Latest Version

2025.1.4

February 03, 2025

ING Deutschland

Finance

Android

0

Free

de.ing.banking

Report a Problem

More About ING Business Deutschland

Master Your Finances Anytime, Anywhere: The Ultimate Guide to Mobile Business Banking

In today's fast-paced world, managing your finances on the go is not just a luxury; it's a necessity. Mobile business banking has revolutionized the way entrepreneurs and business owners handle their financial transactions, making it simpler and more secure than ever before. This article explores the key features of mobile business banking that empower you to take control of your finances effortlessly.

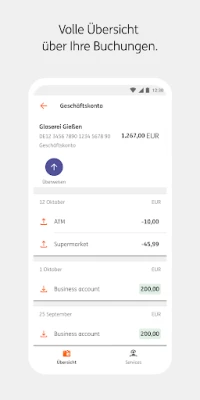

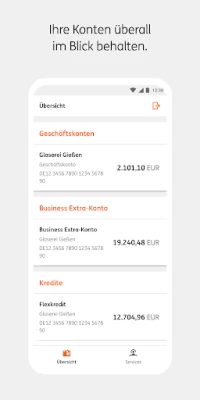

All Your Business Accounts at a Glance

One of the standout features of mobile business banking is the ability to view all your ING business accounts in one convenient location. This comprehensive overview allows you to monitor your financial health at a glance, ensuring you never miss a beat. With just a few taps, you can access account balances, transaction histories, and more, streamlining your financial management process.

Clear and Organized Transaction Listings

Keeping track of your business transactions is crucial for effective financial management. Mobile business banking provides a clear and organized listing of all your transactions, making it easy to review your spending patterns and identify areas for improvement. This feature not only saves you time but also helps you make informed decisions about your business finances.

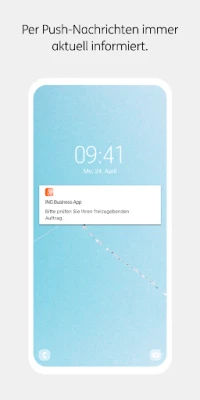

Stay Informed with Real-Time Notifications

In the world of business, staying informed is key. With mobile business banking, you receive push notifications for transactions and other important updates. This real-time information keeps you in the loop, allowing you to respond quickly to any changes in your financial situation. Whether it's a deposit, withdrawal, or any other activity, you’ll always be aware of what's happening with your accounts.

Enhanced Security Features for Peace of Mind

Security is a top priority when it comes to managing your business finances. Mobile business banking employs advanced security measures, including two-factor authentication, to protect your accounts from unauthorized access. This added layer of security ensures that your sensitive financial information remains safe, giving you peace of mind as you conduct your banking activities.

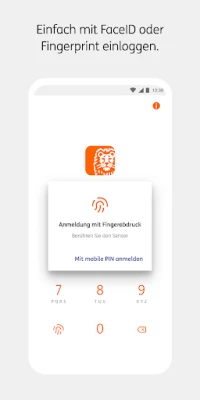

Flexible Login Options Tailored to You

Convenience is essential in mobile banking, and ING understands that. With mobile business banking, you can create a personalized mobile PIN for easy access. Additionally, you have the option to log in using facial recognition or fingerprint technology, making the process not only secure but also incredibly user-friendly. This flexibility allows you to choose the login method that best suits your lifestyle.

Conclusion: Embrace the Future of Business Banking

Mobile business banking is transforming the way entrepreneurs manage their finances. With features that provide a comprehensive overview of your accounts, organized transaction listings, real-time notifications, robust security measures, and flexible login options, it’s clear that this innovative approach to banking is designed with the modern business owner in mind. Embrace the future of business banking and take control of your finances anytime, anywhere.

Rate the App

User Reviews

Popular Apps

Editor's Choice