Latest Version

Version

8.1

8.1

Update

May 25, 2025

May 25, 2025

Developer

Network18

Network18

Categories

Finance

Finance

Platforms

Android

Android

Downloads

0

0

License

Free

Free

Package Name

com.divum.MoneyControl

com.divum.MoneyControl

Report

Report a Problem

Report a Problem

More About Moneycontrol-Share Market News

Moneycontrol App is Asia's #1 App for Business & Finance - Track markets, get loans, do financial transactions, and more.

Stay Ahead in Finance: The Ultimate Guide to the Moneycontrol App

In today's fast-paced financial landscape, staying updated on market trends is crucial. The Moneycontrol App empowers users to track both Indian and global financial markets directly from their smartphones. With comprehensive coverage of various assets across BSE, NSE, MCX, and NCDEX exchanges, this app is your go-to resource for monitoring indices like Sensex and Nifty, as well as stocks, futures, options, mutual funds, and commodities. Additionally, it offers features for personal loans and fixed deposits, making it a versatile tool for all your financial needs.Comprehensive Market Monitoring

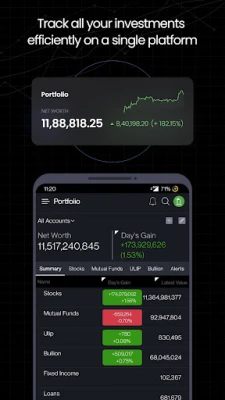

The Moneycontrol App provides a robust platform for monitoring your investments. With features like Portfolio and Watchlist, users can easily keep track of their assets and stay informed about market movements. The app also includes extensive news coverage in its News and Personal Finance sections, ensuring you have access to expert opinions and in-depth analysis of financial markets, complete with live streaming from CNBC.Key Features of the Moneycontrol App

- Seamless Navigation: The app's user-friendly interface allows for effortless browsing of your portfolio, market data, latest news, watchlist, forums, and more.

- Real-Time Market Data: Access live quotes for stocks, futures, options, and mutual funds from BSE, NSE, MCX, and NCDEX. Stay updated with key indices like Sensex, Nifty, and India VIX, and explore detailed market statistics.

- Interactive Charts: Utilize various chart types, including Line, Area, Candlestick, and OHLC, to analyze market trends effectively.

- Latest News Updates: Keep abreast of the latest developments in the market, business, and economy. Enjoy exclusive interviews with industry leaders and use the ‘Text to Speech’ feature to listen to articles on the go.

- Portfolio Management: Effortlessly monitor your investments across stocks, mutual funds, and other assets.

- Personalized Watchlist: Track your favorite stocks, mutual funds, and commodities with ease.

- Engaging Forum: Participate in discussions on your favorite topics and follow insights from top contributors.

Unlock Premium Features with Moneycontrol Pro

For those seeking an enhanced experience, Moneycontrol Pro offers a range of premium features designed to elevate your investment strategy:- Ad-Free Experience: Enjoy uninterrupted access to all features without advertisements.

- Personalized News: Receive tailored news updates relevant to your portfolio.

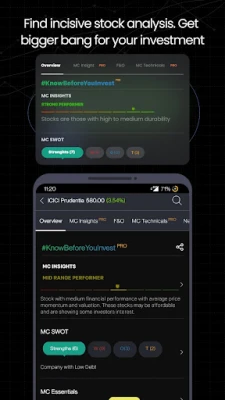

- Expert Insights: Gain access to in-depth analysis and trends, complete with sharp commentary to inform your investment decisions.

- Research-Driven Ideas: Benefit from investment ideas generated by our in-house and independent research teams.

- Technical Analysis: Leverage insights from professional chartists to enhance your trading strategies.

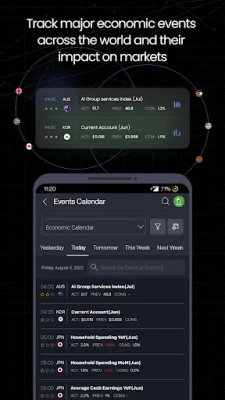

- Smart Calendar: Stay organized with a calendar of important business and economic events.

- Guru Speak: Learn from the experiences of successful investors.

Moneycontrol Pro Subscription Plans

Moneycontrol Pro offers flexible subscription options to suit your needs:- Monthly: INR 99 per month (India) or $1.40 (outside India)

- Quarterly: INR 289 for three months (India) or $4.09 (outside India)

- Annual: INR 999 for one year (India) or $14.13 (outside India)

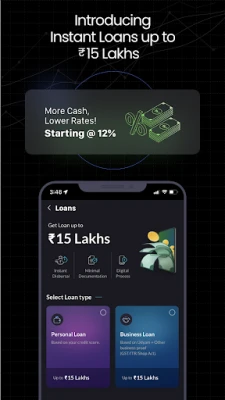

Personal Loans Made Easy

For users in India, Moneycontrol provides a curated platform to secure instant personal loans from top lenders. The app connects you with reputable Non-Banking Financial Companies (NBFCs) and banks, ensuring a smooth borrowing experience. Key lenders include:- Bhanix Finance & Investment Ltd (Cashe)

- L&T Finance Limited (L&T)

- Earlysalary Services Private Limited (Fibe)

- QFI Technologies Private Limited (Niro)

Loan Structure Overview

Understanding the loan structure is essential. Here are some important pointers:- Loan Tenure: 6 to 60 months

- Max Annual Percentage Rate (APR): 36%

- Sample Loan Breakdown:

- Loan Amount: Rs 1,00,000

- Tenure: 3 years

- Rate of Interest: 15%

- Principal: Rs 1,00,000

- Interest on the Loan: Rs 24,795

- Monthly Payment for 36 Months: Rs 3,467

- Processing Fees: Approx. Rs 2,000

Fixed Deposits: A New Offering

Moneycontrol is excited to announce the introduction of Fixed Deposits (FD). To book an FD, users must complete a one-time SIM binding process. Here’s how to create an FD:- Tap on Fixed Deposits

- Provide permission for the SIM binding process

- Select your preferred FD

- Complete KYC

- Make your FD payments via UPI or net banking

Stay Connected with Moneycontrol

For the latest updates and insights, follow Moneycontrol on social media: In conclusion, the Moneycontrol App is an indispensable tool for anyone looking to navigateRate the App

Add Comment & Review

User Reviews

Based on 0 reviews

No reviews added yet.

Comments will not be approved to be posted if they are SPAM, abusive, off-topic, use profanity, contain a personal attack, or promote hate of any kind.

More »

Popular Apps

LINE: Calls & MessagesLINE (LY Corporation)

Rogue SlimeQuest Seeker Games

PrivacyWallPrivacyWall

Roman empire games - AoD RomeRoboBot Studio

Nova BrowserJef Studios

CHANCE THE GAMETake Your Chance !

XENO; Plan, AutoSave & InvestXENO Investment

Throne WishlistThrone.com

Dot PaintingChill Calm Cute

Trovo - Watch & Play TogetherTLIVE PTE LTD

More »

Editor's Choice

Grim Soul: Dark Survival RPGBrickworks Games Ltd

Craft of Survival - Gladiators101XP LIMITED

Last Shelter: SurvivalLong Tech Network Limited

Dawn of Zombies: Survival GameRoyal Ark

Merge Survival : WastelandStickyHands Inc.

AoD Vikings: Valhalla GameRoboBot Studio

Viking Clan: RagnarokKano Games

Vikings: War of ClansPlarium LLC

Asphalt 9: LegendsGameloft SE

Modern Tanks: War Tank GamesXDEVS LTD