Latest Version

2.0.189

April 15, 2025

Seen Finance, Inc.

Finance

Android

0

Free

com.seenfinance.app

Report a Problem

More About Seen Mobile - Build Credit

Build Your Credit with Seen Mastercard®: The Ultimate Credit Builder Card

In today's financial landscape, establishing or repairing your credit can feel overwhelming. Fortunately, the Seen Mastercard® offers a reliable solution for those seeking a second chance or a fresh start. Whether you're aiming to rebuild your credit history or establish credit for the first time, Seen empowers you to build credit responsibly. With a commitment to reporting your payment history to all three major credit bureaus—TransUnion®, Equifax®, and Experian®—your positive credit habits will be recognized and rewarded.

Take Control of Your Finances with the Seen Mobile App

The Seen Mobile app is designed to give you the tools you need to manage your finances effectively. By downloading the app, you can take charge of your credit journey and work towards a brighter financial future. Here’s what you can do:

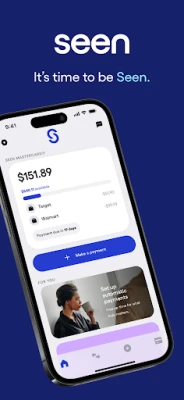

- Log in from anywhere to check your balance and available credit.

- View all your account transactions for better tracking.

- Manage your profile and account settings with ease.

- Schedule, edit, or cancel payments effortlessly.

- Enable notifications for important account activities, payment reminders, and alerts for any suspicious activity.

Key Features of the Seen Mastercard®

Rebuilding your credit doesn’t have to be a daunting task. The Seen Mastercard® is equipped with features designed to keep you focused on your financial goals:

Instant Access with a Digital Card

Once approved, you can start using your digital card immediately. This means you can begin leveraging your new buying power on the same day you receive approval.

Convenient Autopay Options

With the Autopay feature, scheduling your monthly payments becomes a hassle-free experience. Set it and forget it, ensuring you never miss a payment.

Seamless Integration with Plaid

The Plaid integration allows you to connect effortlessly to over 12,000 financial institutions across the United States. This feature simplifies tracking your finances and managing your budget.

Enhanced Security with Card Lock

Worried about losing your card? The Card Lock feature lets you secure your card with a single tap, providing peace of mind whether your card is misplaced, lost, or stolen.

Stay Informed with Account Alerts

Stay on top of your financial activities with Account Alerts. These notifications help you monitor your account and ensure you’re always aware of any changes or important updates.

Personalized Recommendations

When you log into the app, you’ll find For You recommendations on the home page. These tips are tailored to help you stay informed and engaged with your account, guiding you on your credit-building journey.

Why Choose Seen Mastercard®?

The Seen Mastercard® is not just a credit card; it’s a comprehensive tool for financial empowerment. By choosing Seen, you’re opting for a card that prioritizes your financial growth and stability. With responsible use and regular on-time payments, you can see a positive impact on your credit score. However, it’s important to note that all payment activity—both positive and negative—is reported to the major credit bureaus, and the impact on your score may vary.

Get Started Today

Ready to take the first step towards a better financial future? Download the Seen Mobile app and apply for the Seen Mastercard® today. With the right tools and support, you can transform your credit journey and achieve your financial goals.

For more information, please review our Privacy Policy, Terms of Use, and Cardmember Agreement.

Seen Finance Inc™, all rights reserved. The Seen Mastercard® is issued by Coastal Community Bank, Member FDIC, pursuant to a license from Mastercard® International Incorporated.

Start building your credit today with Seen Mastercard®—your partner in financial success!

Rate the App

User Reviews

Popular Apps

Editor's Choice