Latest Version

5.23.1

February 21, 2026

neoleap

Finance

Android

0

Free

com.urpay.consumer

Report a Problem

More About urpay

Unlock Financial Freedom with urpay: Your Ultimate Digital Wallet

In today's fast-paced world, managing finances efficiently is crucial. urpay emerges as a revolutionary digital wallet designed to streamline your everyday financial tasks, making them faster, easier, and more rewarding. This comprehensive guide will explore the myriad features of urpay, showcasing how it can transform your financial management experience.

Quick and Secure Account Setup

Creating an account with urpay is a breeze. In just a minute, you can set up your digital wallet and start managing your finances securely. The user-friendly interface ensures that even those new to digital wallets can navigate effortlessly.

Flexible Wallet Top-Up Options

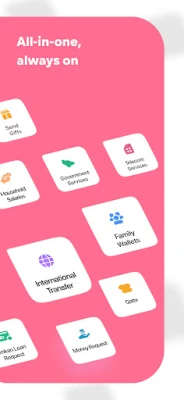

urpay offers a variety of convenient methods to top up your wallet. Whether you prefer using bank cards, Apple Pay, bank transfers, or even Mokafaa points, urpay has you covered. This flexibility allows you to choose the method that best suits your lifestyle, ensuring that your funds are always accessible when you need them.

Seamless Money Transfers

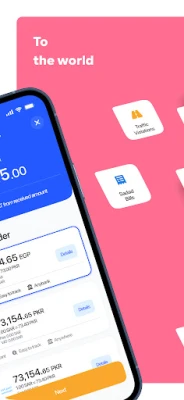

One of the standout features of urpay is its ability to send and receive money both locally and internationally. With partnerships with renowned providers like MoneyGram, Tahweel Al Rajhi, and Ria, you can transfer funds to over 140 countries with ease. This capability makes urpay an ideal choice for expatriates and anyone needing to send money abroad.

Convenient Card Issuance

With urpay, you can issue Mada and Visa cards for various purposes, including shopping and withdrawals. These cards come with premium benefits such as cashback rewards and access to airport lounges, enhancing your shopping experience while providing added value.

Effortless Bill Payments

Paying bills has never been easier. urpay allows you to settle your electricity, water, and government service bills through the SADAD system. This feature eliminates the hassle of manual payments, ensuring that you never miss a due date.

Mobile Line Recharge and E-Sim Requests

Stay connected effortlessly by recharging your mobile lines or requesting an E-Sim card through urpay. The platform supports various local and international providers, including STC, Mobily, Zain, Vodafone, and Jazz, making it a versatile choice for all your mobile needs.

Shop Digital Products with Ease

urpay features a built-in store where you can purchase digital products and devices, including gaming cards and smartwatches. This convenience allows you to shop for your favorite items without leaving the app, saving you time and effort.

Split Payments Made Simple

With the Qatta feature, splitting payments with friends and family is a breeze. You can send money requests to collect funds in just a few taps, making group outings and shared expenses hassle-free.

Timely Salary Payments

Managing household salaries is straightforward with urpay. Ensure that your employees receive their payments on time without any hassle, streamlining your payroll process and enhancing employee satisfaction.

Empower Your Family with the Family Wallet

urpay understands the importance of family financial management. With the Family Wallet feature, you can provide your children with their own wallets while maintaining oversight of their spending. This empowers them to learn financial responsibility while giving you peace of mind.

Instant Financing with Emkan

Need quick access to funds? urpay offers instant financing through Emkan, with no salary transfer required. This feature provides a safety net for unexpected expenses, ensuring you’re never caught off guard.

Download urpay Today and Take Control of Your Finances

Ready to revolutionize your financial management? Download urpay now and take control of your financial life. With its extensive features and user-friendly interface, urpay is your go-to solution for all your financial needs.

Need Assistance? We're Here to Help!

If you have any questions or need support, don’t hesitate to contact us at 8001000081. Our dedicated team is ready to assist you with any inquiries you may have.

Experience the future of financial management with urpay—where convenience meets security.

Rate the App

User Reviews

Popular Apps

Editor's Choice