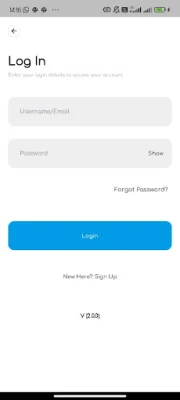

Latest Version

2.0.7+3

May 15, 2025

Spectrum MFB

Finance

Android

0

Free

com.spectrummfb.spectrum_pay

Report a Problem

More About Spectrum Pay

Transforming Communities: The Role of Spectrum Microfinance Bank in Economic Growth

Spectrum Microfinance Bank (MFB) stands as a beacon of customer-centric financial services, leveraging cutting-edge technology to meet the diverse needs of its clientele. Licensed by the Central Bank of Nigeria (CBN), this institution plays a pivotal role in fostering economic growth and development through innovative microfinancing solutions.

Empowering Individuals and Businesses

At Spectrum MFB, the mission is clear: to empower individuals and businesses by providing accessible financial services. The bank offers a variety of products, including savings accounts, loans, and investment opportunities, tailored to meet the unique needs of its customers. By focusing on microfinancing, Spectrum MFB aims to create self-sufficient individuals and sustainable businesses, ultimately contributing to the economic landscape of Nigeria.

Comprehensive Financial Solutions

One of the standout features of Spectrum Microfinance Bank is its comprehensive range of financial solutions. Whether you are a budding entrepreneur seeking capital to launch your business or an individual looking to save for the future, Spectrum MFB has you covered. Here’s a closer look at the key offerings:

- Savings Accounts: Designed to encourage saving habits, these accounts offer competitive interest rates and flexible withdrawal options, making it easier for customers to manage their finances.

- Loans: Spectrum MFB provides various loan products, including personal loans, business loans, and emergency loans, ensuring that customers have access to the funds they need when they need them.

- Investment Opportunities: The bank also offers investment products that allow customers to grow their wealth over time, contributing to their financial independence.

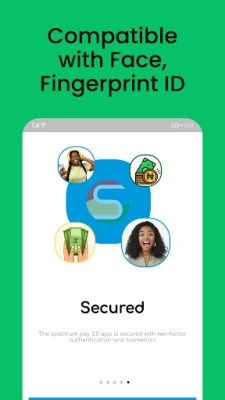

Technology-Driven Approach

In today’s fast-paced world, technology plays a crucial role in enhancing customer experience. Spectrum MFB embraces this by integrating advanced technology into its operations. From user-friendly online banking platforms to mobile applications, customers can easily access their accounts, apply for loans, and manage their finances from the comfort of their homes.

This technology-driven approach not only streamlines processes but also ensures that customers receive timely support and information, fostering a sense of trust and reliability.

Community Transformation

At the heart of Spectrum Microfinance Bank’s mission is a commitment to community transformation. The bank believes that by empowering individuals and supporting local businesses, it can create a ripple effect that benefits entire communities. Each loan disbursed and every savings account opened contributes to the economic vitality of the regions served.

Through various initiatives, Spectrum MFB actively engages with communities, providing financial literacy programs and workshops aimed at educating individuals about managing their finances effectively. This commitment to education ensures that customers are not only recipients of financial services but also informed participants in their economic journeys.

Conclusion: A Partner in Economic Development

Spectrum Microfinance Bank is more than just a financial institution; it is a partner in economic development. By offering tailored financial solutions, leveraging technology, and focusing on community transformation, Spectrum MFB is dedicated to creating a brighter future for individuals and businesses alike. As it continues to grow and innovate, the bank remains steadfast in its mission to support the economic growth of Nigeria, one community at a time.

In a world where financial inclusion is paramount, Spectrum Microfinance Bank stands out as a leader, committed to making a difference in the lives of its customers and the communities it serves.

Rate the App

User Reviews

Popular Apps

Editor's Choice