Latest Version

1.07

July 27, 2025

Wealthinfoline

Education

Android

0

Free

com.hdfcsecurities

Report a Problem

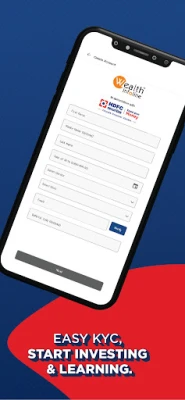

More About HDFC Securities KnowYourMoney

Why Financial Literacy is Essential for Your Financial Success

In today's fast-paced world, financial literacy is more crucial than ever. A lack of financial knowledge can lead to poor money management decisions, resulting in stress and missed opportunities. Understanding the fundamentals of finance empowers individuals to make informed choices that can significantly impact their financial well-being. This article explores the importance of financial literacy and how resources like Know Your Money can help bridge the knowledge gap.

The Importance of Financial Literacy

Financial literacy encompasses the skills and knowledge necessary to make informed financial decisions. It includes understanding how to manage money, invest wisely, and plan for the future. Here are some key reasons why financial literacy matters:

- Informed Decision-Making: Knowledge of financial principles enables individuals to make better choices regarding spending, saving, and investing.

- Debt Management: Understanding how to manage debt effectively can prevent financial crises and promote long-term stability.

- Wealth Building: Financial literacy equips individuals with the tools to grow their wealth through smart investment strategies.

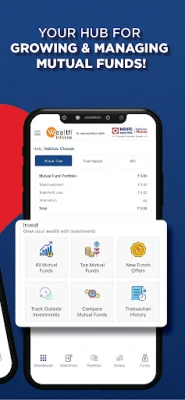

Smart Investing: Grow Your Wealth

Investing is a powerful way to build wealth over time. However, many people hesitate to invest due to a lack of understanding. Know Your Money provides practical insights into various investment options, helping users:

- Explore Investment Options: Learn about stocks, bonds, mutual funds, and real estate to diversify your portfolio.

- Understand Risk: Gain insights into risk management and how to balance potential returns with acceptable risk levels.

- Grow Your Wealth: Discover strategies for long-term growth and how to make your money work for you.

Effective Budgeting: Control Your Finances

Budgeting is a fundamental skill that everyone should master. It allows individuals to manage their income effectively, control expenses, and save for future goals. Here’s how Know Your Money simplifies budgeting:

- Income Management: Learn how to track your income and allocate funds to various expenses.

- Expense Control: Discover techniques to reduce unnecessary spending and prioritize essential expenses.

- Goal-Oriented Saving: Set realistic savings goals and develop a plan to achieve them.

Financial Planning: Prepare for Life’s Milestones

Life is full of milestones, from education to retirement. Effective financial planning ensures that you are prepared for these significant events. Know Your Money offers guidance on:

- Education Planning: Understand the costs associated with education and how to save for your children’s future.

- Retirement Preparation: Learn about retirement accounts, savings strategies, and how to ensure a comfortable retirement.

- Emergency Fund Creation: Discover the importance of having an emergency fund and how to build one.

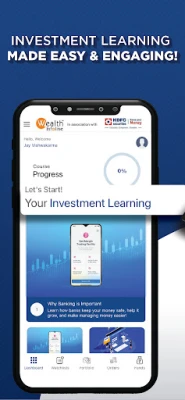

Simplified Learning for Real Life

Know Your Money breaks down complex financial concepts into easy-to-understand lessons. This approach makes financial literacy accessible to everyone, regardless of their background. The app provides:

- Actionable Lessons: Each lesson is designed to be practical and applicable in everyday life.

- Interactive Tools: Utilize calculators and budgeting tools to enhance your learning experience.

- Real-Life Scenarios: Engage with examples that reflect real-world financial situations.

Who Can Benefit from Financial Literacy?

Financial literacy is not just for a specific group; it benefits a wide range of individuals, including:

- Young Professionals: Those starting their financial journey can build a strong foundation for future success.

- Families: Parents planning for a secure future can make informed decisions that impact their children’s lives.

- Anyone Seeking Independence: Individuals looking to achieve financial independence can develop smarter money habits.

Commitment to Financial Awareness

Organizations like HDFC Securities are dedicated to promoting financial awareness. By providing resources and tools, they empower individuals to manage their finances with confidence. Financial literacy is not just a skill; it’s a pathway to a secure and prosperous future.

Conclusion

In conclusion, financial literacy is essential for making informed decisions that lead to financial stability and growth. By utilizing resources like Know Your Money, individuals can enhance their understanding of smart investing, effective budgeting, and comprehensive financial planning. Embrace the journey towards financial literacy and take control of your financial future today.

Rate the App

User Reviews

Popular Apps

Editor's Choice