Latest Version

2.5.3

August 01, 2025

Siam Commercial Bank PCL.

Finance

Android

0

Free

com.scb.merc

Report a Problem

More About Mae Manee

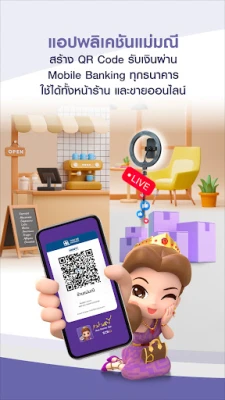

Revolutionize Your Payment Experience with Advanced QR Code Solutions

In today's fast-paced digital economy, businesses and consumers alike are seeking efficient and secure payment methods. One innovative solution that has emerged is the use of QR codes for seamless transactions. This article explores the myriad benefits of utilizing QR codes for payments, highlighting features that enhance user experience and streamline financial operations.

Effortless Payment Collection with QR Codes

Imagine generating QR codes that allow you to receive payments effortlessly from any mobile banking app. This technology simplifies the payment process, enabling businesses to accept funds without the hassle of traditional methods. With just a scan, customers can complete their transactions, making it a convenient option for both parties.

Instant Payment Notifications

One of the standout features of this QR code payment system is the ability to receive payment notifications instantly. Gone are the days of needing to photograph payment slips or wait for confirmation. With real-time alerts, you can manage your finances more effectively and focus on what truly matters—growing your business.

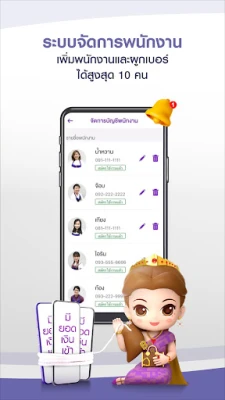

Connect Multiple Mobile Numbers Seamlessly

This innovative app allows you to connect up to 10 mobile phone numbers, all within a single platform. This feature is particularly beneficial for businesses with multiple representatives or locations, ensuring that all transactions are tracked and managed efficiently. No more juggling between different apps or accounts; everything you need is at your fingertips.

Support for Major Credit Cards

When it comes to payment flexibility, this QR code solution does not disappoint. It supports payments through major credit cards, including Visa, Mastercard, and UnionPay. This wide acceptance ensures that customers can pay using their preferred method, enhancing their overall experience and increasing the likelihood of repeat business.

Generate Payment Links for Accurate Transactions

To further streamline the payment process, the app allows users to generate payment links via chat. This feature minimizes the risk of incorrect amounts or account transfers, particularly when using Mae Manee Bills. By providing a direct link, you can ensure that customers are paying the correct amount, reducing confusion and potential disputes.

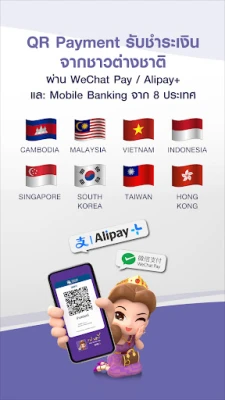

International Payment Capabilities

In an increasingly globalized world, the ability to handle payments from various countries is crucial. This QR code payment system supports transactions via WeChatPay and Alipay, as well as mobile banking applications from six other countries: Cambodia, Vietnam, Malaysia, Singapore, Indonesia, and South Korea. This international reach opens up new markets and opportunities for businesses looking to expand their customer base.

Instant Fund Crediting

One of the most appealing aspects of this payment solution is the instant crediting of funds to your accounts. This feature ensures that you have immediate access to your earnings, allowing for better cash flow management and quicker reinvestment into your business. No more waiting days for transactions to clear; your money is available when you need it.

Comprehensive Management for Online Stores

For online retailers, managing stock, orders, and customer interactions can be a daunting task. However, with Manee Social Commerce features, businesses can streamline these processes across multiple platforms. This comprehensive management system allows you to keep track of inventory, fulfill orders efficiently, and engage with customers, all from one convenient location.

Enhance Your Skills with Manee Academy

Knowledge is power, especially in the business world. Manee Academy offers free training courses designed to enhance your understanding of financial management and expand your business opportunities. By investing in your education, you can stay ahead of industry trends and make informed decisions that drive success.

Earn Rewards with Every Transaction

As an added incentive, users can collect Manee Rewards points with every receipt. These points can be redeemed for various awards, providing an extra layer of motivation for customers to engage with your business. Additionally, Manee Academy offers financial tips that can help you make the most of your earnings and improve your overall financial literacy.

Conclusion: Embrace the Future of Payments

In conclusion, the integration of QR code technology into payment systems offers a multitude of benefits for both businesses and consumers. From instant notifications and multi-number connectivity to international payment capabilities and comprehensive management tools, this innovative solution is set to revolutionize the way we handle transactions. By embracing these advancements, you can enhance your payment experience, streamline your operations, and ultimately drive your business towards greater success.

Rate the App

User Reviews

Popular Apps

Editor's Choice