Latest Version

20.2

January 29, 2025

ICICI Bank Ltd.

Finance

Android

0

Free

com.csam.icici.bank.imobile

Report a Problem

More About iMobile: Loan, Cards & Banking

Unlocking Financial Freedom: The Comprehensive Guide to ICICI Bank's iMobile App

In today's fast-paced world, managing finances efficiently is crucial. The ICICI Bank iMobile App offers a seamless banking experience for both ICICI Bank customers and non-customers alike. With a plethora of features designed to simplify banking, iMobile brings the power of net banking right to your fingertips.

Key Features of the iMobile App

The iMobile app is packed with features that cater to various financial needs. Here’s a closer look at what you can do:

- Instant Loans: Access a range of loans including personal loans, home loans, and car loans with just a few taps.

- Online Digital Savings Account: Open a savings account digitally without the hassle of paperwork.

- Credit Card Applications: Apply for credit cards directly through the app.

- Fixed and Recurring Deposits: Easily open Fixed Deposits (FDs), Recurring Deposits (RDs), or iWish Deposits.

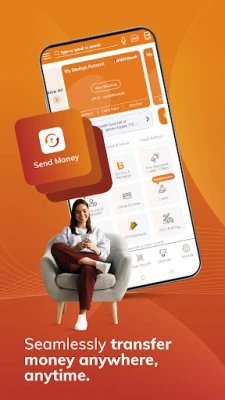

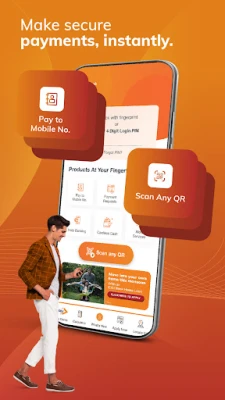

- UPI Payments: Scan QR codes for quick and easy UPI transactions.

- Utility Bill Payments: Pay your utility and electricity bills hassle-free.

- Mobile and DTH Recharge: Recharge your mobile and DTH services instantly.

- Travel Bookings: Book flights, trains, and hotels effortlessly.

Benefits of Using iMobile

Utilizing the iMobile app comes with numerous advantages that enhance your banking experience:

- Pre-approved RuPay Credit Cards: Enjoy instant access to RuPay benefits, facilitating seamless payments and UPI transactions.

- Manage Multiple Cards: Oversee your debit, credit, and forex cards all in one place. Schedule reminders for credit card bill payments, even for cards from other banks.

- Simplified Investments: Invest in various mutual fund schemes without the need for a Demat account, making investing straightforward.

- iScore & Discover: Use the 'Discover' feature to analyze your income and expenses. The 'Budget' feature helps you maintain financial discipline.

- iFinance: View all your bank accounts in one innovative interface, allowing for easy income and expense tracking.

- Unlock Rewards & Offers: Earn reward points and access exclusive offers by using your credit card for transactions.

- Customized Notifications: Stay updated on bills, cards, loans, and bank accounts with personalized alerts.

- SmartLock: Control access to banking services like net banking and UPI with a single swipe.

- Global UPI: NRI customers can conduct UPI payments using their international mobile numbers.

- 24/7 Chatbot Assistance: Get help anytime with the iPal chatbot feature.

Personal Loan Highlights

iMobile makes obtaining personal loans straightforward and accessible. Here are the key highlights:

- Loan Amount: Minimum of ₹25,000, with a maximum based on eligibility.

- Repayment Tenure: Flexible options ranging from 12 to 72 months.

- Interest Rate: Starting from 10.80% per annum.

- Processing Fees: Starting from ₹3,999.

For instance, if you borrow ₹5 lakh at an interest rate of 11.00% for 60 months, your monthly payment would be ₹10,817. The total repayment amount after five years would be ₹6,52,273, which includes ₹1,52,273 in interest.

Note: Terms and conditions apply.

Additional Offerings by ICICI’s iMobile

The iMobile app also provides a variety of other financial services, including:

- Forex Prepaid Cards

- Companion Cards

- Systematic Investment Plans (SIPs)

- IPO Applications

- Tap to Pay and Scan to Pay features

- Public Provident Fund (PPF)

- National Pension System (NPS)

- Gold Loans and Sovereign Gold Bonds

- Term Life Insurance and Health/Travel/Motor Covers

- 24-hour Top-Up and PayLater options

Pre-approved Loans

iMobile also offers a range of pre-approved loans, including:

- Home Loan Balance Transfer

- Education Loans

- Loans Against Property

- Commercial Property Loans

- Consumer EMIs

- Home Loan Overdrafts

- Insta FlexiCash Loans

- Personal Loans on Credit Cards

Contact and Support

For any feedback, queries, or issues related to the iMobile app, you can reach out via email at imobileapps@icicibank.com.

In conclusion, the ICICI Bank iMobile app is a powerful tool that simplifies banking and financial management. With its extensive features and user-friendly interface, it empowers users to take control of their finances effortlessly. Whether you are looking to manage loans, savings, or investments, iMobile is your go-to solution for modern banking.

Rate the App

User Reviews

Popular Apps

Editor's Choice