Latest Version

5.83.0

February 03, 2025

Mynt - Globe Fintech Innovations

Finance

Android

0

Free

com.globe.gcash.android

Report a Problem

More About GCash

Unlock the Full Potential of GCash: Your Ultimate Guide to Seamless Transactions and Financial Management

In today's fast-paced digital world, managing your finances efficiently is crucial. GCash, a leading mobile wallet in the Philippines, offers a plethora of features that make transactions easier, faster, and more secure. This article delves into the various functionalities of GCash, from free transactions to investment opportunities, ensuring you make the most of this powerful tool.

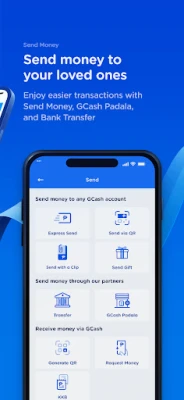

Effortless Transactions with GCash

One of the standout features of GCash is its free GCash-to-GCash transactions. Users can send money to friends and family without incurring any fees, making it an ideal choice for quick transfers. Additionally, the Send to Many feature allows you to send funds to multiple GCash accounts simultaneously, saving you time and effort.

GCash also enables users to transfer funds to various e-wallets and banks, including Maya, BPI, BDO, UnionBank, LandBank, Metrobank, and Chinabank. This flexibility ensures that you can manage your finances across different platforms seamlessly. Plus, you can save bank account details for future transfers, making the process even more convenient.

Buy Load Anytime, Anywhere

With GCash, purchasing load is a breeze. The platform supports all networks, allowing you to buy load whenever and wherever you need it. GCash users can also enjoy exclusive offers for Globe and TM subscribers, enhancing the value of their transactions.

Moreover, GCash provides options for prepaid broadband, TV channel packages, and even prepaid health insurance, ensuring that you have access to essential services at your fingertips.

Pay Bills & Fees with Ease

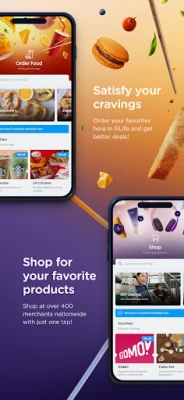

GCash simplifies bill payments by allowing users to settle bills with over 400 billers. Whether you need to pay in advance or catch up on past due bills, GCash makes it possible anytime, anywhere. You can set payment reminders and save recurring billers for added convenience.

Additionally, select billers accept GCredit, providing you with more flexibility in managing your payments.

Convenient Payment Options Everywhere You Go

Paying for goods and services has never been easier with GCash. Users can scan to pay via GCash QR or QRPh at over 70,000 merchants nationwide, as well as select international merchants through Alipay+ QR. The GCash Card allows you to make payments in over 200 countries and territories, ensuring you can shop globally without hassle.

For online shopping, GCash offers secure and instant payment options on various e-commerce platforms. With the Online Shopping Protect feature, you can enjoy coverage of up to P20,000 in case of scams, providing peace of mind while you shop.

GCash also links directly to the Play Store, allowing you to pay for subscriptions, games, movies, and more with ease.

Accessible Lending Solutions

GCash provides accessible lending options to help you manage your finances better. With GCredit, you can enjoy a credit limit of up to P50,000 with a competitive daily interest rate of only 0.17%. For larger needs, GLoan offers up to P125,000 with monthly interest rates starting as low as 1.59%.

Additionally, GGives allows you to borrow up to P125,000 with zero down payment, enabling you to pay in installments over 24 months. For those who need a quick load, GCash offers load promos of P50 and P99 for any network, payable in 14 days at 0% interest, with a minimal processing fee.

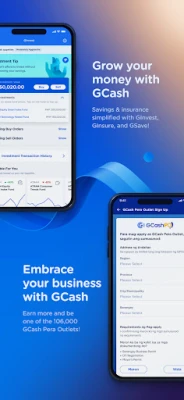

Effortless Wealth Management

Managing your wealth is simple with GCash's various financial products. GSave offers an easy application process with no minimum deposit or maintaining balance requirements, making it accessible for everyone. For those interested in the stock market, GStocks provides a wide selection of Philippine companies with no cash-in fees.

For a more hands-off approach, GFunds offers expert wealth management with an easy application process and investment style assessment, allowing you to invest in a wide selection of funds starting at just P50. If you're interested in cryptocurrency, GCrypto allows you to invest in diverse cryptocurrencies starting at P200, also with no cash-in fees.

Stay Protected with Comprehensive Insurance

GCash prioritizes your security with various insurance options. You can get health insurance for as low as P79, providing coverage of up to P1.2 million. For travelers, GCash offers travel insurance that can be obtained in just five minutes for as low as P350, with coverage up to P2.5 million.

Additionally, GCash provides bill protection of up to P3.6 million for 30 days and scam protection for only P30, covering you for up to P15,000 in case of fraudulent activities.

Cash In Made Easy

GCash offers multiple ways to cash in, both online and offline. You can easily cash in through partner banks or online banking with Instapay. For those who prefer over-the-counter transactions, GCash partners with various outlets such as Cebuana Lhuillier, Villarica, Touchpay, and more, ensuring you have convenient options to fund your wallet.

Make a Difference: Plant Real Trees with GCash

GCash is not just about financial transactions; it also promotes environmental sustainability. By earning and collecting Energy Points, users can contribute to planting real trees in various forests across the Philippines. This initiative allows you to make a positive impact on the environment while managing your finances.

Conclusion

GCash is more than just a mobile wallet; it is a comprehensive financial management tool that empowers users to handle their finances with ease. From seamless transactions and bill payments to investment opportunities and insurance, GCash offers everything you need to manage your money effectively. Embrace the future of finance with GCash and unlock a world of possibilities today!

Rate the App

User Reviews

Popular Apps

Editor's Choice