Latest Version

21.1.0.g

June 23, 2025

Scotiabank Colpatria DF

Finance

Android

0

Free

eu.netinfo.colpatria.system

Report a Problem

More About Scotiabank Colpatria

Maximize Your Banking Experience: Essential Services You Should Know

In today's fast-paced world, managing your finances efficiently is crucial. Whether you're looking to consult and manage your products, download statements, or transfer funds, understanding the available banking services can significantly enhance your financial management. This article explores essential banking services that can streamline your financial activities and improve your overall banking experience.

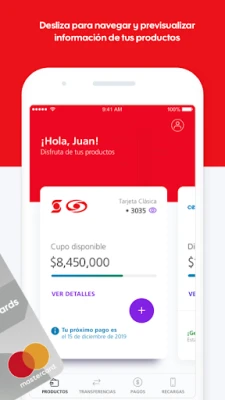

Consult and Manage Your Banking Products

Staying informed about your banking products is vital for effective financial management. Most banks offer online platforms where you can easily consult and manage your accounts. This includes checking balances, reviewing transaction histories, and monitoring your investments. By regularly accessing your banking products, you can make informed decisions and optimize your financial strategies.

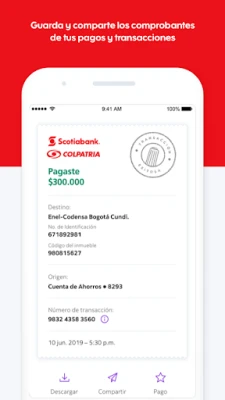

Download Your Bank Statements with Ease

Accessing your bank statements is a fundamental aspect of personal finance management. Most banks provide the option to download your statements directly from their online banking platforms. This feature allows you to keep track of your spending, analyze your financial habits, and prepare for tax season without the hassle of paper statements. Ensure you download your statements regularly to maintain an accurate record of your financial activities.

Transfer Funds to Scotiabank Colpatria and Other Banks

Transferring funds between accounts is a common banking need. Whether you are sending money to a Scotiabank Colpatria account or to other banks, most financial institutions offer seamless transfer options. Utilizing online banking services for fund transfers not only saves time but also provides a secure way to manage your money. Be sure to check for any fees associated with transfers and choose the method that best suits your needs.

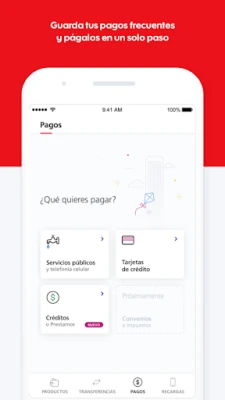

Pay Your Utility and Private Services

Paying bills can often be a tedious task, but modern banking solutions have simplified this process. With online banking, you can easily pay your utility bills and other private services from the comfort of your home. This feature not only saves time but also helps you avoid late fees by ensuring your payments are made on time. Set up reminders or automatic payments to streamline your bill-paying process further.

Recharge Your Mobile and Streaming Platforms

In an increasingly digital world, staying connected is essential. Many banks now offer services that allow you to recharge your mobile phone and even pay for streaming platforms directly through their online banking systems. This convenience means you can manage your entertainment and communication expenses all in one place, making it easier to keep track of your monthly budget.

Open a Certificate of Deposit (CDT)

Investing in a Certificate of Deposit (CDT) can be a smart financial move for those looking to grow their savings. Most banks provide the option to open a CDT through their online platforms. This investment vehicle typically offers higher interest rates than regular savings accounts, making it an attractive option for those willing to lock in their funds for a specified period. Research different terms and rates to find the best CDT that aligns with your financial goals.

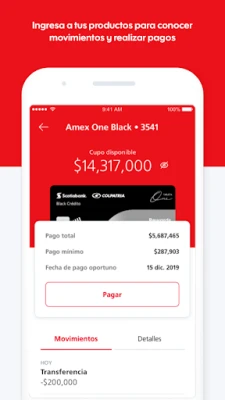

Redefine Your Credit Card Balance

Managing your credit card balance is crucial for maintaining a healthy credit score. Many banks offer tools to help you redefine and manage your credit card balances effectively. This includes options for balance transfers, which can help you consolidate debt and potentially lower your interest rates. Regularly reviewing your credit card statements and utilizing available tools can empower you to take control of your financial situation.

Make Cash Advances on Your Credit Card

In times of need, having access to cash can be essential. Most credit cards allow you to make cash advances, providing you with immediate funds when necessary. However, it's important to understand the terms and fees associated with cash advances, as they often come with higher interest rates. Use this feature wisely and only when absolutely necessary to avoid accumulating debt.

Conclusion: Empower Your Financial Journey

Understanding and utilizing the various banking services available can significantly enhance your financial management. From consulting and managing your products to making payments and investments, these services are designed to empower you in your financial journey. Take advantage of the tools and resources provided by your bank to streamline your financial activities and achieve your financial goals.

Rate the App

User Reviews

Popular Apps

Editor's Choice