Latest Version

3.0.6

November 20, 2025

BMG Money

Finance

Android

0

Free

com.bmgmoney.app

Report a Problem

More About BMG Money

Unlocking Financial Freedom: Your Guide to Better Loan Offers

In today's fast-paced world, having access to quick and reliable financial solutions is essential. Whether you need funds for an unexpected expense or a planned purchase, understanding the various loan options available can empower you to make informed decisions. This article explores the benefits of better loan offers, focusing on accessibility, ease of application, and favorable terms.

Flexible Loan Options: From $500 to $10,000

When it comes to personal loans, flexibility is key. With loan amounts ranging from $500 to $10,000 and terms spanning 6 to 48 months, borrowers can find a solution that fits their financial needs. This range allows individuals to choose a loan that aligns with their budget and repayment capabilities, ensuring a manageable financial commitment.

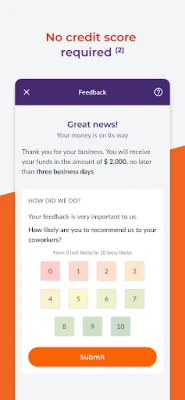

No Credit Score? No Problem!

One of the most significant barriers to obtaining a loan is the reliance on credit scores. Fortunately, many lenders, including BMG Money, do not use FICO credit scores when reviewing loan applications. This approach opens the door for individuals who may have less-than-perfect credit histories, allowing them to access the funds they need without the stress of credit evaluations.

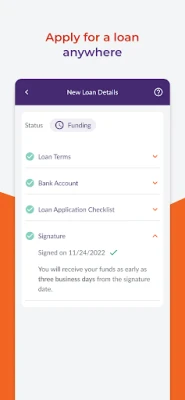

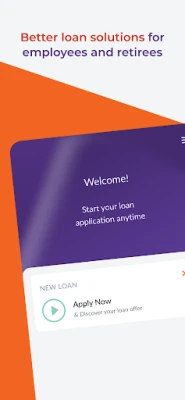

Streamlined Application Process

Applying for a loan should be a hassle-free experience. With a user-friendly application process, borrowers can receive loan offers in just minutes from any device. This convenience means you can apply for a loan from the comfort of your home or on the go, making it easier than ever to secure the financial assistance you require.

Higher Acceptance Rates: We Say Yes When Others Say No

Many traditional banks and financial institutions have stringent lending criteria, often resulting in high rejection rates. However, BMG Money prides itself on a higher acceptance rate. When banks turn you down, we are here to provide a solution, ensuring that more individuals have access to the funds they need.

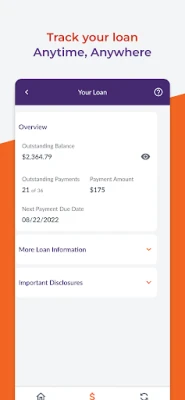

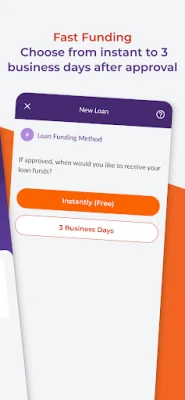

Instant Funding: Get Your Money Fast

Time is often of the essence when it comes to financial needs. Most borrowers can expect their loan proceeds to be deposited in their bank accounts instantly. With options for automatic payments through allotment, direct deposit, debit card, or payroll deduction, managing your loan repayment becomes seamless and straightforward.

Understanding Annual Percentage Rates (APR)

When considering a loan, it's crucial to understand the Annual Percentage Rate (APR), which typically ranges from 16.99% to 35.99%. This rate reflects the cost of borrowing and can vary based on individual circumstances. By comparing APRs from different lenders, you can make an informed choice that minimizes your overall loan costs.

Repayment Flexibility: No Rush Required

Unlike some lenders that require full repayment within 60 days, BMG Money offers a more flexible repayment schedule. This approach allows borrowers to manage their finances without the pressure of immediate repayment, making it easier to stay on track with your financial obligations.

Eligibility Criteria: Are You Qualified?

To qualify for a loan, applicants must meet specific criteria. If you have been employed for at least one year, are over 18 years of age, are not active in the military, and are not in bankruptcy, you may be eligible. Additionally, you must be employed by one of the participating employers. To check if your employer qualifies, visit BMG Money's signup page. Terms and conditions apply.

Stay Updated with Notifications

In today's digital age, staying informed is crucial. By enabling notifications, you can receive timely updates about your loan status, payment reminders, and new offers. This feature ensures you never miss important information regarding your financial commitments.

Secure Access with Touch ID and Face ID

Security is a top priority when managing your finances. BMG Money offers the option to enable Touch ID or Face ID for instant access to your account. This added layer of security ensures that your personal information remains protected while providing you with quick access to your loan details.

Earn Extra Cash: Refer Friends and Colleagues

Sharing is caring, especially when it comes to financial solutions. By referring BMG Money to your friends and colleagues, you can earn extra cash. This referral program not only helps others access valuable financial resources but also rewards you for spreading the word.

Loan Example: Understanding Your Costs

To illustrate the potential costs associated with borrowing, consider this example: A 17-month loan of $2,000 with a finance charge of $500.06 and a 31.67% APR results in 36 bi-weekly installments of $70.00 each, culminating in a total loan cost of $2,500.06. Understanding these figures can help you make informed decisions about your borrowing options.

Conclusion: Empowering Your Financial Journey

Accessing financial resources shouldn't be a daunting task. With better loan offers, no credit score requirements, and a streamlined application process, BMG Money is committed to empowering individuals on their financial journeys. By understanding the terms, eligibility criteria, and repayment options, you can confidently navigate the world of personal loans and secure the funding you need.

All loans marketed by BMG Money are made by WebBank, except for loans issued to residents of Illinois, Ohio, and Rhode Island, which are made by BMG LoansAtWork, Inc.

Rate the App

User Reviews

Popular Apps

Editor's Choice