Latest Version

1.18.8

June 18, 2025

WalletHub

Finance

Android

0

Free

com.wallethub.mywallet

Report a Problem

More About WalletHub: Credit & Budgeting

Unlock Your Financial Potential with WalletHub: A Comprehensive Guide

In today's fast-paced financial landscape, managing your credit and budgeting effectively is crucial. WalletHub offers a free account that empowers you with essential tools to enhance your financial health. Here’s what you can expect when you sign up:

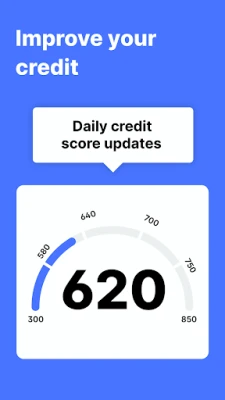

Daily Credit Scores and Reports

With WalletHub, you receive credit scores updated daily, allowing you to monitor your financial standing in real-time. This feature ensures you stay informed about your credit health, enabling you to make timely decisions.

Personalized Financial Planning

WalletHub provides a clear plan for improving your credit score. By analyzing your financial habits, it offers tailored recommendations to help you achieve your credit goals. Additionally, you can create a personalized budget that aligns with your financial objectives.

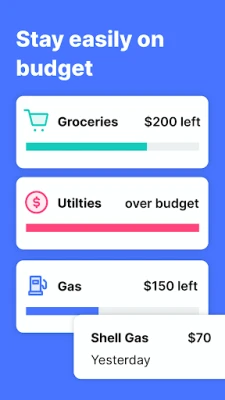

Comprehensive Spending Tracker

Track your expenses effortlessly with WalletHub’s spending tracker. This tool allows you to categorize your spending, helping you identify areas where you can cut back and save more.

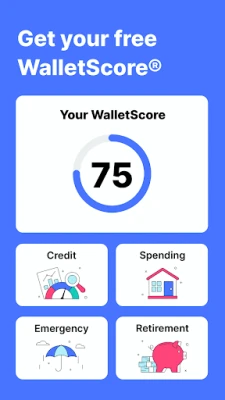

WalletScore: Your Financial Health Indicator

Introducing WalletScore, a unique feature that provides a holistic view of your financial health. It evaluates your:

- Credit: Understand how your creditworthiness affects your borrowing capabilities.

- Spending: Learn to live within your means for better financial stability.

- Emergency Preparedness: Assess your readiness for unexpected financial challenges.

- Retirement: Plan for a comfortable retirement with adequate savings.

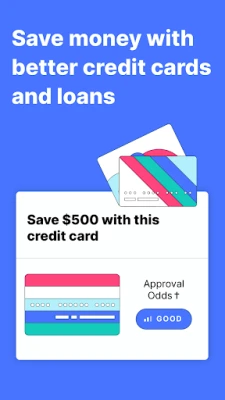

Smart Recommendations for Credit Cards and Loans

WalletHub offers credit card and loan recommendations tailored to your financial profile. This feature helps you find the best deals available, ensuring you make informed choices that save you money.

24/7 Credit Monitoring for Peace of Mind

Stay protected against identity theft and fraud with WalletHub’s 24/7 credit monitoring. You’ll receive alerts for any significant changes to your credit report, allowing you to act swiftly if necessary.

Debt Payoff Roadmap

WalletHub provides a debt payoff roadmap that guides you through the process of eliminating debt efficiently. This feature helps you prioritize your debts and develop a strategy to pay them off faster.

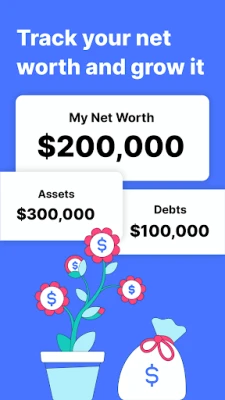

Net-Worth Tracker

Monitor your financial progress with the net-worth tracker. This tool allows you to see how your assets and liabilities change over time, giving you a clearer picture of your financial journey.

Trusted by Major News Outlets

WalletHub has been featured in over 10,000 news articles, including reputable sources like:

- The Wall Street Journal

- The New York Times

- The Washington Post

- CNBC

- Yahoo Finance

- MSN Money

- USA TODAY

- Reuters

- Fox News

- And many more

Frequently Asked Questions

Will Using WalletHub Hurt My Credit?

No, using WalletHub will not hurt your credit. Checking your credit through WalletHub results in a soft inquiry, which does not impact your credit score.

Why Choose WalletHub?

WalletHub stands out for three key reasons:

- Customer-centric approach

- Simplifying complex financial concepts

- Unique features like WalletScore and an all-in-one platform for credit, budgeting, and identity theft protection

What Is WalletScore?

WalletScore is an innovative tool that assesses your financial health based on various factors, including creditworthiness, spending habits, emergency preparedness, and retirement planning.

How Will WalletHub Save Me Money?

WalletHub actively searches for better financial product deals, helping you save money daily. If your credit needs improvement, WalletHub provides guidance to enhance it, potentially saving you thousands on loans and insurance.

What Budgeting Methods Are Supported?

WalletHub accommodates various budgeting strategies, from envelope budgeting to zero-based budgeting. You can customize your approach and switch methods seamlessly without losing your settings.

How Can WalletHub Help Improve My Credit?

WalletHub analyzes your credit score and report to pinpoint strengths and weaknesses. It simulates different actions to show their potential impact on your credit, ultimately providing a personalized improvement plan.

How Does 24/7 Credit Monitoring Work?

WalletHub’s free credit monitoring alerts you to significant changes in your TransUnion credit report. You can customize your account to receive SMS alerts, a feature not commonly offered by other services.

Is WalletHub a Good Alternative to Mint for Budgeting?

Absolutely! WalletHub offers all the features users love about Mint, plus additional benefits. Try it out and experience the difference for yourself!

In conclusion, WalletHub is a powerful tool for anyone looking to take control of their financial future. With its comprehensive features and user-friendly interface, it simplifies the journey to better credit and budgeting. Sign up today and unlock your financial potential!

Rate the App

User Reviews

Popular Apps

Editor's Choice