Latest Version

3.27.0

September 19, 2025

Old Second Bank

Finance

Android

0

Free

com.oldsecond.grip

Report a Problem

More About O2 Digital Banking

Unlock the Full Potential of O2 Digital Banking: Your Comprehensive Guide

In today's fast-paced world, managing your finances efficiently is crucial. O2 Digital Banking offers a suite of features designed to streamline your banking experience. This article explores the various functionalities of O2 Digital Banking, ensuring you make the most of this innovative platform.

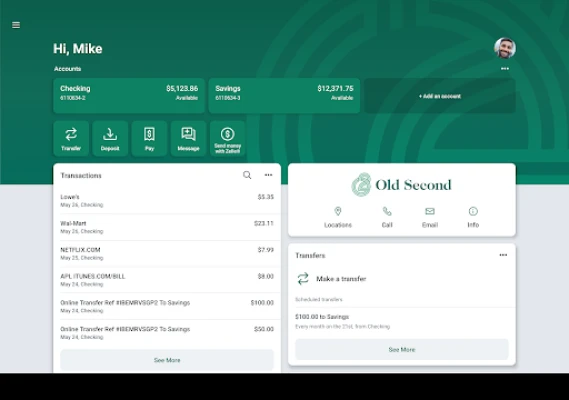

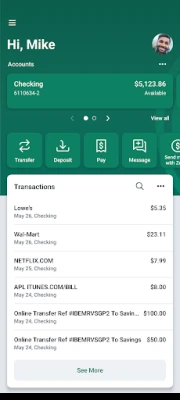

Organize Your Transactions with Ease

One of the standout features of O2 Digital Banking is its ability to keep your transactions organized. You can enhance your financial management by adding tags, notes, and even photos of receipts and checks. This functionality allows you to track your spending habits and maintain a clear overview of your financial activities.

Stay Informed with Custom Alerts

Never miss a beat with O2 Digital Banking's alert system. You can set up personalized alerts to notify you when your account balance drops below a specified amount. This proactive approach helps you manage your finances effectively and avoid unexpected overdraft fees.

Seamless Payment Options

Whether you need to pay a company or send money to a friend, O2 Digital Banking simplifies the payment process. With just a few taps, you can make payments quickly and securely, ensuring that your transactions are completed without hassle.

Effortless Money Transfers

Transferring money between your accounts has never been easier. O2 Digital Banking allows you to move funds seamlessly, giving you the flexibility to manage your finances as needed. This feature is particularly useful for budgeting and ensuring that your accounts are balanced.

Deposit Checks Instantly

Gone are the days of visiting the bank to deposit checks. With O2 Digital Banking, you can deposit checks in a snap by simply taking a picture of the front and back. This convenient feature saves you time and makes banking more accessible than ever.

Manage Your Debit Card with Confidence

Misplacing your debit card can be stressful, but O2 Digital Banking offers a solution. You can easily reorder your debit card or temporarily disable it if you can't find it. This added layer of security ensures that your finances remain protected at all times.

Access and Save Your Monthly Statements

Keeping track of your financial history is essential for effective budgeting. O2 Digital Banking allows you to view and save your monthly statements, providing you with a comprehensive overview of your spending and saving patterns.

Find Nearby Branches and ATMs

Need to find a branch or ATM? O2 Digital Banking makes it easy to locate the nearest facilities. This feature is particularly beneficial when you're traveling or in an unfamiliar area, ensuring you have access to your funds whenever you need them.

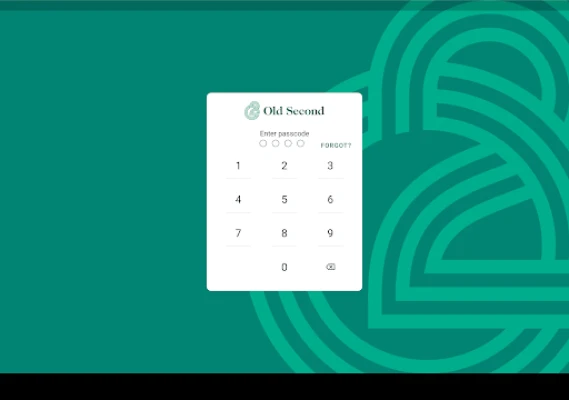

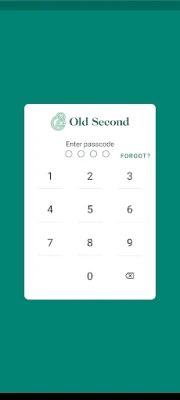

Secure Your Account with Advanced Features

Security is a top priority for O2 Digital Banking. You can protect your account with a 4-digit passcode and utilize biometric features such as fingerprint or face recognition on supported devices. These advanced security measures provide peace of mind, knowing that your financial information is safe.

Getting Started with O2 Digital Banking

To take advantage of the O2 Digital Banking app, you must be enrolled as a digital banking user with Old Second National Bank. If you are already using their Internet Banking services, simply download the app, launch it, and log in using your existing Internet Banking credentials. It's that easy!

Conclusion

O2 Digital Banking is designed to enhance your banking experience, offering a range of features that promote organization, security, and convenience. By utilizing these tools, you can take control of your finances and enjoy a seamless banking experience. Don't miss out on the opportunity to simplify your financial management—explore O2 Digital Banking today!

Rate the App

User Reviews

Popular Apps

Editor's Choice