Latest Version

December 26, 2025

EMM Ventures AG

Finance

Android

0

Free

defisuisse.thorwallet

Report a Problem

More About THORWallet - Crypto Wallet

Unlocking the Future of Finance: Whales, Treasuries, and DAOs

In the rapidly evolving landscape of digital finance, three key players are making waves: whales, treasuries, and Decentralized Autonomous Organizations (DAOs). Understanding their roles and how they interact can provide valuable insights into the future of cryptocurrency and blockchain technology. This article delves into these components, highlighting their significance and the innovative solutions that enhance their functionality.

Understanding Whales in the Crypto Ecosystem

In the cryptocurrency world, "whales" refer to individuals or entities that hold substantial amounts of digital assets. Their influence on market dynamics is profound, as their buying or selling decisions can lead to significant price fluctuations. Whales often seek secure and efficient ways to manage their assets, which is where advanced financial solutions come into play.

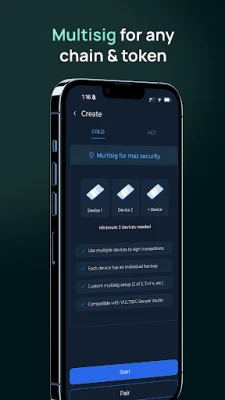

Empowering Treasuries with Innovative Solutions

Treasuries, particularly within DAOs, require robust management tools to ensure the security and growth of their assets. A multisig solution stands out as a vital component for these organizations. This approach allows multiple parties to authorize transactions, enhancing security and reducing the risk of fraud. It is flexible and compatible with various blockchain networks and tokens, making it an ideal choice for managing treasury funds.

DAOs: The Future of Governance and Finance

Decentralized Autonomous Organizations (DAOs) represent a revolutionary shift in how organizations operate. By leveraging smart contracts and blockchain technology, DAOs enable transparent and democratic decision-making processes. Members can propose and vote on initiatives, ensuring that every voice is heard. This structure not only fosters community engagement but also enhances the overall security of treasury management.

Cross-Chain Swaps: A Seamless Trading Experience

One of the most significant advancements in the crypto space is the ability to perform cross-chain swaps. This feature allows users to trade assets across different blockchains without the need for intermediaries or wrapped tokens. By eliminating these barriers, traders can enjoy a more efficient and cost-effective trading experience, further empowering whales and DAOs alike.

Best-in-Class Fiat Gateway: Bridging Traditional and Digital Finance

As the cryptocurrency market matures, the need for a reliable fiat gateway becomes increasingly important. A best-in-class fiat gateway enables users to seamlessly convert their digital assets to traditional currency and vice versa. This functionality is crucial for those looking to enter or exit the crypto market, providing access to competitive rates and accommodating large transactions.

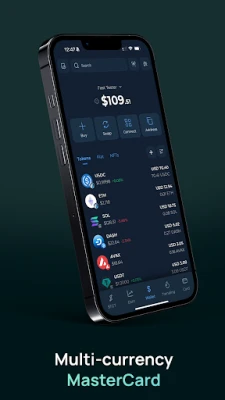

Maintaining Full Ownership of Your Funds

One of the most appealing aspects of using a non-custodial wallet is the ability to maintain full ownership of your funds. With solutions like the Global MasterCard, users can access their assets in over 100 countries while ensuring that their funds remain secure and under their control. This level of autonomy is essential for whales and DAOs, who prioritize security and flexibility in managing their digital assets.

The Future of Finance: A Collaborative Ecosystem

The interplay between whales, treasuries, and DAOs is shaping the future of finance. As these entities adopt innovative solutions, they create a more secure, efficient, and transparent financial ecosystem. By leveraging multisig solutions, cross-chain swaps, and robust fiat gateways, they can navigate the complexities of the crypto market with confidence.

Conclusion: Embracing the Evolution of Digital Finance

As the cryptocurrency landscape continues to evolve, understanding the roles of whales, treasuries, and DAOs becomes increasingly important. By embracing innovative solutions and maintaining a focus on security and efficiency, these entities can thrive in the digital finance world. The future is bright for those who adapt and leverage the tools available, paving the way for a more inclusive and dynamic financial ecosystem.

Rate the App

User Reviews

Popular Apps

Editor's Choice