Latest Version

1.0.5

September 25, 2025

Avaloq Sourcing (Switzerland&Liechtenstein) SA

Finance

Android

1

Free

ch.bgsuissebank.mobile.android

Report a Problem

More About BG Suisse Private Bank

Unlock Seamless E-Banking Access Anytime, Anywhere

In today's fast-paced digital world, managing your finances efficiently is more important than ever. With the advent of advanced banking applications, you can now access all your e-banking services at your convenience, even from your mobile device. This article explores the benefits of using a dedicated banking app and how it can transform your financial management experience.

Why Choose a Mobile Banking App?

Mobile banking apps have revolutionized the way we handle our finances. Here are some compelling reasons to consider using one:

- 24/7 Access: With a mobile banking app, your financial services are available around the clock. Whether it's early morning or late at night, you can check your account balance, transfer funds, or pay bills without any hassle.

- User-Friendly Interface: Most banking apps are designed with user experience in mind. They offer intuitive navigation, making it easy for anyone to manage their finances, regardless of their tech-savviness.

- Enhanced Security: Leading banking apps employ advanced security measures, including biometric authentication and encryption, ensuring that your financial information remains safe and secure.

Key Features of E-Banking Apps

When choosing a mobile banking app, it's essential to look for features that cater to your financial needs. Here are some key functionalities to consider:

Account Management

Effortlessly manage multiple accounts from a single platform. You can view balances, transaction histories, and even set up alerts for specific account activities.

Fund Transfers

Transfer money between your accounts or send funds to friends and family with just a few taps. Many apps also support international transfers, making it easier to send money abroad.

Bill Payments

Paying bills has never been easier. Set up recurring payments or pay your bills on the go, ensuring you never miss a due date.

Budgeting Tools

Many banking apps come equipped with budgeting tools that help you track your spending and manage your finances more effectively. Set financial goals and monitor your progress directly from the app.

How to Get Started with Your Banking App

Getting started with a mobile banking app is a straightforward process. Follow these simple steps:

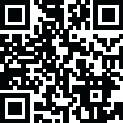

- Download the App: Visit your device's app store and download the official app of your bank.

- Create an Account: Follow the prompts to set up your account. You may need to provide personal information and verify your identity.

- Log In: Once your account is set up, log in using your credentials. Ensure you enable any security features offered by the app.

- Explore Features: Familiarize yourself with the app's features. Take advantage of tutorials or help sections to maximize your experience.

Tips for Safe Mobile Banking

While mobile banking offers convenience, it's crucial to prioritize security. Here are some tips to keep your financial information safe:

- Use Strong Passwords: Create complex passwords that are difficult to guess. Avoid using easily accessible information like birthdays or names.

- Enable Two-Factor Authentication: Whenever possible, activate two-factor authentication for an added layer of security.

- Keep Your App Updated: Regularly update your banking app to ensure you have the latest security features and bug fixes.

- Monitor Your Accounts: Regularly check your account statements for any unauthorized transactions and report them immediately.

Conclusion

In conclusion, a mobile banking app is an invaluable tool for anyone looking to manage their finances efficiently. With 24/7 access to your e-banking services, user-friendly features, and enhanced security, you can take control of your financial life like never before. Embrace the convenience of mobile banking and experience the freedom of managing your finances on your terms.

Rate the App

User Reviews

Popular Apps

Editor's Choice