Latest Version

7.4.0

June 05, 2025

Petal Card

Finance

Android

0

Free

com.petalcard.petal

Report a Problem

More About Petal

Unlock Your Financial Potential with Petal Credit Cards

In today's fast-paced financial landscape, improving your credit score is essential for achieving your financial goals. The Petal 1 and Petal 2 credit cards are designed to help you do just that, offering unique features that cater to your needs without the burden of excessive fees. Let’s explore how these cards can empower you to take control of your finances.

Petal 1: Your Gateway to Better Credit

The Petal 1 credit card is tailored for individuals looking to enhance their credit score. With no annual fee, it provides an accessible entry point for those new to credit or those looking to rebuild their financial standing. For the latest APR ranges, visit Petal's official website.

Petal 2: The Ultimate Cash Back Experience

Introducing the Petal 2, our most advanced credit card yet. This card offers all the benefits of a cash back card without any hidden fees. Enjoy the freedom of no annual fee, no late payment fees, no foreign transaction fees, and absolutely no other fees. To check the current APR ranges, head over to Petal's official website.

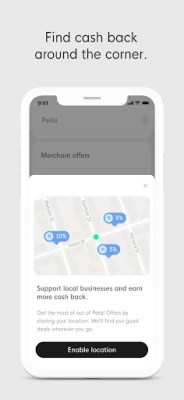

Maximize Your Rewards with Cash Back Offers

Both Petal cards come equipped with enticing cash back opportunities, allowing you to earn between 2% to 10% cash back at top brands and over 500 local businesses. This feature not only rewards your spending but also encourages you to shop smartly and support local enterprises.

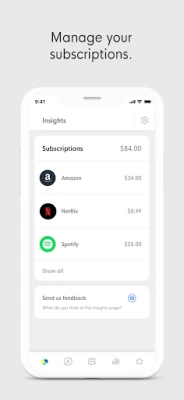

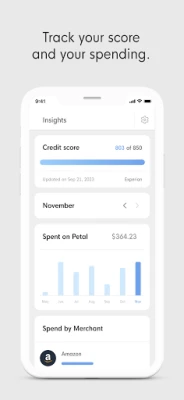

Stay in Control of Your Finances

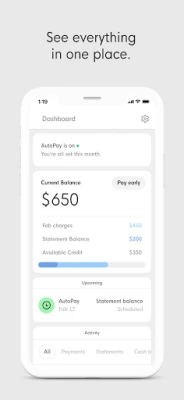

Managing your finances has never been easier. With the Petal app, you can effortlessly track your credit score, set budgets, manage subscriptions, and view all your accounts in one convenient location. This level of control ensures that you stay on top of your financial health and make informed decisions.

Built to Build Your Credit History

One of the standout features of Petal cards is their commitment to helping you build your credit history. Petal reports to all three major credit bureaus, making it easier for you to establish a solid credit profile. Importantly, you don’t need a previous credit history to qualify, making these cards accessible to a wider audience.

Enjoy Competitive Rates with Innovative Technology

Thanks to advanced technology, Petal offers lower variable APRs compared to traditional credit cards. This means you can enjoy great rates while working towards improving your credit score. For the most current APR ranges, visit Petal's official website.

Understanding Fees: What You Need to Know

While Petal 1 does have late and bounced payment fees, Petal 2 stands out with its commitment to zero fees of any kind. This makes Petal 2 an attractive option for those who want to avoid unexpected charges and focus on building their credit without financial stress.

Conclusion: Take the Next Step Towards Financial Freedom

With the Petal credit cards, you have the tools you need to improve your credit score and manage your finances effectively. Whether you choose Petal 1 for its straightforward approach or Petal 2 for its comprehensive cash back rewards, both cards are designed to help you succeed. Don’t wait any longer—visit Petal's official website today to learn more and take control of your financial future!

Thank you for taking the time to explore the benefits of Petal credit cards. Your journey towards better credit starts now!

Rate the App

User Reviews

Popular Apps

Editor's Choice