Latest Version

171.03

September 22, 2025

Lloyds Banking Group PLC

Finance

Android

0

Free

uk.co.bankofscotland.businessbank

Report a Problem

More About Bank of Scotland Business

Unlocking the Power of Business Banking: Your Comprehensive Guide

In today's fast-paced business environment, having a reliable banking solution is essential. This guide will walk you through the features and benefits of our business banking services, ensuring you can manage your finances efficiently and securely.

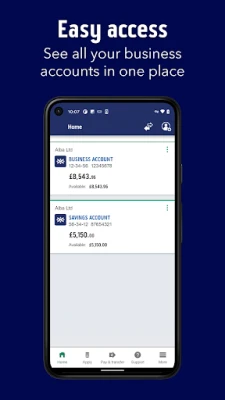

What You Can Do with Our Business Banking Services

Our business banking platform offers a range of features designed to simplify your financial management. Here’s what you can do:

- Quick Business Account Application: Apply for a business account in just a few minutes.

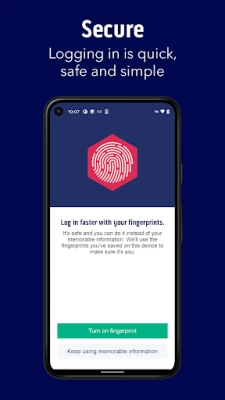

- Secure Login: Access your account quickly and securely using fingerprint recognition or your memorable information.

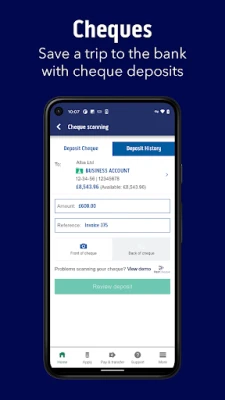

- Cheque Payments: Pay in cheques up to a daily limit of £10,000.

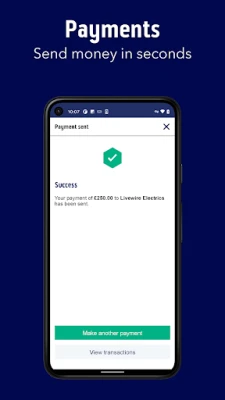

- High Daily Payment Limits: Make payments of up to £250,000 each day.

- Add Payment Recipients: Easily add new payment recipients to streamline your transactions.

- View Your PIN: Check your PIN number for your business debit card at any time.

- Manage Standing Orders: Create and amend standing orders to automate your payments.

- Account Transfers: Transfer money seamlessly between your business accounts.

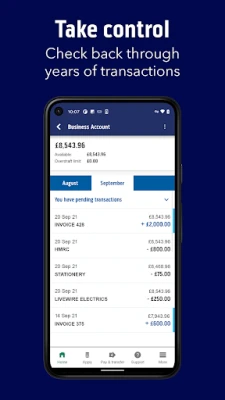

- Account Balances and Transactions: Monitor your account balances and transaction details effortlessly.

- Go Paper-Free: Sign up for our Digital Inbox to manage your documents electronically.

- Direct Debit Management: View and delete Direct Debits as needed.

- Transaction Search: Easily search through your transactions for better financial oversight.

- Update Business Information: Keep your business address, email, and phone number up to date.

- Personal Address Updates: Update your personal address to ensure accurate records.

- International Payments: Make international payments to existing recipients with ease.

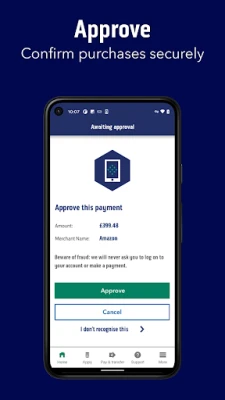

- Online Purchase Approval: Approve online purchases to enhance security.

- Account Closure: Close any unused accounts to streamline your banking experience.

- View Business Details: Access your business details whenever you need them.

- Password Reset: Reset your password quickly if you forget it.

- Virtual Assistant Support: Get help with our mobile app's virtual assistant feature.

Getting Started with Business Internet Banking

If you’re already a Business Internet Banking customer, ensure you have the following:

- Your Business Internet Banking login details.

- Your card and card reader for secure access.

If you’re new to our services, you can apply via the app if you meet these criteria:

- You are at least 18 years old.

- You are a UK resident.

- You are a sole trader or a director of the business.

- Your business has an annual turnover of £25 million or less.

For limited companies, please ensure:

- Your company has been registered with Companies House for at least four days.

- The Companies House register has not changed in the past four days.

- Your company has an ‘active’ status on the Companies House register.

If you haven’t registered for online banking yet, please visit our website to get started.

Keeping Your Information Safe Online

Your security is our top priority. We employ the latest online security measures to protect your money, information, and privacy. Our app verifies your details, device, and software for security before you log in. If your phone is lost or stolen, we can block it to prevent unauthorized access to your accounts.

Important Information to Consider

Be aware that your phone’s signal and functionality may affect your service. Terms and conditions apply. Here are some additional points to keep in mind:

- Fingerprint login requires a compatible mobile device running Android 6.0 or higher and may not work on some tablets.

- Features that require your device’s phone capabilities, such as calling us, will not function on tablets.

- When using this app, we collect anonymous location data to help combat fraud, fix bugs, and improve future services.

- You must not download, install, use, or distribute our Mobile Banking apps in countries subject to UK, US, or EU technology export prohibitions, including North Korea, Syria, Sudan, Iran, and Cuba.

Bank of Scotland plc is registered at The Mound, Edinburgh EH1 1YZ, and is registered in Scotland under number SC327000. We are authorized by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority under Registration Number 169628.

By leveraging our business banking services, you can streamline your financial operations, enhance security, and focus on what truly matters—growing your business.

Rate the App

User Reviews

Popular Apps

Editor's Choice