Latest Version

1.1

May 17, 2025

Zenith Bank

Finance

Android

0

Free

com.zenith.etoken.app

Report a Problem

More About Zenith Token

Understanding the Costs and Activation Process of e-Token Services

In today's digital banking landscape, security is paramount. One of the essential tools for ensuring secure transactions is the e-Token. This article delves into the costs associated with activating an e-Token and provides a comprehensive guide on how to activate it effectively.

Activation Charges for e-Token

To activate your e-Token, you will incur a one-time fee of N1500. This charge is essential for enabling secure access to your banking services through the e-Token application.

By proceeding with the activation of the e-Token on your device, you consent to the deduction of the activation fee from your linked bank account. It is important to note that the bank reserves the right to adjust this activation charge periodically without prior notice to customers.

What is a One-Time Password (OTP)?

A One-Time Password (OTP) is a unique series of characters that serves as a secure authentication method for a single transaction or session. This feature acts as an alternative to the traditional Hardware Token, providing users with an additional layer of security for their online banking activities.

Steps to Activate Your e-Token

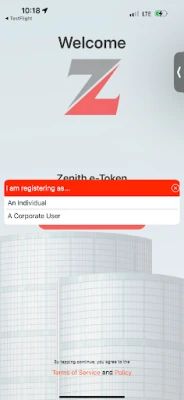

Activating your e-Token is a straightforward process. Follow the steps below based on your registration type—Individual or Corporate.

For Individual Registration

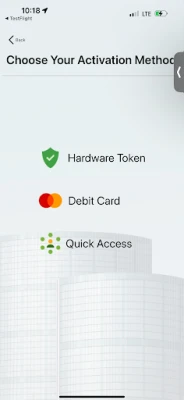

- Select Your Activation Method:

- Hardware Token: Enter your Account Number, followed by your 4-digit Server PIN and the Hardware Token Code.

- Debit Cards: Provide your Account Number, the last 6 digits of your ZENITH Bank issued ATM card (PAN #), and your 4-digit card PIN.

- Quick Access: Visit your nearest bank branch to generate the activation code required for enabling access on the e-Token App.

For Corporate Registration

- Select Your Activation Method:

- Quick Access: Similar to individual registration, visit your bank branch to generate the activation code necessary for accessing the e-Token App.

Benefits of Using e-Token

The e-Token system offers numerous advantages for both individual and corporate users:

- Enhanced Security: The use of OTPs and hardware tokens significantly reduces the risk of unauthorized access to your accounts.

- Convenience: Activate and manage your banking transactions from the comfort of your device, eliminating the need for physical tokens.

- Real-Time Authentication: Experience immediate authentication for transactions, ensuring swift and secure banking operations.

Conclusion

Understanding the costs and activation process of the e-Token is crucial for ensuring secure banking transactions. By following the outlined steps and being aware of the associated charges, you can effectively utilize this essential tool for your banking needs. Always stay informed about any changes in fees or procedures by regularly checking with your bank.

Embrace the future of banking security with the e-Token and enjoy peace of mind knowing your transactions are protected.

Rate the App

User Reviews

Popular Apps

Editor's Choice