Latest Version

Version

4.89.3

4.89.3

Update

September 22, 2025

September 22, 2025

Developer

FNNI

FNNI

Categories

Finance

Finance

Platforms

Android

Android

Downloads

0

0

License

Free

Free

Package Name

com.firstnational.omaha

com.firstnational.omaha

Report

Report a Problem

Report a Problem

More About FNBO

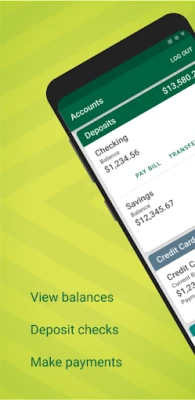

Take FNBO with you wherever you go. Access your funds, control your cards, make deposits and more. All from the FNBO mobile app. Free. Secure. Anywhere.

Essential Mobile Banking Features for On-the-Go Users

In today's fast-paced world, managing your finances efficiently is crucial. Mobile banking has revolutionized how we handle our money, offering a plethora of features that allow users to stay connected and in control, no matter where they are. This article explores the essential features of mobile banking that cater to the needs of on-the-go users.Check Your Account Balances Anytime, Anywhere

One of the primary benefits of mobile banking is the ability to view your account balances and transaction history at your convenience. With just a few taps on your smartphone, you can access real-time information about your finances. This feature helps you stay informed about your spending habits and manage your budget effectively.Remote Check Deposits Made Easy

Gone are the days of visiting a bank branch to deposit checks. With mobile banking, you can deposit checks remotely through your phone. Simply take a picture of the check, and the funds will be processed directly into your account. This feature not only saves time but also provides a seamless banking experience.Send and Receive Money Instantly with Zelle®

Zelle® offers a fast and easy way to send and receive money directly from your bank account. Whether you need to split a bill with friends or pay for services, Zelle® makes transactions quick and hassle-free. This feature is particularly useful for those who frequently engage in peer-to-peer payments.Enhanced Card Security at Your Fingertips

Keeping your financial information secure is paramount. Mobile banking allows you to lock and unlock your debit or credit cards on the go. If you misplace your card or suspect fraudulent activity, you can quickly disable it through the app, ensuring your funds remain protected 24/7.Real-Time Account Alerts

Stay informed about your account activity with real-time alerts. You can set up notifications for various account-related events, such as low balances, large transactions, or upcoming payments. This feature helps you monitor your finances proactively and avoid potential overdraft fees.Manage Payments with Ease

Mobile banking simplifies the process of managing your payments. You can view scheduled and recent payments, ensuring you never miss a due date. Additionally, setting up one-time or recurring payments is straightforward, allowing you to automate your bills and save time.Effortless Money Transfers

Transferring money between your accounts or to others has never been easier. Mobile banking enables you to initiate transfers quickly, whether you’re moving funds between your savings and checking accounts or sending money to a friend. This feature enhances your financial flexibility and convenience.Find ATMs and Branches Near You

Need cash or want to visit a branch? Mobile banking apps often include a feature to locate the nearest ATM or bank branch. This functionality ensures you can access your funds and banking services without unnecessary delays, no matter where you are.Important Considerations for Mobile Banking

While mobile banking offers numerous advantages, it’s essential to be aware of certain limitations. Deposits made through the app are subject to verification and may not be available for immediate withdrawal. Always check the terms within the app for specific limits and restrictions.Security and Investment Product Disclaimers

For your peace of mind, it’s crucial to understand the security measures in place. Review the Security Statement provided by your bank to ensure your information is protected. Additionally, be aware that investment products are not FDIC insured, are not bank guaranteed, and may lose value. Always consider these factors when managing your investments.Conclusion

Mobile banking has transformed the way we manage our finances, offering a range of features designed for convenience and security. From checking balances to making payments and securing your cards, these tools empower users to take control of their financial lives on the go. Embrace the benefits of mobile banking and enjoy a more efficient way to handle your money.For more information on security and banking services, visit FNBO Security Center. FNBO is a registered trademark licensed to First National Bank of Omaha. Member FDIC.

Rate the App

Add Comment & Review

User Reviews

Based on 0 reviews

No reviews added yet.

Comments will not be approved to be posted if they are SPAM, abusive, off-topic, use profanity, contain a personal attack, or promote hate of any kind.

More »

Popular Apps

LINE: Calls & MessagesLINE (LY Corporation)

Rogue SlimeQuest Seeker Games

PrivacyWallPrivacyWall

Roman empire games - AoD RomeRoboBot Studio

CHANCE THE GAMETake Your Chance !

XENO; Plan, AutoSave & InvestXENO Investment

Dot PaintingChill Calm Cute

Trovo - Watch & Play TogetherTLIVE PTE LTD

Nova BrowserJef Studios

Tank Hero: Jump 3DAMANDA

More »

Editor's Choice

Grim Soul: Dark Survival RPGBrickworks Games Ltd

Craft of Survival - Gladiators101XP LIMITED

Last Shelter: SurvivalLong Tech Network Limited

Dawn of Zombies: Survival GameRoyal Ark

Merge Survival : WastelandStickyHands Inc.

AoD Vikings: Valhalla GameRoboBot Studio

Viking Clan: RagnarokKano Games

Vikings: War of ClansPlarium LLC

Asphalt 9: LegendsGameloft SE

Modern Tanks: War Tank GamesXDEVS LTD