Latest Version

2.672

May 23, 2025

SyGame

Games

Android

0

Free

com.SyGame.Capitalism

Report a Problem

More About Stock Game - Capitalism

Mastering Investment Strategies: A Comprehensive Guide to Wealth Creation

Embarking on your investment journey can be both thrilling and daunting. Starting at the age of 20, you have the opportunity to build your financial future through various avenues. This guide will explore essential investment strategies, including stocks, the futures market, cryptocurrency, real estate, auctions, and bonds, while providing insights on how to navigate these markets effectively.

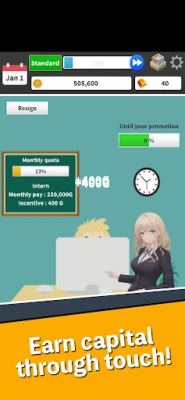

Starting Your Career: The Basics of Earning

As you begin your professional journey, you can earn a salary and incentives by engaging with interactive platforms. By simply touching the screen, you can receive your earnings and explore investment opportunities. For those seeking a greater challenge, consider setting personal goals to conquer the market using only your salary. This approach not only tests your skills but also enhances your financial acumen.

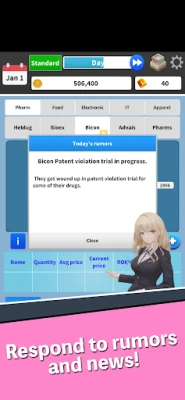

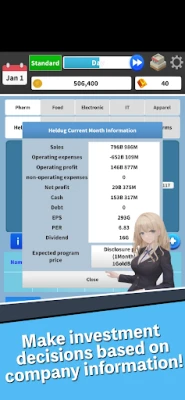

Investing in Stocks: Strategies for Success

When it comes to stock investments, understanding economic indicators, corporate market shares, and sales figures is crucial. Market rumors and news can create both opportunities and challenges. You have the flexibility to choose between short-term and long-term investments based on your financial goals.

As you accumulate wealth, consider becoming the largest shareholder in a company. By holding over 50% of the shares, you can activate the "largest shareholder mode," allowing you to invest directly in the company's technology and marketing efforts. This strategy can significantly enhance the company's market share and, in turn, your investment returns.

Diving into the Futures Market

The futures market offers a unique investment landscape divided into five sectors, each containing five listed companies. To make informed investment decisions, analyze the indices and comprehensive index of each sector. Keep in mind that there is a 50% correlation between the sector indices and the stock prices of the listed companies. This understanding can help you identify lucrative investment opportunities.

Understanding Economic Indicators

The economy experiences various phases, from depression to boom. Monitoring economic indicators is essential; positive indicators often signal market growth, while negative indicators may suggest a downturn. Staying informed about these trends can help you make timely investment decisions and maximize your returns.

Exploring the Cryptocurrency Market

The cryptocurrency market is a fast-paced environment where traditional indicators may not apply. Quick judgment is key to capitalizing on opportunities, but be aware that the risks are equally high. Successful investors in this space often rely on their instincts and market trends to make informed decisions.

Investing in Real Estate: Building Your Empire

Real estate investment offers a tangible way to create wealth. With the option to invest in 800 plots of land, you can build structures that generate stable income. This strategy not only provides financial returns but also allows you to create your own world within the real estate market.

Participating in Auctions: A Path to Profit

Land auctions occur from the 2nd to the 15th of each month, presenting opportunities to purchase properties at lower prices. By acquiring land, you can either develop it into profitable buildings or resell it for a profit. This approach can yield significant returns if executed wisely.

Navigating the Bond Market

The bond market offers unique benefits, particularly in a virtual investment environment. Understanding various risk rates is essential for achieving quick investment results. Bonds can provide a stable income stream and diversify your investment portfolio.

Time Management: Accelerating Your Progress

In the fast-paced world of investing, time can feel like it’s slipping away. If you wish to expedite your progress, consider utilizing the time jump feature available in some investment platforms. This feature allows you to fast-track your journey, enabling you to focus on achieving your financial goals more efficiently.

Competing on a Global Scale

Once you have mastered the investment landscape, challenge yourself by competing in real-time rankings against investors worldwide. This weekly competition can provide motivation and insights into different investment strategies. Alternatively, if you wish to reset your progress, you can do so, preserving your expanded trade capabilities and gold bars while starting anew.

Conclusion: Your Path to Financial Mastery

Investing is a multifaceted journey that requires knowledge, strategy, and a willingness to adapt. By exploring various markets and understanding the dynamics at play, you can build a robust investment portfolio. Whether you choose stocks, real estate, or cryptocurrencies, the key to success lies in informed decision-making and continuous learning. Start your journey today and pave the way to financial mastery.

Rate the App

User Reviews

Popular Apps

Editor's Choice