Latest Version

Version

4.6.6

4.6.6

Update

December 29, 2025

December 29, 2025

Developer

Bancoagrícola

Bancoagrícola

Categories

Finance

Finance

Platforms

Android

Android

Downloads

0

0

License

Free

Free

Package Name

com.bancoagricola.bancamovil

com.bancoagricola.bancamovil

Report

Report a Problem

Report a Problem

More About Bancoagrícola

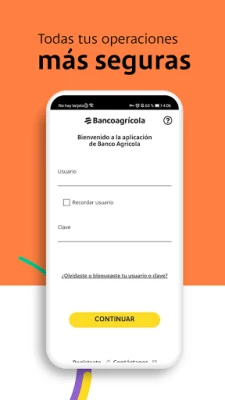

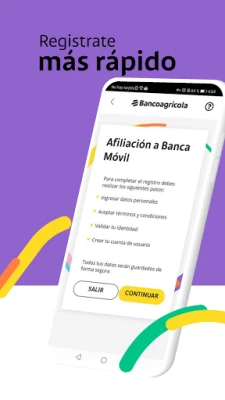

Banca Móvil de Banco Agrícola te permite realizar tus transacciones bancarias de manera fácil, rápida y segura; desde cualquier lugar y en el momento que lo necesites.

Unlock the Full Potential of Your Banking App: Essential Features and Functions

In today's fast-paced digital world, managing your finances has never been easier. With the right banking app, you can perform a variety of transactions and manage your accounts seamlessly. This article explores the essential features of a modern banking application, designed to enhance your banking experience and provide you with the tools you need at your fingertips.Comprehensive Account Management

One of the primary advantages of using a banking app is the ability to manage your accounts efficiently. Here are some key functionalities that you can access:- Account Balance Inquiry: Instantly check the balances of your accounts, loans, fixed deposits, and credit cards.

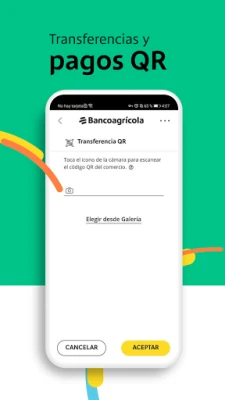

- Transfers: Easily transfer funds between your own accounts or to third parties with just a few taps.

- Mobile Top-Up: Recharge your mobile phone directly through the app.

- Internet Packages: Purchase mobile internet packages to stay connected on the go.

- Remittance Collection: Conveniently collect remittances from family and friends.

- Friend Payments: Send and receive money from friends effortlessly.

- Limit Management: Set and manage transaction limits for added security.

- Favorites Management: Save frequently used transactions for quick access.

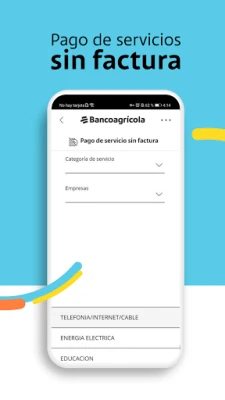

- Utility Payments: Pay your bills directly through the app.

- User Unlock and Password Recovery: Easily unlock your account and recover your password if needed.

Innovative Features for Enhanced User Experience

The latest banking applications come equipped with innovative features that cater to your financial needs. Discover the new functionalities that can simplify your banking tasks:- Open a Savings Account: Start saving effortlessly by opening a savings account directly through the app.

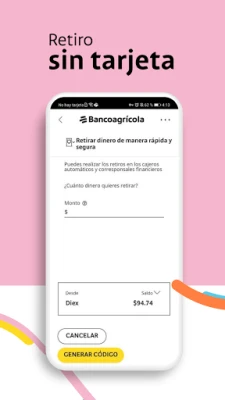

- Cardless Cash Withdrawal: Withdraw cash without a card, making transactions more convenient.

- International Transactions: Manage transactions using international numbers for global accessibility.

- Transaction Auditing: Keep track of your transactions with detailed auditing features.

- Traveler Notifications: Notify your bank when traveling to avoid any disruptions in service.

- LifeMiles Transfers: Transfer LifeMiles points easily within the app.

- Credit Card to Own Account Transfers: Transfer funds from your credit card to your own accounts seamlessly.

- Mobile Recharge Packages: Purchase mobile recharge packages directly from the app.

- Digital Fixed Deposit Management: Open or cancel digital fixed deposits with ease.

- Mobile Wallet: Utilize a mobile wallet for quick and secure transactions.

- QR Code Creation: Generate QR codes for opening digital savings accounts.

- SMS Personalization: Customize SMS notifications to suit your preferences.

- Online Disbursement: Access funds online with a streamlined disbursement process.

- Security Initiatives: Receive notifications for security measures, including the removal of trusted devices.

Requirements for Optimal Performance

To ensure that you can take full advantage of these features, your device must meet certain requirements:- Operating System: The app is compatible with devices running Android version 7.0 or higher.

- Internet Connection: A stable internet connection is necessary, whether through a data plan or Wi-Fi.

Conclusion: Embrace the Future of Banking

With the advancements in banking technology, managing your finances has become more accessible and efficient. The features offered by modern banking applications not only simplify transactions but also enhance your overall banking experience. By leveraging these tools, you can take control of your finances, ensuring that you are always informed and in charge. Embrace the future of banking today and unlock the full potential of your banking app!Rate the App

Add Comment & Review

User Reviews

Based on 0 reviews

No reviews added yet.

Comments will not be approved to be posted if they are SPAM, abusive, off-topic, use profanity, contain a personal attack, or promote hate of any kind.

More »

Popular Apps

LINE: Calls & MessagesLINE (LY Corporation)

Rogue SlimeQuest Seeker Games

PrivacyWallPrivacyWall

Roman empire games - AoD RomeRoboBot Studio

CHANCE THE GAMETake Your Chance !

XENO; Plan, AutoSave & InvestXENO Investment

Trovo - Watch & Play TogetherTLIVE PTE LTD

Dot PaintingChill Calm Cute

Tank Hero: Jump 3DAMANDA

Commando Assault: Gun ShooterCommando Gun Shooter Game

More »

Editor's Choice

Grim Soul: Dark Survival RPGBrickworks Games Ltd

Craft of Survival - Gladiators101XP LIMITED

Last Shelter: SurvivalLong Tech Network Limited

Dawn of Zombies: Survival GameRoyal Ark

Merge Survival : WastelandStickyHands Inc.

AoD Vikings: Valhalla GameRoboBot Studio

Viking Clan: RagnarokKano Games

Vikings: War of ClansPlarium LLC

Asphalt 9: LegendsGameloft SE

Modern Tanks: War Tank GamesXDEVS LTD