Latest Version

2.1

August 12, 2025

Borrow Money LLC

Finance

Android

0

Free

com.borrow.money.loan

Report a Problem

More About 2DAY - Borrow Money Instantly

Unlock Instant Cash: Your Guide to Quick Payday Advances

In today's fast-paced world, financial emergencies can arise unexpectedly. Fortunately, with the advent of technology, obtaining an instant cash advance has never been easier. This article will guide you through the process of securing a payday advance loan quickly and efficiently, ensuring you have the funds you need when you need them most.

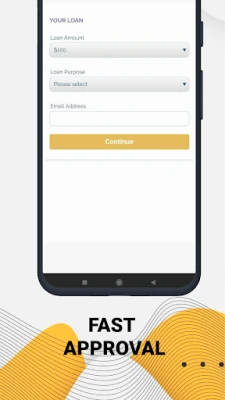

Fast and Simple Cash Advance Application

Filling out an instant cash advance form can take just a few minutes, and your payday advance loan request is typically processed on the same day. The application process is designed to be quick and straightforward, similar to popular apps like Dave or Earnin. With just a few clicks, you can apply and receive approval, making it an ideal solution for those urgent financial needs.

Access Cash Anytime, Anywhere

Whenever you find yourself in need of cash for unexpected expenses, our money lending app allows you to borrow funds swiftly. Launched with the goal of providing consumers with easy access to instant loans, this app is your go-to solution for financial relief until your next payday. Don’t waste time; a quick cash loan app can be incredibly beneficial in times of need.

Enhance Your Loan Approval Chances

Using a personal loans app can significantly improve your chances of being approved for a long-term loan from various lenders. Even if you have bad credit, you can submit applications to lenders who are willing to work with you. This flexibility opens up opportunities for many borrowers who might otherwise struggle to secure funding.

24/7 Availability for Your Convenience

One of the standout features of our loan app is its 24/7 availability. Unlike traditional loan services that operate within specific hours, our app is entirely online, allowing you to compare rates and submit loan requests at any time, from anywhere. This convenience ensures that you can access the funds you need without the hassle of waiting for business hours.

Understanding the Loan Process

It’s important to note that our app is not a direct payday loan lender but a connecting service that collaborates with direct money lenders. We do not charge any fees for connecting clients with lenders. When you submit your personal and employment details for a same-day cash advance, you consent to allow lenders to verify your information. Remember, you are not obligated to use this service or accept any loan offers.

Loan Terms and Conditions

The minimum and maximum periods for money lending and loan repayment typically range from 65 days to 2 years, depending on the lender you connect with. The Annual Percentage Rate (APR) is a crucial factor to consider, as it represents the yearly interest rate charged when borrowing money, including any additional fees. APR rates can vary widely among lenders, often falling between 5.99% and 35.99%.

It’s essential to understand that while no credit check loans are often advertised, all lending services will conduct a credit check to verify the borrower’s information. However, this check is usually a soft inquiry and does not impact your credit score. Some borrowers may still qualify for loans despite having bad credit.

Transparent Loan Costs

Our app does not participate in the lending process, so we cannot guarantee a specific APR once you submit your borrowing request. Credit decisions and terms vary among payday advance lenders and depend on factors such as income, credit history, and employment status. Lenders are legally required to inform you of the APR and all terms before you sign any agreement.

For example, consider a loan of $1,000 with a term of 3 months and an APR of 32%. Your monthly repayment would be approximately $351.27, resulting in a total payable amount of $1,053.81, which includes $53.81 in interest.

Key Benefits of Our Quick Cash Borrowing App

- Apply for payday loans anytime, 24/7, directly from your smartphone.

- Complete your payday cash advance application in just minutes and receive cash quickly.

- No documentation is required for approval, streamlining the process.

- Access to bad credit loans is available, as we partner with numerous direct lenders willing to assist applicants with poor credit scores.

Conclusion: Your Financial Solution Awaits

In conclusion, when you find yourself in need of quick cash, our instant cash advance app provides a reliable and efficient solution. With a simple application process, 24/7 availability, and the potential for bad credit loans, you can secure the funds you need without unnecessary delays. Don’t let financial emergencies catch you off guard—download our app today and take control of your financial future!

Rate the App

User Reviews

Popular Apps

Editor's Choice