Latest Version

4.8

December 23, 2024

FinArt - Expense Tracker

Finance

Android

0

Free

com.finart

Report a Problem

More About Automated Expense Tracker

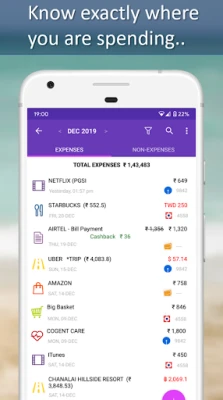

Unlock Financial Freedom with AI-Powered Automated Expense Tracking

In today's fast-paced world, managing finances can be a daunting task. However, with the advent of AI-powered automated features, tracking your expenses has never been easier. This article delves into the key functionalities of an advanced expense tracking app that can help you take control of your finances effortlessly.

Key Features of AI-Powered Expense Tracking

Understanding your financial landscape is crucial for effective budgeting and saving. Here are the standout features that make this expense tracker a must-have:

1. Effortless Expense Tracking

The AI-driven Expense Tracker utilizes transaction SMS alerts from banks and credit cards to automatically log your expenses. This feature not only saves time but also minimizes the chances of human error. You can also make manual entries for any transactions that may not be captured automatically.

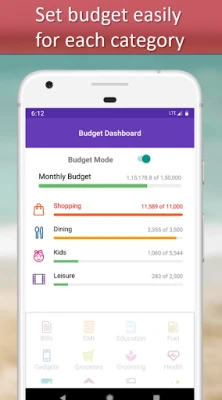

2. Comprehensive Household Budget Planning

With the Family Budget Planner, you can create a detailed budget that categorizes your spending. This tool helps you allocate funds for essential life goals, such as education and retirement, ensuring that you save effectively for the future.

3. Automatic Bill Reminders

Never miss a payment again! The app sends timely reminders for due bills, including credit card payments, utilities, and more. This feature helps you avoid late fees and maintain a healthy credit score.

4. Personal and Business Expense Management

Separate your personal and business expenses effortlessly with dedicated profiles. This feature allows you to keep your financial life organized and transparent, making tax season a breeze.

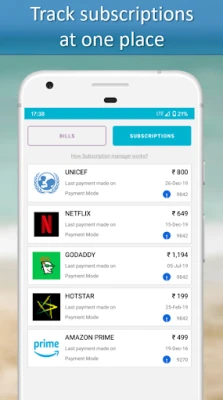

5. Subscription Tracking

Stay on top of your recurring payments with the Subscription Tracker. The app monitors all your premium subscriptions, such as Netflix and Spotify, ensuring you’re never caught off guard by unexpected charges.

6. Instant Account Balance Checks

With automated alerts, you can check your account balance and credit card limits in real-time. This feature helps you make informed spending decisions and avoid overdrafts.

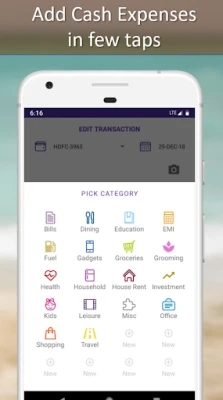

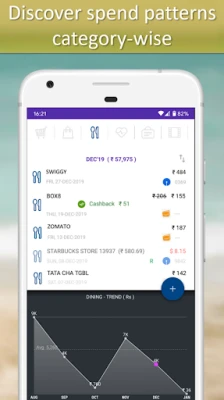

7. Detailed Expense Categorization

Gain insights into your spending habits with detailed categorization. Track your expenses across various categories like groceries, travel, and business, allowing you to identify areas for improvement.

8. Family Expense Management

Sync your expense data across multiple devices within your family. This feature promotes transparency and collective financial responsibility, making it easier to manage household expenses.

9. Split Expenses with Ease

Whether it’s group outings or shared bills, the app allows you to split expenses seamlessly. This feature is perfect for roommates or friends who want to keep track of shared costs.

10. Multi-Currency Support

Traveling abroad? The app supports multiple currencies, making it easy to manage expenses in different countries without the hassle of manual conversions.

11. Customizable Start Date

Set a custom start date for your budgeting cycle to align with your financial planning. This flexibility allows you to tailor the app to your unique financial situation.

12. Ad-Free Experience

Enjoy an uninterrupted experience with an ad-free interface, ensuring that your focus remains on managing your finances.

Data Privacy and Security Controls

Your financial data's security is paramount. The app offers robust privacy controls to ensure your information remains confidential:

- No Registration Required: You can use the app without providing your email or phone number.

- Private Mode: This option ensures that your transaction data is not sent to external servers.

- Backup on Google Drive: Store your data securely on your own Google Drive instead of relying on third-party servers.

- No Bank Account Connection: The app does not connect to your bank accounts, further enhancing your data security.

Why SMS Permission is Essential

Granting SMS permission is optional but highly beneficial. It enables the app to automate expense tracking, provide insightful spending analytics, and send automatic bill reminders based on your SMS inbox. By leveraging this feature, you can eliminate the tedious task of manual expense tracking and focus on what truly matters in life.

Download the AI-Powered FinArt Automated Expense Tracker Today!

Take the first step towards financial freedom by downloading the FinArt Automated Expense Tracker. With its advanced AI features and user-friendly interface, managing your finances has never been easier. Start your journey to smarter spending and saving today!

Rate the App

User Reviews

Popular Apps

Editor's Choice