Latest Version

2.1.1

June 22, 2025

My Beacon

Finance

Android

0

Free

comm.mybeaconapp

Report a Problem

More About My Beacon

Unlocking Financial Freedom in Canada: The Ultimate Guide to Beacon Money Services

Moving to a new country can be both exciting and daunting, especially when it comes to managing your finances. Beacon Money offers a suite of services designed to simplify your financial journey in Canada. From opening a Canadian account to paying bills in India, this guide will explore how Beacon Money can help you navigate your new life with ease.

Open a Canadian Account from Anywhere

With Beacon Money, you can open a Canadian bank account right from your home country. This feature allows you to manage your everyday spending both before and after your arrival in Canada. No more waiting in long lines or dealing with complicated paperwork upon landing. You can set up your account in advance, ensuring a smooth transition into your new life.

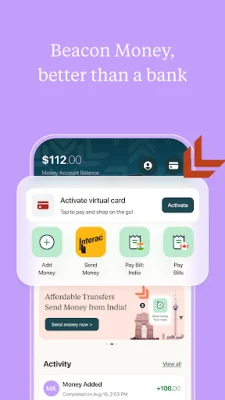

Get Your Free Virtual Prepaid Card

One of the standout features of Beacon Money is the free virtual prepaid card you receive before arriving in Canada. This card can be easily added to your Apple or Google Wallet, allowing you to go cashless within minutes of your arrival. Whether you need to pay for transportation, groceries, or dining out, your virtual card is ready to use, making your initial days in Canada hassle-free.

Order a Physical Card Upon Arrival

Once you arrive in Canada, you can order a physical card to be sent to your Canadian address. Expect to receive it within 7-10 days, ensuring you have a reliable payment method for your everyday needs. This feature reduces the risk of misplacing traveler’s cheques or dealing with expensive prepaid travel cards, giving you peace of mind as you settle into your new environment.

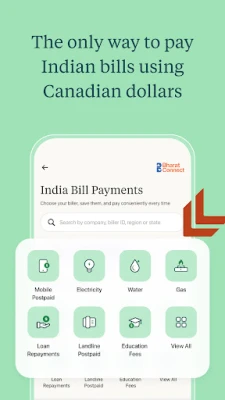

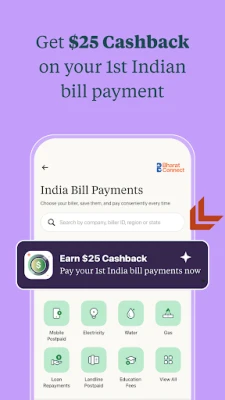

Effortless Bill Payments with Beacon India Bill Pay

Beacon Money also offers a unique service called Beacon India Bill Pay, which allows you to pay Indian bills directly from Canada using Canadian dollars. This service is a game-changer for expatriates, as it eliminates the need for multiple logins or NRI accounts. You can securely pay over 21,000 Indian billers, ensuring that your family back home can manage important expenses like hospital bills and house cleaning without any hassle.

Manage Your Loans with Ease

In addition to bill payments, Beacon India Bill Pay makes it easy to handle your student or home loans in India. With low foreign exchange rates, you can ensure that your payments are processed efficiently, allowing you to focus on your new life in Canada without worrying about financial obligations back home.

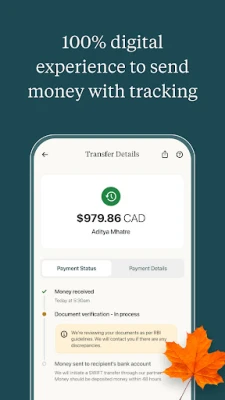

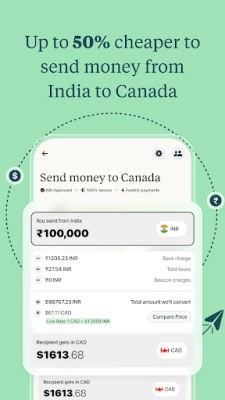

Beacon Remit: Affordable Money Transfers

Sending money from India to Canada has never been easier or more affordable than with Beacon Remit. This 100% digital platform eliminates the need for bank visits, allowing you to send money quickly and securely. With fast, trackable international money transfers, you can rest assured that your funds will reach their destination without unnecessary delays.

Beacon Remit operates on an RBI-approved platform, ensuring that all transactions are processed securely. This level of security is crucial for anyone looking to send money internationally, providing peace of mind for both senders and recipients.

Seamless Settling with Beacon Planning Lists

Transitioning to a new country involves a lot of planning, and Beacon Money understands this. Their human-curated planning lists are designed to help newcomers prepare and settle seamlessly into their new lives. Created by immigrants for immigrants, these lists offer time-saving tips and resources that make your journey easier.

In addition to planning lists, Beacon Money provides free learning resources tailored for newcomers to Canada. These resources can help you navigate various aspects of life in Canada, from understanding the healthcare system to finding employment opportunities.

Conclusion: Embrace Your New Life with Beacon Money

Beacon Money is more than just a financial service; it’s a comprehensive solution for anyone looking to start anew in Canada. With features like a Canadian account, virtual prepaid cards, easy bill payments, affordable money transfers, and valuable planning resources, Beacon Money empowers you to embrace your new life with confidence. Say goodbye to financial stress and hello to a brighter future in Canada!

Rate the App

User Reviews

Popular Apps

Editor's Choice