Latest Version

4017.1.1

June 15, 2025

Premier Members CU

Finance

Android

0

Free

com.premiermemberscu.premiermemberscu

Report a Problem

More About Premier Members Credit Union

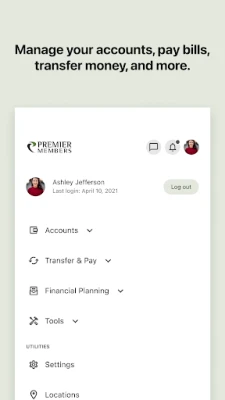

Ultimate Guide to Managing Your Accounts Efficiently

In today's fast-paced world, managing your finances effectively is crucial. With the right tools and features, you can take control of your accounts, make payments, track your budget, and stay informed about your financial activities. This guide will walk you through the essential features that can help you manage your accounts seamlessly.

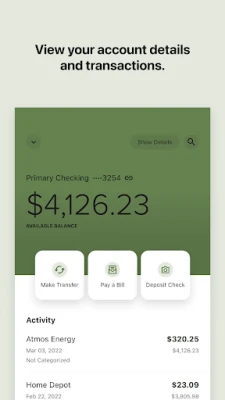

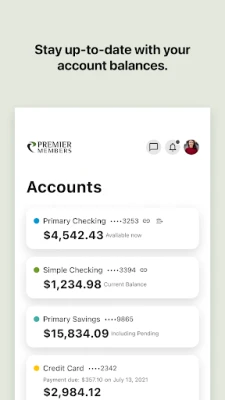

Get a Quick Snapshot of Your Accounts

Understanding your financial status at a glance is vital. With modern banking apps, you can:

- Sign in securely: Use advanced security features like Touch ID® or Face ID® for quick and safe access to your accounts.

- Review activity and balances: Instantly check the activity and balances of all your accounts in one place.

- Lock and unlock cards: Easily manage your debit and credit cards by locking or unlocking them as needed.

- Set up alerts: Stay informed with customizable alerts, ensuring you’re never caught off guard by unexpected transactions.

- Deposit checks: Utilize mobile check deposit features to add funds to your account without visiting a branch.

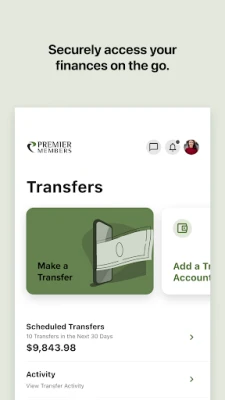

Make Payments and Transfer Money with Ease

Managing your payments and transfers is simpler than ever. Here’s how you can streamline these processes:

- Pay other people: Send money to friends or family quickly and securely.

- Make loan payments: Stay on top of your financial obligations by making timely loan payments directly through the app.

- Manage bill pay: Add new payees, schedule future payments, and view your payment history all in one convenient location.

- Schedule recurring transfers: Set up, edit, and manage recurring money transfers to simplify your financial planning.

Track Your Budget and Savings Goals

Keeping an eye on your budget and savings is essential for financial health. Here’s how you can effectively track your progress:

- View budget progress: Access a summary of your budget to see how well you’re sticking to your financial plan.

- Analyze spending and income: Get detailed insights into your spending habits and income sources to make informed decisions.

- Monitor savings goals: Keep track of your savings goals and measure your progress towards achieving them.

Get Alerts on Just About Anything

Staying informed about your financial activities is crucial. Set up alerts for:

- Transactions and purchases: Receive notifications for every transaction to keep your account secure.

- Upcoming or past due payments: Never miss a payment deadline with timely reminders.

- Transfers: Get alerts for any money transfers you initiate or receive.

- Budget categories: Monitor your spending in different categories to stay within your budget.

- Savings goals: Track your progress towards your savings objectives with regular updates.

Contact Us for Assistance

If you need help or have questions, reaching out is easy:

- Send a message: Use the app to send us a message directly for quick assistance.

- Find your branch or ATM: Locate your nearest branch or ATM with just a few taps.

- Give us a call: Contact our customer service team for personalized support.

Conclusion

Managing your accounts has never been easier with the right tools at your fingertips. By utilizing the features outlined in this guide, you can take control of your finances, make informed decisions, and achieve your financial goals. Embrace the convenience of modern banking and start managing your accounts today!

Rate the App

User Reviews

Popular Apps

Editor's Choice