Latest Version

0.9.18.3.274

June 19, 2025

Disrapp LLC

Finance

Android

0

Free

com.disrapp.coinkeeper3

Report a Problem

More About CoinKeeper — expense tracker

Mastering Your Finances: Effective Strategies to Save Money

Are you curious about how to save money effectively? Understanding your spending habits is the first step towards financial freedom. This article will guide you through essential strategies to manage your finances better, highlighting key areas where you can cut costs and make informed decisions based on your unique financial situation.

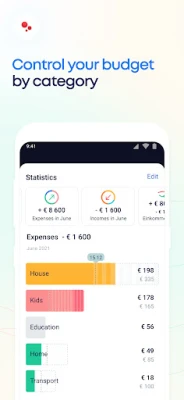

Identify Your Spending Categories

To save money, it’s crucial to analyze your spending patterns. Start by categorizing your expenses into different segments. Here are some common categories where you might be overspending:

- Dining Out: Eating at restaurants can quickly drain your budget.

- Entertainment: Subscriptions and outings can add up.

- Shopping: Impulse purchases often lead to unnecessary expenses.

- Utilities: High energy bills can be reduced with mindful usage.

By identifying these categories, you can pinpoint where to cut back and allocate your funds more wisely.

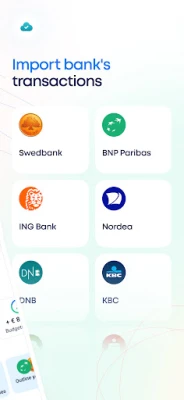

Track Your Spending with Technology

Are you consistently exceeding your budget? Utilizing financial management apps can help you stay on track. For instance, CoinKeeper allows you to set limits on various expense categories. When you approach or exceed your budget, the app alerts you, enabling you to make timely adjustments.

With such tools, you can gain a clearer picture of your financial health and avoid overspending.

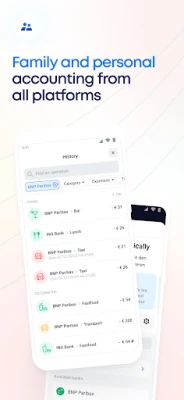

Establish a Family Budget

Managing finances as a family can be challenging, but shared budgeting simplifies the process. With apps like CoinKeeper, family members can record their expenses on their devices. This feature ensures that everyone is aware of the family’s financial status, as account balances are updated in real-time across all devices.

By collaborating on budgeting, families can work together to achieve their financial goals and foster a culture of financial responsibility.

Personalized Financial Solutions

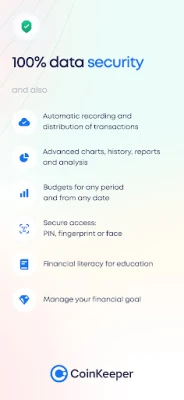

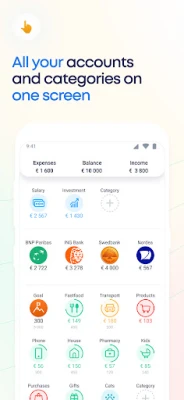

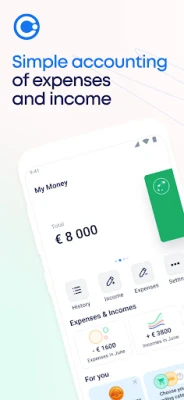

If you’re seeking tailored financial management solutions, CoinKeeper³ offers a user-friendly interface that consolidates all your financial information in one place. Here’s what you can expect:

- Comprehensive Overview: View all your accounts, cards, and cash on a single screen for easy management.

- Quick Access: Retrieve any financial information with a simple swipe, saving you time and effort.

- Expense Tags and Comments: Add specific tags and comments to your expenses for better tracking and analysis.

- Unlimited Expense Categories: Create a personalized budgeting system that fits your lifestyle and financial goals.

These features empower you to take control of your finances and make informed decisions that align with your objectives.

Make Informed Financial Decisions

Understanding your financial situation is vital for making sound decisions. Regularly reviewing your spending habits and adjusting your budget accordingly can lead to significant savings over time. Here are some tips to help you make informed choices:

- Set Clear Financial Goals: Define what you want to achieve, whether it’s saving for a vacation, paying off debt, or building an emergency fund.

- Review Your Budget Monthly: Regularly assess your budget to identify areas for improvement and ensure you’re on track to meet your goals.

- Prioritize Needs Over Wants: Distinguish between essential expenses and discretionary spending to allocate your resources effectively.

Conclusion: Take Charge of Your Financial Future

Saving money doesn’t have to be a daunting task. By understanding your spending habits, utilizing technology, and collaborating with family members, you can create a robust financial plan that works for you. With tools like CoinKeeper, you can track your expenses, set budgets, and make informed decisions that lead to financial stability. Start today, and take charge of your financial future!

Rate the App

User Reviews

Popular Apps

Editor's Choice