Latest Version

January 30, 2025

Standard Bank / Stanbic Bank

Finance

Android

0

Free

com.sbsa.mobile.sme

Report a Problem

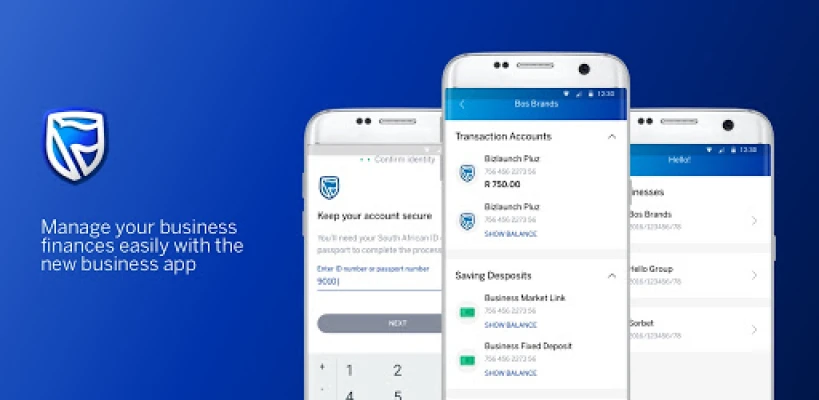

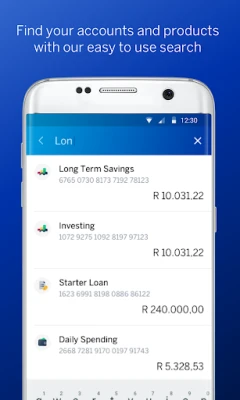

More About Standard Bank Business Banking

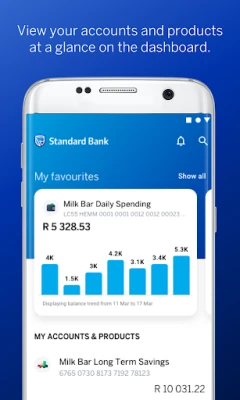

Mastering Your Finances: How to View Balances and Transact Securely

In today's fast-paced digital world, managing your finances effectively is crucial. Whether you're keeping track of your bank account balances or making transactions, understanding how to do so safely and securely is paramount. This article will guide you through the essential steps to view your balances and conduct transactions with confidence.

Understanding Your Financial Balances

Knowing your financial balances is the first step toward effective money management. Here’s how you can easily view your balances:

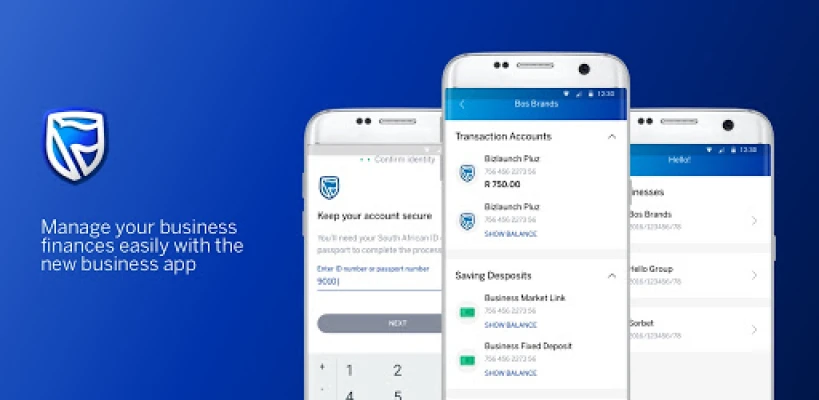

1. Accessing Your Online Banking

Most banks offer online banking services that allow you to check your account balances anytime, anywhere. To access your online banking:

- Visit your bank's official website or download their mobile app.

- Log in using your secure credentials.

- Navigate to the 'Accounts' or 'Balances' section to view your current balances.

2. Utilizing Mobile Banking Apps

Mobile banking apps provide a convenient way to monitor your finances on the go. These apps often feature real-time updates, allowing you to:

- Check balances instantly.

- Receive notifications for transactions and balance changes.

- Set up alerts for low balances or unusual activity.

Transacting Safely and Securely

Once you have a clear understanding of your balances, the next step is to ensure that your transactions are safe and secure. Here are some best practices to follow:

1. Use Secure Connections

Always ensure that you are using a secure internet connection when accessing your bank accounts. Avoid public Wi-Fi networks for financial transactions, as they can be vulnerable to hackers. Instead, use a private network or a VPN for added security.

2. Enable Two-Factor Authentication

Two-factor authentication (2FA) adds an extra layer of security to your online banking. By requiring a second form of verification, such as a text message code or an authentication app, you can significantly reduce the risk of unauthorized access to your accounts.

3. Monitor Your Accounts Regularly

Regularly reviewing your account statements and transaction history is essential for identifying any unauthorized transactions. Set aside time each week to:

- Check your account balances.

- Review recent transactions for any discrepancies.

- Report any suspicious activity to your bank immediately.

Choosing the Right Payment Methods

When it comes to making transactions, selecting the right payment method can enhance your security. Here are some options to consider:

1. Credit and Debit Cards

Using credit and debit cards for transactions can be safe, especially if you choose cards with built-in fraud protection. Always monitor your statements for unauthorized charges and report them promptly.

2. Digital Wallets

Digital wallets like PayPal, Apple Pay, and Google Pay offer secure transaction options. These services often use encryption and tokenization to protect your financial information, making them a safe choice for online purchases.

3. Bank Transfers

For larger transactions, consider using bank transfers. They are generally secure and can be tracked easily. Ensure that you double-check the recipient's details before completing the transfer to avoid errors.

Conclusion: Take Control of Your Finances

By understanding how to view your balances and transact securely, you can take control of your financial health. Regularly monitoring your accounts, using secure connections, and choosing the right payment methods are all essential steps in safeguarding your finances. Embrace these practices to ensure that your financial transactions are not only efficient but also secure.

Stay informed, stay secure, and master your finances today!

Rate the App

User Reviews

Popular Apps

Editor's Choice