Latest Version

6.0.0

April 25, 2025

National Westminster Bank PLC

Finance

Android

0

Free

com.ulster.clearspend

Report a Problem

More About Ulster Bank NI ClearSpend

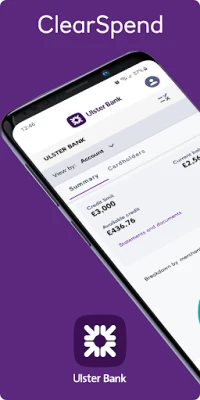

Unlocking Financial Control: The Ultimate Guide to Ulster Bank NI ClearSpend

In today's fast-paced business environment, managing finances efficiently is crucial. Ulster Bank NI ClearSpend offers a comprehensive solution for businesses looking to gain real-time insights into their spending. This article delves into the key features of the ClearSpend app, ensuring you maximize its potential for your business.

Real-Time Balance Information

Stay informed about your financial status with real-time balance information. The ClearSpend app allows you to monitor your account balance instantly, ensuring you have the latest data at your fingertips. This feature is essential for making informed spending decisions and maintaining financial health.

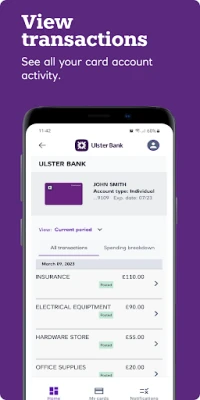

Transaction Monitoring: View Transactions, Pending and Declines

Understanding your spending habits is vital for effective financial management. With ClearSpend, you can easily view transactions, including pending and declined purchases. This transparency helps you track expenses and identify any discrepancies quickly, allowing for prompt action when necessary.

Access Regular Statements

ClearSpend simplifies financial oversight by providing access to regular statements. These statements offer a detailed overview of your transactions, making it easier to analyze spending patterns and prepare for financial reviews. Regular access to statements ensures you are always in control of your finances.

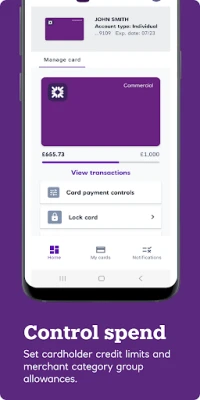

Set Cardholder Credit Limits

Managing employee spending is crucial for maintaining budgetary control. With ClearSpend, you can set cardholder credit limits tailored to individual needs. This feature empowers you to enforce spending policies while giving employees the flexibility to make necessary purchases.

Merchant Category Blockings for Enhanced Control

To further refine spending, ClearSpend allows you to set cardholder merchant category blockings. This feature enables you to restrict purchases in specific categories, ensuring that employees adhere to company policies and preventing unauthorized spending.

Lock and Unlock Employee Cards

Security is paramount in financial management. ClearSpend provides the ability to lock and unlock an employee’s card instantly. This feature is particularly useful in cases of lost or stolen cards, allowing you to mitigate potential fraud quickly.

Receive Transaction Notifications

Stay updated with transaction notifications that alert you to every purchase made with your business cards. These notifications provide real-time insights into spending, helping you monitor expenses and detect any unusual activity immediately.

Approve Online Purchases Instantly

In a world where online transactions are increasingly common, ClearSpend allows you to approve online purchases seamlessly. This feature ensures that all expenditures align with your business objectives, providing an additional layer of control over your finances.

Create Departments to Segregate Spending

For larger organizations, managing expenses across various departments can be challenging. ClearSpend enables you to create departments to segregate spending, making it easier to track and analyze expenditures by department. This feature enhances accountability and helps in budget management.

App Accessibility for Administrators and Cardholders

The ClearSpend app is designed for both administrators and cardholders, ensuring that everyone involved in financial management has the tools they need. The app is user-friendly and accessible, making it easy for all users to navigate and utilize its features effectively.

Quick Registration Process

Getting started with Ulster Bank NI ClearSpend is a breeze. The registration process takes just a few minutes. Simply download the app, click on ‘Need to register,’ and follow the on-screen instructions. Remember, your Business or Commercial Card account must be registered and activated before cardholder users can sign up.

Eligibility and Availability

Ulster Bank NI ClearSpend is available to eligible customers holding Ulster Bank NI Business and Commercial Card accounts. The app is compatible with Android devices and requires a UK or international mobile number from specific countries. Please note that users must be over 18 years old, and other terms and conditions apply.

Conclusion: Empower Your Business with ClearSpend

Ulster Bank NI ClearSpend is an invaluable tool for businesses seeking to enhance their financial management. With features like real-time balance information, transaction monitoring, and customizable spending controls, ClearSpend empowers you to take charge of your finances. Start your journey towards better financial oversight today by downloading the app and registering your account.

Rate the App

User Reviews

Popular Apps

Editor's Choice