Latest Version

16.3.0

February 18, 2026

Krungthai Bank PCL.

Finance

Android

0

Free

com.ktb.customer.qr

Report a Problem

More About เป๋าตัง - Paotang

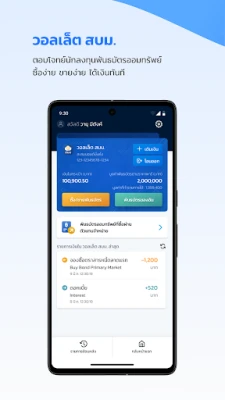

Unlocking the Power of G Wallet: Your Comprehensive Guide to Financial Freedom

In today's fast-paced world, managing finances efficiently is crucial. With G Wallet, you can easily register using just your national ID card and access a plethora of services including transfers, top-ups, payments, loans, and investments in gold, bonds, and stocks. This article explores the various features of G Wallet that make financial management seamless and stress-free.

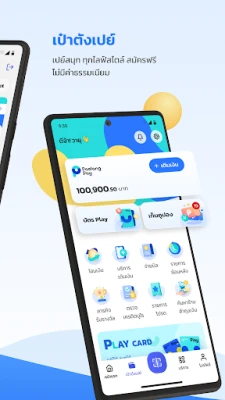

G Wallet Pay Features

G Wallet Pay offers a range of features designed to enhance your payment experience across Thailand:

- Nationwide Payment Scanning: Enjoy the convenience of scanning to pay at numerous locations throughout Thailand, along with exclusive discounts.

- Play Card Integration: Link your Play Card with G Wallet Pay for a complete payment solution that fits every lifestyle.

- Smooth Transactions: Connect your bank account to G Wallet Pay for uninterrupted payment experiences.

- Fee-Free Transactions: Transfer money, pay bills, and top up your account without incurring any fees.

- Exclusive Offers: Participate in special activities and stand a chance to win free discounts.

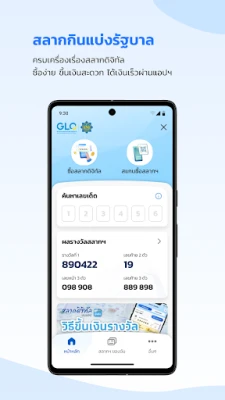

Utilizing G Wallet for Economic Stimulus Programs

G Wallet allows users to take advantage of various government initiatives aimed at stimulating the economy:

- Access to Government Programs: Utilize your rights under different government schemes.

- Payments at Participating Merchants: Make purchases at stores that accept G Wallet.

- Money Transfers: Easily transfer funds to your bank account or use PromptPay.

- Bill Payments: Pay for mobile top-ups, water, electricity, and traffic fines effortlessly.

Health Wallet: Simplifying Healthcare Services

The Health Wallet feature streamlines access to healthcare services for Thai citizens:

- Check Your Benefits: Easily verify your health benefits and service conditions.

- Appointment Management: Receive notifications for upcoming appointments with participating healthcare facilities.

- Service Confirmation: Confirm your healthcare services on the appointment day through the app without contacting medical records.

- Claim Your Benefits: Use the app to claim medical expenses based on your entitlements, such as civil servant rights and national health insurance (coming soon).

- Payment Notifications: Get alerts for medical payments and enjoy more convenient payment options through the app.

- Transaction History: Review your past transactions and access receipts from participating healthcare providers.

Investment Features: Bonds and Securities

G Wallet also offers investment opportunities in government bonds and corporate bonds:

- Government Bonds: Invest in government bonds starting at just 1 baht (minimum 100 baht), available for users aged 15 and above.

- 24/7 Trading: Buy and sell bonds anytime through the secondary market.

- Pledge Bonds: Pledge your bonds and request guarantee letters (LG) easily.

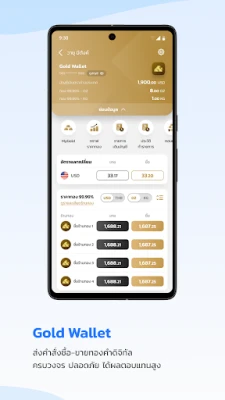

Easy Trading of Corporate Bonds

With G Wallet, trading corporate bonds is straightforward and accessible:

- Convenient Trading: Buy and sell corporate bonds anytime, anywhere through the G Wallet app.

- Simple Top-Ups: Easily add funds to your wallet from Krung Thai Next or other banking apps.

- Automatic Deductions: Purchase bonds with automatic deductions from your linked Krung Thai account.

- Comprehensive Information: View your bond holdings, purchase/sale prices, interest rates, and withholding tax details.

Krung Thai Account: Comprehensive Financial Management

The Krung Thai account offers a user-friendly platform for managing all your financial transactions:

- Online Account Setup: Open a 'Pao Mee Tang' account online and link up to three Krung Thai accounts through the app.

- Universal Transfers: Transfer funds to any bank account, including PromptPay transfers.

- Easy Mobile Top-Ups: Recharge any mobile carrier, including toll fees for Easy Pass and M-Pass.

- Bill Payments: Cover all expenses, including water, electricity, phone bills, credit card payments, and government bills like student loans and traffic fines.

- QR Code Payments: Set a primary account for QR code scanning to facilitate money transfers and payments.

- Account Statements: Access your account statements directly through the G Wallet app.

- Special Services: Enjoy tailored services for student loan customers, including payment information and notifications.

Krung Thai Loans: Quick and Easy Approval

Krung Thai offers accessible loan options for all professions with flexible repayment terms:

- High Loan Limits: Access loans up to 1,000,000 baht.

- Competitive Interest Rates: Enjoy interest rates between 20-22% per annum for timely payments (no additional fees).

- Flexible Repayment Terms: Choose repayment periods ranging from 12 to 60 months.

- Example Repayment: For a loan of 50,000 baht over 60 months at a 20% interest rate, monthly payments would be approximately 1,400 baht, totaling 76,608 baht (including interest).

G Wallet: The Future of Financial Management

G Wallet is designed to meet the evolving needs of modern Thai lifestyles, offering a comprehensive suite of financial services at your fingertips. Whether you are looking to manage your daily expenses, invest in bonds, or access healthcare services, G Wallet provides a seamless experience.

For more information, visit the official website at www.krungthai.com or connect with us on Rate the App

User Reviews

Popular Apps

Editor's Choice