Latest Version

2.3.51

September 23, 2025

Firstcard, Inc

Finance

Android

0

Free

com.firstcard.firstcard

Report a Problem

More About Firstcard: Credit Builder Card

Build Your Credit Score Early and Safely: A Comprehensive Guide

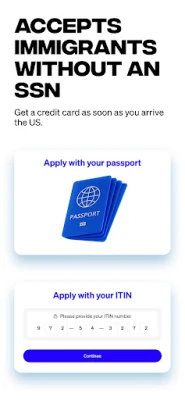

Establishing a solid credit score is essential for financial health, especially for those new to the United States. Whether you're an immigrant, an international student, or a foreigner without a Social Security Number (SSN), there are safe and effective ways to build your credit score. This guide will explore how you can enhance your credit profile while enjoying various financial benefits.

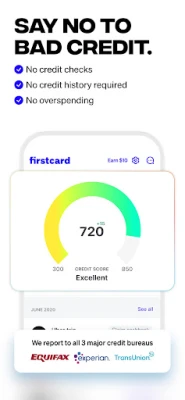

Build Your Credit Score with Every Purchase

Every time you spend, you have the opportunity to build your credit score. With innovative financial products like Firstcard, you can start establishing your credit history without the usual barriers. Here are some key features:

- No SSN Required: Firstcard accepts applications from immigrants, international students, and non-US citizens using just a passport.

- No Credit Check: Enjoy the peace of mind that comes with no hard inquiries affecting your credit score.

- Responsible Spending: Firstcard promotes responsible financial habits by preventing overspending.

- No Hidden Fees: Say goodbye to interest charges, overdraft fees, late payment penalties, and account minimums.

- Inclusive Approval: Regardless of your credit history, Firstcard can approve your application.

- Credit Reporting: Firstcard reports to all three major credit bureaus: TransUnion®, Equifax®, and Experian®.

- No Impact on Credit Score: Applying for Firstcard does not affect your credit score.

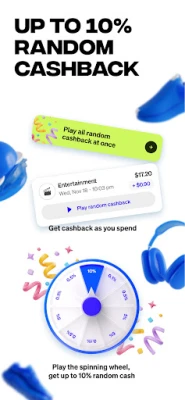

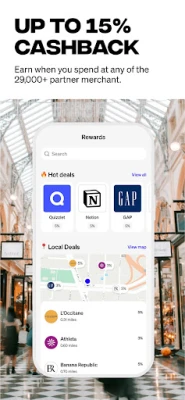

Earn Cashback on Every Transaction

Maximize your spending with cashback rewards. Firstcard offers an attractive cashback program that allows you to earn money back on your purchases:

- Merchant Cashback: Earn up to 15% cashback at 29,000 partner merchants.

- Random Cashback: Enjoy up to 10% random cashback on all qualifying purchases.

- Firstcard+ Benefits: Get an additional 1% cashback on all qualifying purchases with Firstcard+.

These cashback opportunities not only reward you for spending but also help you save money over time.

Grow Your Savings Over Time

Building wealth is a gradual process, and Firstcard offers competitive interest rates to help you grow your money:

- Standard Members: Earn 0.75% Annual Percentage Yield (APY).

- Firstcard+ Members: Enjoy a higher APY of 2.00%.

- Premium Members: Maximize your earnings with a 4.00% APY.

For context, the national average interest rate on savings accounts is only 0.45% APY, making Firstcard's offerings particularly attractive.

Equal Access for Everyone

Firstcard is committed to providing equal financial opportunities for all, regardless of credit history:

- No Credit Score? No Problem: If you have no credit score or a low credit score, Firstcard can still approve your application.

- Inclusive Application Process: The application process is designed to be accessible for immigrants, international students, and non-US citizens.

Security and Support You Can Trust

Your financial security is paramount. Firstcard ensures that your money is safe and that you receive reliable support:

- FDIC Insurance: Your funds are insured up to $250,000 through Regent Bank, a member of the FDIC.

- Mastercard Partnership: The Firstcard credit card is issued under a license from Mastercard® International Inc.

- US-Based Support: Firstcard's team is based in the United States, with headquarters in Silicon Valley, ensuring you receive prompt assistance.

Conclusion

Building your credit score early and safely is not only possible but also straightforward with Firstcard. By leveraging the benefits of cashback rewards, competitive interest rates, and an inclusive application process, you can establish a strong financial foundation. Whether you're new to the country or simply looking to improve your credit profile, Firstcard offers the tools and support you need to succeed.

Take the first step towards financial empowerment today and explore how Firstcard can help you build your credit score while enjoying the benefits of cashback and savings growth.

Disclaimer: The Firstcard credit cards are issued by Regent Bank, pursuant to a license from Mastercard® International Inc. Firstcard is a financial technology company, not a bank. Banking services are provided by Regent Bank; Member FDIC. FDIC deposit insurance up to $250,000 per qualified customer account on a "pass-through" basis; FDIC insurance only covers failure of insured depository institutions. Certain conditions must be satisfied for pass-through FDIC deposit insurance to apply.

Rate the App

User Reviews

Popular Apps

Editor's Choice