive reporting features:

- View or Email Reports: Access detailed reports for transactions, alerts, GST summaries, and fixed deposit receipts.

Customer Support and Assistance

For any feedback, queries, or issues related to Axis Corporate Internet Banking, you can:

- Contact your Relationship Manager or Nodal Branch.

- Email: corporate.ib@axisbank.com

- Call: 18605004971 (Available 24x7).

Learn More About Axis Corporate Internet Banking

To explore more about the features and benefits of Axis Corporate Internet Banking, Click Here. For mobile corporate banking, Click Here.

In conclusion, Axis Corporate Internet Banking is designed to provide businesses with a secure, efficient, and user-friendly banking experience. With its extensive features, managing your finances has never been easier. Embrace the future of banking with Axis Bank today!

Rate the App

User Reviews

Popular Apps

Editor's Choice