Latest Version

4.0.33

June 22, 2025

TransUnion Interactive, Inc.

Finance

Android

0

Free

com.transunion.tucm

Report a Problem

More About Legacy TransUnion® App

Unlock Your Credit Potential: Essential Tips for Monitoring Your VantageScore

Understanding your credit score is crucial for maintaining financial health. Fortunately, checking your score won't negatively impact your credit; instead, it empowers you with valuable insights. Here’s how you can conveniently manage your credit health right from your smartphone.

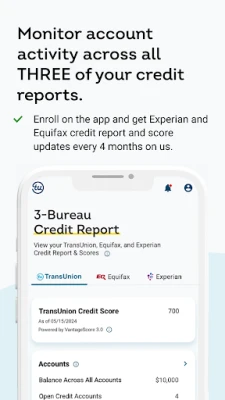

1. Understand Your VantageScore® 3.0

Gain clarity on what influences your VantageScore® 3.0 by accessing reports from major credit bureaus: TransUnion, Equifax, and Experian. It’s important to note that while these scores are based on the VantageScore® 3.0 model, lenders often utilize various scoring models to evaluate your creditworthiness. Familiarizing yourself with these factors can help you make informed financial decisions.

2. Identity Theft Protection: Peace of Mind

Rest easy knowing you have access to $1,000,000 Identity Theft Insurance. This coverage helps mitigate certain expenses related to identity theft, providing you with a safety net in case of fraudulent activities. Protecting your identity is a vital aspect of maintaining your overall credit health.

3. Stay Alert with Instant Inquiry Alerts

Monitor your credit file with Instant Inquiry Alerts from TransUnion. These alerts notify you of hard inquiries, allowing you to stay informed about any changes to your credit profile. Being proactive can help you address potential issues before they escalate.

4. Get Real-Time Updates with Push Notifications

Enable push notifications to receive timely updates directly on your phone. Stay informed about score changes, stolen cards, collections, new authorized users, and critical account activities that could impact your credit report. This feature ensures you are always in the loop regarding your credit status.

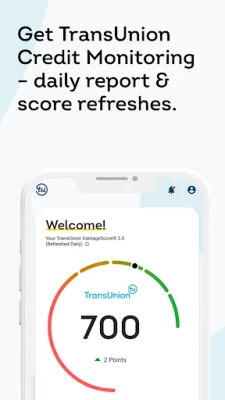

5. Daily Monitoring of Your VantageScore® 3.0

Make it a habit to check your VantageScore® 3.0 daily through TransUnion. Regular monitoring allows you to track your credit health and make necessary adjustments to improve your score over time. Consistency is key to achieving and maintaining a strong credit profile.

Download the App Today!

Take control of your credit health by downloading the TransUnion app today. With its user-friendly interface and comprehensive features, managing your credit has never been easier.

About TransUnion

TransUnion is a global information and insights company, employing over 13,000 associates across more than 30 countries. Our mission is to foster trust by ensuring that every individual is accurately represented in the marketplace. We achieve this through our Tru™ picture of each consumer, providing an actionable view that is carefully managed.

Through strategic acquisitions and technological advancements, we have developed innovative solutions that extend beyond traditional credit services. Our expertise spans marketing, fraud prevention, risk management, and advanced analytics. This enables both consumers and businesses to engage confidently, unlocking opportunities for success. We refer to this commitment as Information for Good®, which drives economic growth, enhances experiences, and empowers millions worldwide.

For more information, visit our business page at TransUnion Business.

Your Privacy Matters

At TransUnion, we prioritize your privacy. To learn more about the personal information we collect, please visit our Privacy Policy. If you wish to opt-out of the sale or sharing of your personal information, please follow this link. Additionally, you can limit the use of your sensitive personal information by visiting this page.

Empower yourself with knowledge and tools to enhance your credit health. Start today and take the first step towards a brighter financial future!

Rate the App

User Reviews

Popular Apps

Editor's Choice