Latest Version

5.1.2659

December 29, 2025

Ava Finance, Inc.

Finance

Android

0

Free

com.meetava.avaapp

Report a Problem

More About Ava Finance

Unlock Your Financial Potential with Ava: The Smart Choice for Credit Building

Are you looking to improve your credit score quickly and efficiently? Look no further than Ava, a revolutionary platform designed to help you build a better credit history. With impressive results and user-friendly features, Ava stands out as a top choice for anyone serious about enhancing their financial health.

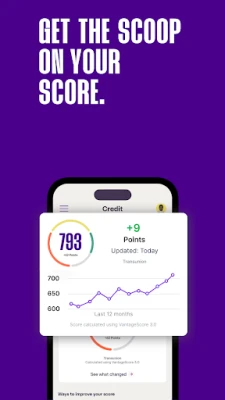

Rapid Credit Score Improvement

Why choose Ava? The answer is simple: results. An astounding 74% of Ava members who subscribed within the first week experienced a credit score increase within just two weeks. Among these members, many reported gains of over 40 points within three months. This rapid improvement is a testament to Ava's effective strategies for credit enhancement.

Effortless Setup Process

Getting started with Ava is a breeze. In less than five minutes, you can set up your account and begin your journey toward better credit. The straightforward process ensures that you can focus on what matters most—improving your financial standing.

Transparent and Affordable Pricing

Ava offers a clear and affordable pricing structure, starting at just $8 per month for the annual plan. This competitive pricing makes it easy for anyone to access the tools they need for a healthier credit history without breaking the bank.

What Ava Offers

With Ava, you can expect a range of benefits designed to support your credit-building journey:

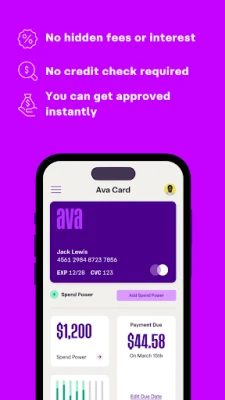

- No hidden fees

- 0% interest

- Instant account setup with no credit check

- No deposit or collateral required

Key Features of Ava

Ava Credit Builder Card

The Ava Credit Builder Card allows you to manage over 60 online subscriptions and bills, such as Netflix and Verizon, while simultaneously lowering your credit utilization. This dual benefit helps you maintain a healthy credit profile.

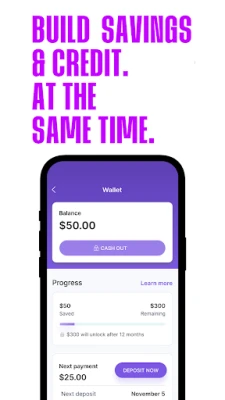

Save & Build Credit Account

The Save & Build Credit Account is a secured loan that not only helps you save money but also adds an additional credit line to your report. You can start with a minimum of $25 per month, make on-time payments for 12 to 24 months, and potentially receive at least $300. This account features zero interest, although an origination fee may apply in certain states.

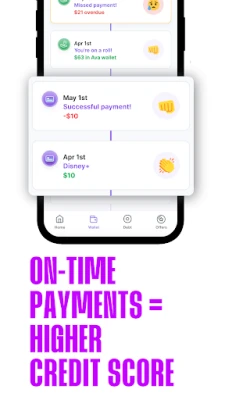

Establishing a pattern of positive payment history can significantly strengthen your credit profile over time.

Free Monthly Credit Reports

Stay informed about your credit status with free monthly credit reports available in the app. These reports provide valuable insights and suggestions, making it easier to understand critical credit factors such as utilization rates and on-time payment percentages.

Dedicated Customer Support

If you need assistance, Ava's dedicated support team is ready to help. You can reach out to them at support@meetava.com for any inquiries or support you may need.

Ava: A Technology Company, Not a Bank

It’s important to note that Ava is not a bank. Instead, it operates as a technology company that partners with banking services provided by Evolve Bank & Trust, a member of the FDIC, to offer the Save & Build Credit Account. The Ava Credit Builder Mastercard® is issued by Patriot Bank, N.A., also a member of the FDIC, under a license from Mastercard International Incorporated.

Understanding Credit Score Factors

With Ava's Credit Builder Card and Save & Build Account, you can add two new tradelines to your credit report, which can positively impact your credit mix (10%) and credit history (15%). Each on-time payment contributes to your payment history (35%), while the credit limit on the Credit Builder Card helps with your credit utilization (30%).

Data from January 1, 2023, to December 31, 2023, shows that members who activated the Ava Card and were reported to the bureaus within seven days, without canceling their membership, experienced an average credit score increase. However, it’s essential to remember that a credit score increase is not guaranteed.

Conclusion: Take Control of Your Credit Today

In summary, Ava offers a comprehensive solution for anyone looking to improve their credit score. With quick results, easy setup, transparent pricing, and a suite of valuable features, Ava empowers you to take control of your financial future. Don’t wait any longer—join Ava today and start building a better credit history!

Rate the App

User Reviews

Popular Apps

Editor's Choice