Latest Version

2.0.0

June 03, 2025

Fast Cash Advance Apps

Finance

Android

0

Free

cash.advance.app.borrow.money.instantly

Report a Problem

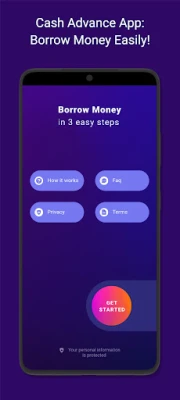

More About Cash Advance App: Borrow Money

Quick Cash Advances: Your Guide to Fast and Easy Borrowing

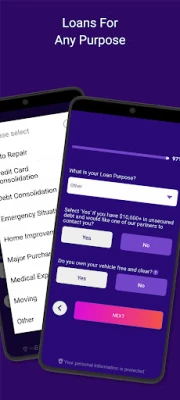

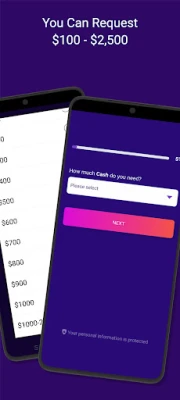

Need a cash advance between $100 and $2,500? Even if your credit rating isn't perfect, you can still apply and potentially receive funds quickly!

Simple 3-Step Application Process

Our streamlined online application process allows you to secure a cash advance in just three easy steps:

- Submit Your Request: Indicate the amount you wish to borrow and provide your personal information.

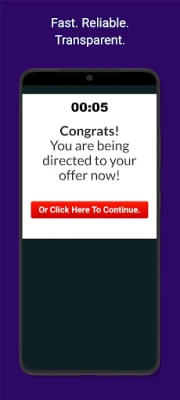

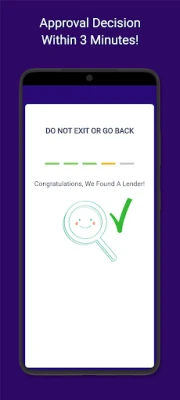

- Get Instant Approval: Find out if you’ve been approved within minutes—no lengthy waiting periods!

- Sign and Receive Funds: Digitally sign the contract, and you could have cash in your account as soon as the next business day!

Who Can Apply?

Our cash advance app is accessible to anyone who meets the following criteria:

- Must be a legal U.S. citizen aged 18 or older.

- Must have a monthly income of at least $1,000.

- Must hold a bank account with standard checking capabilities.

If you meet these requirements, don’t hesitate—request your loan today!

Get Cash Fast When You Need It Most

Everyone encounters financial challenges at some point. Fortunately, resolving these issues has never been easier with our online cash advance app. Whether you’re facing an unexpected bill or a more significant financial emergency, you can apply for a cash advance in just minutes.

How to Get Started with Your Cash Advance

In times of crisis, speed and efficiency are crucial. After submitting your application, you’ll receive immediate feedback on available offers—no waiting for callbacks or emails, and no cumbersome paperwork. You can attach any necessary documentation digitally, making the process even smoother.

Complete your cash loan application from the comfort of your home using just the app and an internet connection. The best part? Once you sign the agreement, funds could be deposited into your bank account as early as the next morning. Plus, repayments are automatically deducted, making it a hassle-free solution for your cash needs!

Struggling with a Poor Credit Score?

If you have a poor credit score, obtaining cash loans online is often simpler than applying for a traditional personal loan at a bank. Unlike conventional lenders, our approach does not automatically disqualify applicants with bad credit. Instead, we conduct a fair assessment that considers your employment status, income level, and other relevant information provided in your application.

While you may not receive funds instantly due to the assessment process, this method is one of the fastest ways to secure a cash advance. Since cash advance loans are typically smaller, short-term commitments, lenders perceive less risk and are more willing to work with consumers who have less-than-perfect credit.

Important Material Disclosure

This loan app does not act as a lender, loan broker, or any other type of lending agent. Instead, it serves as a valuable tool to connect borrowers with licensed and accredited cash advance lenders who can provide the requested amounts. When you submit your details, they are shared across a network of lenders who will make their decisions and offers directly. All loan agreements are strictly between the borrower and the lender, not the app operator. This app does not facilitate offers or solicitations for loan products that are prohibited by state law. You are under no obligation to complete the form, apply for a loan, or accept any loan offer from a lender.

Repayment terms may vary by lender, typically ranging from 65 days to 3 years.

Understanding APR Disclosure

The annual percentage rate (APR) represents the yearly interest cost of the loan, which is influenced by the loan amount, repayment term, and timing of repayments. Some states impose limits on interest rates, with APRs ranging from 6.63% to 35.99%, depending on the lender. Before finalizing a loan, you will be clearly informed of the APR.

Example of APR Calculation

Here’s a representative example of how APR might be calculated:

- Loan Amount: $2,000

- Repayment Term: 2 years

- APR: 25%

Calculating the total cost:

- Total charge for the loan: $2,000 * (25% APR) = $500

- Total amount to repay: $2,000 + $500 = $2,500

- Monthly payment: $2,500 / 24 = $104.17

With this understanding, you can make informed decisions about your cash advance options. Don’t let financial emergencies overwhelm you—apply today and take control of your cash flow!

Rate the App

User Reviews

Popular Apps

Editor's Choice